Everything You Need to Know About Life Insurance Coverage

Blog Title

4538 |

India's life insurance market is experiencing strong post-pandemic expansion, driven by rising awareness. According to a recent report by Global Data, India’s life insurance industry is forecast to witness double-digit growth over the next five years. Given the current state of economic uncertainty, it is a good idea to secure your financial future with a life insurance times.

As with other types of insurance, the main goal of life insurance is to provide you with the much-needed peace of mind. The beneficiaries listed in your life insurance policy—often your family members—receive the benefits of the policy if you were to pass away suddenly or unexpectedly.

So how does Life Insurance work? Here is a breakdown of the information you require to make an informed choice on the finest life insurance.

How does a Life Insurance Plan Work?

You purchase an insurance policy as per your needs and family goals and pay the monthly or yearly dues (also known as premiums) in a timely manner. If you pass away, the insurance provider pays the sum of money indicated in the policy to your family or the beneficiaries you designated.

A life insurance policy provides much needed financial support to your family during tough times. In the event of a tragic occurrence, such as an unfortunate death, critical illness, or accident, a sum assured is paid to the nominee of the plan by the insurer. It is a fixed amount that is as per the sum chosen by you at the time of purchasing the policy.

It ensures that your family remains well protected, away from financial burdens, and meets its basic requirements such as your child’s education, day-to-day expenses, etc even when you are not around.

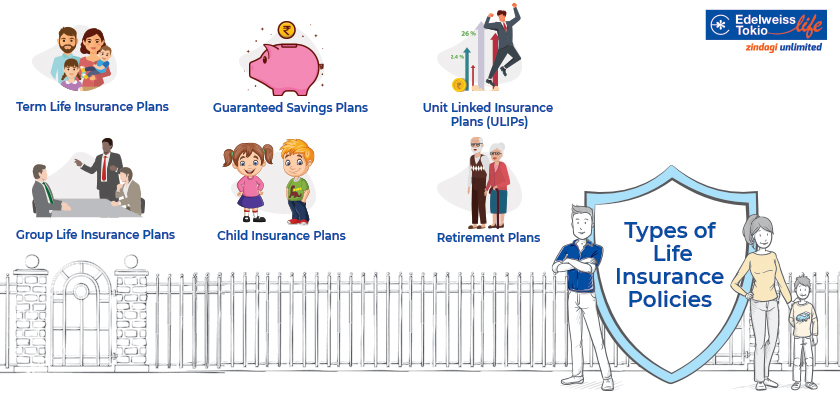

What are the Different Types of Life Insurance Plans?

There is no one size that fits all! The main goal of a life insurance policy is to safeguard and secure your family financially in the event of your passing. But since everyone has different financial objectives and needs, you can choose from a variety of life insurance products.

Term Life Insurance Plans: A term insurance plan is the purest and most affordable form of life insurance plan. It provides complete financial protection to your loved ones as it offers a high sum assured for a low cost.

Guaranteed Savings Plans: This combines insurance cover with the ability to generate a guaranteed financial corpus for you. It helps you achieve your long-term goals, such as buying your dream house, planning a peaceful retirement, or, your child’s marriage, etc.

Unit Linked Insurance Plans (ULIPs): This plan offers you both insurance and market-linked returns in one plan. You can also move your investments between different funds any time during the plan's duration.

Group Life Insurance Plans: This type of life insurance plan provides affordable coverage to a group of people, such as employees or members of an organization. Employers typically offer their employees life insurance under a single Master Life Insurance policy.

Child Insurance Plans: A child insurance plan combines insurance (financial security for your child) and investment (expand your finances) into one single plan. You can use the money you save to help your child achieve his or her educational and career goals.

Retirement Plans: Pension Plans allow you to save money until you retire, so you can enjoy the results of your labour. When your income quits in retirement, you begin receiving a consistent income from your retirement plan at regular intervals.

Who Should Have a Life Insurance Policy?

- If you are young and single, to enjoy the low premium costs.

- If you are starting a new family to take care of your loved ones.

- If you have kids, dependents, or care for someone elder in your family.

- If you support your spouse, you should have it.

- If you have a debt or home loan, for financial security of your family in your absence.

- If you have a group life insurance, as it may not be sufficient.

- If you are a business owner, to support the people depending on you.

- If you wish to leave a legacy behind for your children or grandchildren.

How much Life Insurance Cover Do I Need?

To estimate life insurance cover amount you need, you must:

Factor in the monthly expenses and lifestyle costs of the individual’s dependent on you.

Plan a retirement net for your spouse. It will help your spouse spend his/her golden years without worrying about money.

Calculate the liabilities you hold – outstanding debt obligations, loans, etc.

Evaluate different life goals and events of the individual dependent on you. You must factor in events like your children’s higher education, marriage, etc.

Calculate your existing wealth that is placed in savings and investments. You can deduct this amount from your cover. Here is how you can calculate your life insurance cover:

Information Required |

Amount in Rs. |

|---|---|

How much annual income would your dependents need? |

1,00,000 |

How long would your dependents need financial support? |

40 Years |

Amount Required by Dependants |

4000000 |

How much debt do you need to pay off? |

50,00,000 |

If you want to help with the cost of college tuition for your kid, how much would you like to cover? |

15,00,000 |

Total Responsibility |

10500000 |

How much savings do you have? |

5,00,000 |

Total coverage amount of existing Life Insurance |

0 |

Amount of life insurance needed |

10,000,000 |

Now that you have an estimate of your life insurance need, you can start comparing quotes to select the best plan for you, by clicking here.

How can I buy Life Insurance Online?

- Determine which plan you wish to buy.

Depending on your need, if you want a pure life cover, then you may buy a term insurance plan. If you need life cover and savings option in a single plan, then then you may think of buying a ULIP or guaranteed income plan. - Choose your life cover. You can choose the suitable sum assured, bearing in mind the death benefits you may need to safeguard your family’s financial interests.

- Calculate your premium amount. You need to enter a few details as required, and the premium calculator will show you the exact premium amount you will have to pay towards the best suitable life insurance policy.

- Fill the proposal form. Enter your basic details that are required to issue a policy. Here your contact details, health-related information, as well as hobbies/habits need to be disclosed.

- Make payment. You have the flexibility of paying your premiums in different modes, such as- yearly, half-yearly, monthly, or one-time lump sum amount. The premium can be paid using a credit / debit card, net banking, or online wallets.

- Submit the documents. Proofs of your personal information, address, photo, along with medical documentation and income in some scenarios may be needed to purchase the life insurance policy.

Overall, life insurance is one of the best financial tools because it only costs a modest amount of money each year and helps protect the financial future of a complete family. If you don't already have life insurance policy, make sure to get one right away so you may live a life that's not too stressful.

Neha Panchal - Financial Content Writer

Neha used to be an Engineer by Profession and Writer by passion, which is until she started pursuing full-time writing. She's presently working as a Financial Content Writer, with a keen interest in all things related to the Insurance Sector.