Whole Life Insurance Policy

Blog Title

1358 |

A whole life insurance plan is a life insurance policy that provides financial protection to your loved ones for your entire life, i.e., up to 100 years of age. When you have dependents, such as a spouse or children, who rely on you financially, it's natural to consider purchasing life insurance. A simple, low-cost term life insurance coverage is an excellent choice for many families. However, after a term policy expires, you may no longer have the necessary financial protection for your family. This is where whole life insurance policies come into play.

A whole life insurance policy, often known as permanent life insurance, offers life insurance coverage until your demise. The policy remains active as long as you duly pays all the premiums. When you purchase a whole life insurance policy, the sum assured is determined at the time of policy purchase and is paid out to your nominee or your family members, in case of your unfortunate demise. The average maturity age is 100 years. If you survive over 100, the insurance company pays out maturity benefits per the policy's terms and conditions.

Let us take a detailed look at how these policies work and what benefits they offer.

How Does Whole Life Insurance Work?

A whole life insurance policy is a one-of-a-kind type of life insurance policy. The primary goal of whole life insurance is to allow you to live a worry-free life while leaving a legacy for your descendants.

This is because it provides not just death benefits but also maturity and survivor benefits, as well as bonuses (depending on the type of whole life insurance). So, you are covered till death, and there is a maturity benefit if you survive the policy term, which usually goes up to 100 years.

Whole life insurance policies come in a variety of forms. Let's go over them in detail.

- Participating Whole Life Insurance: Also known as a par policy, a participating policy, helps you to participate insurance provider’s profits. The premiums you pay towards the plan are invested by the insurance company. The profit or the surplus amount earned by the company from various investments is awarded as a bonus to all policyholders after deducting any relevant charges/expenses. However, there is no certainty that the insurer will declare yearly bonuses.

- Non-Participating Whole Life Insurance: A non-participating whole life insurance policy, also known as a non-par policy, does not offer any dividends or payouts. These policies come with a fixed premium and face amount and are generally a low-cost life insurance policy. It does not pay dividends or bonuses, keeping the premiums low, as you are opting out of any profit sharing with the company.

- Level Premium Whole Life Insurance: This is type of whole life insurance plan where the premium amount remains the same over the policy’s tenure. The premiums collected during the early phases of this policy are sufficient to cover the costs of life coverage.

- Limited Payment Whole Life Insurance: Under this plan, you pay the premium for a set duration. However, life insurance coverage is for the rest of your life or until the age of 100. The distinction is not only in the premium payment term but also in the amount. Because it is for a limited time, the premium amount is higher than the regular premium whole-life plan. Premiums are often paid over a set number of years, such as 10, 20, etc.

- Single Premium: The full policy premium is paid in one lump sum under this plan option. In addition, a large sum assured amount is provided as a guaranteed payment to the policy's beneficiary under this plan.

