Premier Guaranteed Income

Menu Display

- Customer Service

- Our Products

- Capital Secure+ - A Combination Of Market-Linked And Guaranteed Returns

- Edelweiss Tokio Life –Wealth Rise+ – A double-advantage ULIP

- Edelweiss Tokio Life – Premier Guaranteed Income – A guaranteed income plan

- Edelweiss Tokio Life –Wealth Secure + - A new generation ULIP

- Edelweiss Tokio Life- Zindagi Protect - A Comprehensive Term Plan

- All Products

- Resume Application

- Insurance Guide

- Knowledge Center

- About Us

Menu Display

-

Our Products

- Capital Secure+ - A Combination Of Market-Linked And Guaranteed Returns

- Edelweiss Tokio Life –Wealth Rise+ – A double-advantage ULIP

- Edelweiss Tokio Life – Premier Guaranteed Income – A guaranteed income plan

- Edelweiss Tokio Life –Wealth Secure + - A new generation ULIP

- Edelweiss Tokio Life- Zindagi Protect - A Comprehensive Term Plan

- All Products

Menu Display

Breadcrumb

"IN THIS POLICY, INVESTMENT RISK IN THE INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER"

Build the Engines of Regular

Guaranteed¹ Income for Tomorrow!

That is why we present Edelweiss Tokio Life Premier Guaranteed Income - a guaranteed¹ income plan

along with a life cover & tax benefits³. This plan offers 4 options to take care of different

financial goals.

Product Enquiry

Take a step ahead to secure your goals

No response from Server, Please try again.

Thank you!!

Thank you for sharing your details with us.

Our product expert will get in touch with you soon to understand your life insurance needs.

Premier-guaranteed-income Our Product

Premier Guaranteed Income Additional Resources

Secure your future by starting now and gaining a comprehensive understanding of the plan.

Reasons Why This Plan Is A Guaranteed¹ Hit!

Reasons Why This Plan Is A Guaranteed¹ Hit!

Income bhi, Life Cover bhi

Good things always come in pairs! Get dual benefits of life insurance and income generation in one plan.

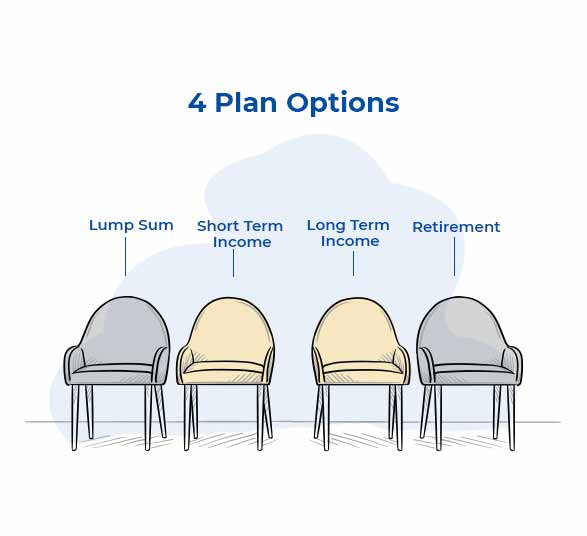

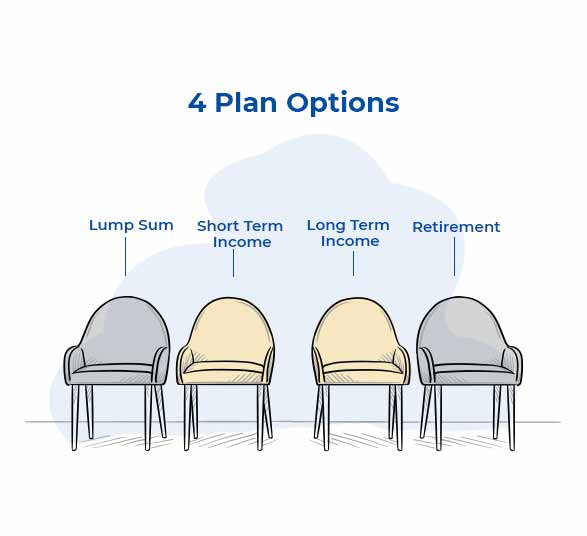

Customize with 4 Plan Options

Achieve your financial goals with 4 plan options – Lump Sum, Short Term Income, Long Term Income and Retirement Income.

Guaranteed¹ Returns

No surprises here! Get guaranteed¹ income even in uncertain times, to secure your future financial needs.

One with the Contingency Plan

Family Income Benefit option ensures no compromise on your dreams in case of an unforeseen event like Critical illness or Death

Benefits of Premier Guaranteed Income

Benefits of Premier Guaranteed Income

-

Income + Protection in 1 plan

This plan can be described as ‘Single Battery Double Power’. Get both - the benefits of protection with life insurance and regular guaranteed¹ income with tax benefits³ through 4 plan options.

-

4 Plan Options

One size doesn’t fit all! Therefore, this plan offers 4 plan options to give guaranteed¹ income. Edelweiss Tokio Life Premier Guaranteed Income offers the flexibility to select a plan option basis your life goals – Lump sum, Short Term Income, Long Term Income & Retirement Income.

-

Guaranteed¹ Returns

No surprises here! With this plan, get guaranteed¹ returns no matter the circumstance, on your investment. The advantage of this plan is that you know exactly how much you’re getting out of it, so you can plan your future goals accordingly.