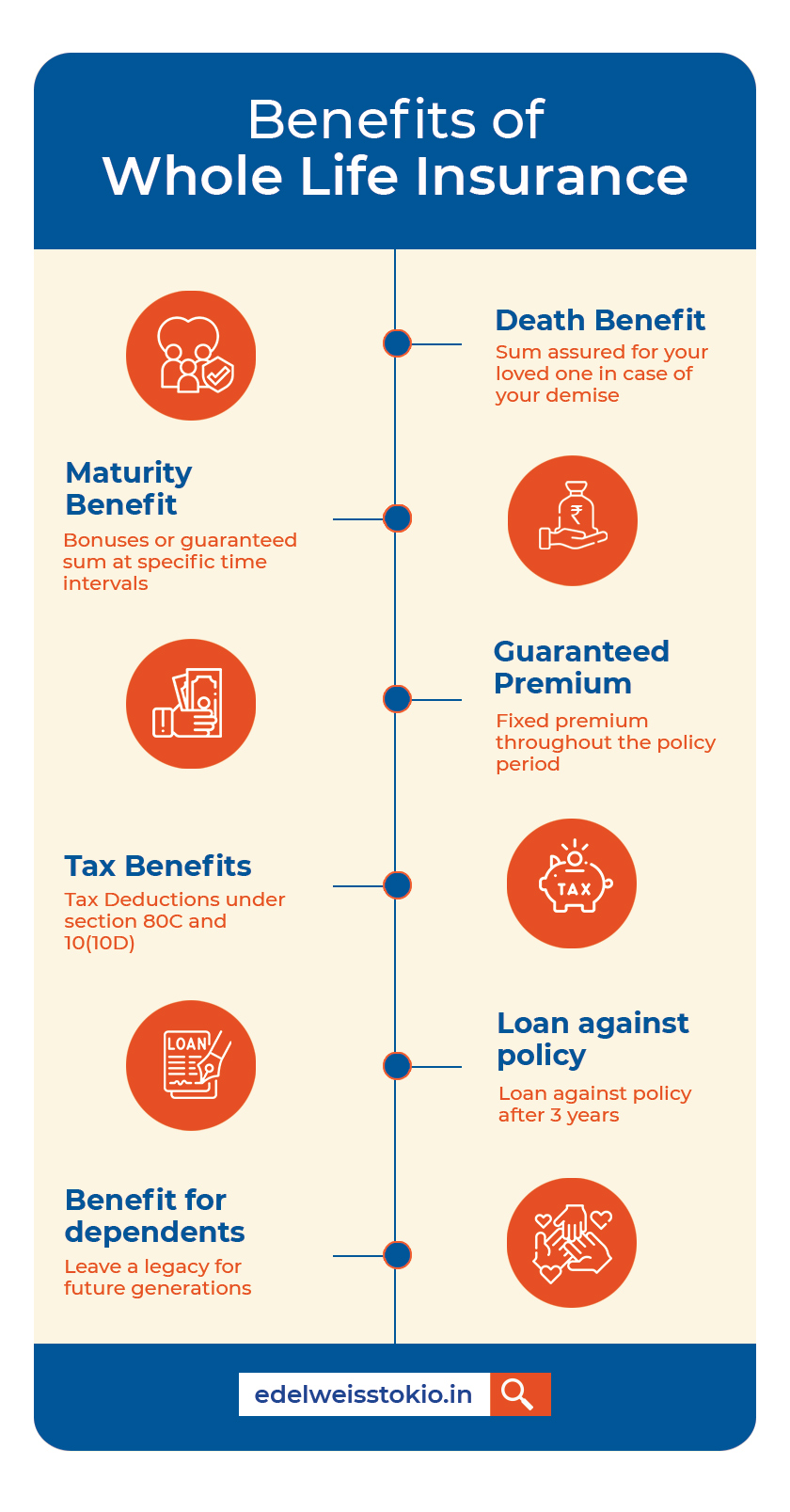

What are the main benefits of Whole Life Insurance?

- Death Benefits: If you meet an unfortunate demise while the policy is still in force and all premium payments are up to date, your nominee will receive the complete sum assured, plus any earned bonuses.

- Maturity Benefits : A whole life plan is primarily designed to provide estate to your heirs in the form of an assured sum plus any bonuses (in case of participating whole life policies) upon your demise. However, some whole life plans may also include the payment of assured sums and bonuses, if any, in the form of maturity benefits upon reaching a specified age or following the expiration of the premium payment term from the day the policy was started.These benefits differ on the basis of the type of policy as well as the terms and conditions set the insurer.

- Guaranteed Premium: This is applicable in case you opt for a level premium whole life insurance. It essentially means that the premium on a whole-life policy is fixed and guaranteed and is not subject to change over the policy term. So, if you pay Rs. 2500 per month for insurance, you will continue to pay Rs. 2500 per month throughout your premium payment term.

- Tax Benefits under Sections 80C and 10 (10D) of the Income Tax Act of 1961: The premium paid for the policy is tax deductible (up to Rs. 1.5 lacs) u/s 80C of the Income Tax Act of 1961. The benefit payouts to the nominee/policyholder are tax-exempt under Section 10(10D) of the Income Tax Act of 1961.

- Loans against whole-life policies: When the policy has been in force for three years, you can apply for a loan against it. Because whole life insurance covers you for your entire life, you can take out a loan against it. Furthermore, the surrender value grows over time, allowing you to borrow against the policy's surrender value.

- Benefit For Your Dependents: Whole-life plans are an excellent way to leave a legacy for future generations, as well as your dependents in the present, such as your spouse. For example, a whole-life plan for both spouses will provide an additional financial resource on which to rely later in retirement. In addition, if either spouse dies, the insurance death benefit from the whole-life plan for both spouses will be paid to the surviving spouse.

Furthermore, the spouse's insurance will leave a bequest to children or grandchildren after the insured person's death. As a result, whole-life plans are an excellent notion for future wealth distribution to heirs.

Conclusion: Who Should Get a Whole Life Insurance Policy?

Whole life insurance is an appropriate form of protection for various people. However, every earner should make plans to provide financial security for their family.

- People who want to leave a legacy for their heirs.

- A financial portfolio should include whole life insurance plans since they provide the chance for bonuses in addition to life insurance.

- Because a whole life plan includes a partial withdrawal option, you can be financially independent when you retire.

- Whole-life plans are ideal for those interested in tax-saving plans because all premiums (up to Rs. 1.5 lacs) are tax deductible.

Neha Panchal - Financial Content Writer

Neha used to be an Engineer by Profession and Writer by passion, which is until she started pursuing full-time writing. She's presently working as a Financial Content Writer, with a keen interest in all things related to the Insurance Sector.