-

Family Income Benefits

We’re always ready to help in any situation! This optional benefit ensures that in case of an unfortunate death or diagnosis of covered Critical Illness, you and your loved ones don’t have to compromise on your dreams as you/they will continue to receive benefit. There are two options under this benefit - Family Income Benefit on Critical Illness & Family Income Benefit on Critical Illness and Death.

-

Loan² Facility

Don’t let financial trouble stop you from your goals!We want you to live your zindagi unlimited, even if you need a little support to do it. That is why Edelweiss Tokio Life Premier Guaranteed Income offers you the choice to avail a loan² for urgent need of cash flow

-

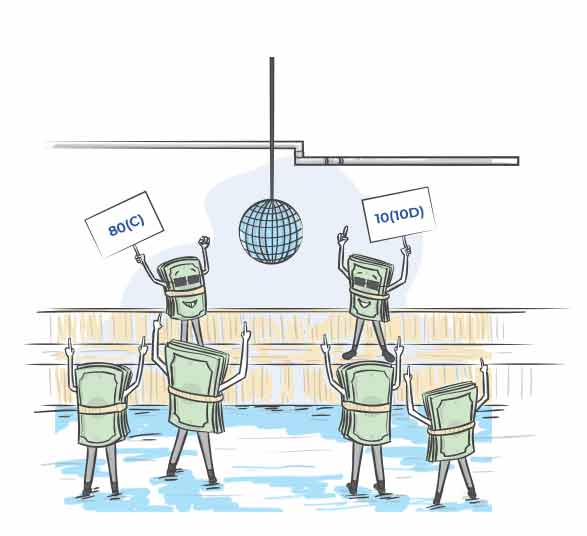

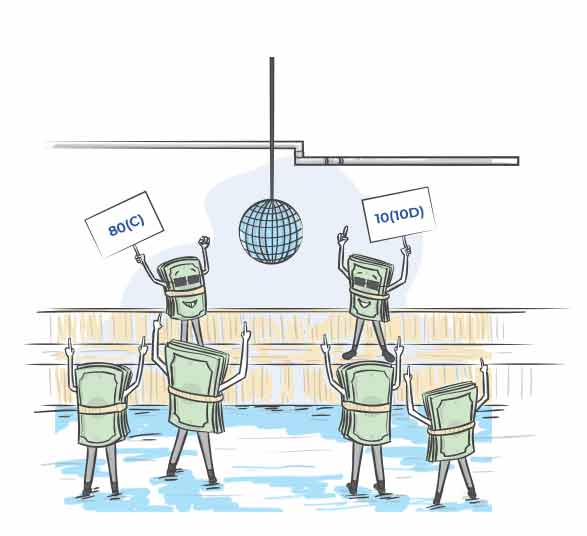

Tax Benefits³

We dislike deductions as much as you. The premiums you pay towards this plan are eligible for deductions under section 80(C) and the income you get has tax benefits³ under section 10(10D)

Income + Protection in 1 plan

This plan can be described as ‘Single Battery Double Power’. Get both - the benefits of protection with life insurance and regular guaranteed¹ income with tax benefits³ through 4 plan options.

4 Plan Options

One size doesn’t fit all! Therefore, this plan offers 4 plan options to give guaranteed¹ income. Edelweiss Tokio Life Premier Guaranteed Income offers the flexibility to select a plan option basis your life goals – Lump sum, Short Term Income, Long Term Income & Retirement Income.

Guaranteed¹ Returns

No surprises here! With this plan, get guaranteed¹ returns no matter the circumstance, on your investment. The advantage of this plan is that you know exactly how much you’re getting out of it, so you can plan your future goals accordingly.

Family Income Benefits

We’re always ready to help in any situation! This optional benefit ensures that in case of an unfortunate death or diagnosis of covered Critical Illness, you and your loved ones don’t have to compromise on your dreams as you/they will continue to receive benefit. There are two options under this benefit - Family Income Benefit on Critical Illness & Family Income Benefit on Critical Illness and Death.

Loan² Facility

Don’t let financial trouble stop you from your goals!We want you to live your zindagi unlimited, even if you need a little support to do it. That is why Edelweiss Tokio Life Premier Guaranteed Income offers you the choice to avail a loan² for urgent need of cash flow

Tax Benefits³

We dislike deductions as much as you. The premiums you pay towards this plan are eligible for deductions under section 80(C) and the income you get has tax benefits³ under section 10(10D)

4 Plan Options

4 Plan Options

Option 1 – Lump sum

- Helps create a guaranteed¹ corpus for future.

- Maturity Benefit is guaranteed¹.

- Choose the Policy Term option available corresponding to the Premium Paying Term.

- Premium Paying Term (PPT) options available (in years) – 5 | 8 | 10 | 12.

- Policy Term (PT) options corresponding to the PPT above (in years) - 10,15,20 | 10,15,20 | 12,15,20 | 15,20

- Income Benefit Pay-out not applicable.

- Critical Illness Benefit Option available with Family Income Benefit.

Option 2 – Short Term Income

- Helps create regular income for short term

- Maturity Benefit not applicable.

- Income Benefit Payout - a regular stream of income will be payable post 2 years of completion of PPT

- Choose the Policy Term option available corresponding to the Premium Paying Term

- Premium Paying Term (PPT) options available (in years) – 8 | 10 | 12

- Policy Term (PT) options corresponding to the PPT above (in years) – 18 | 22 | 26. This includes the Income Payout duration.

- Critical Illness Benefit Option available with Family Income Benefit.

Option 3 – Long Term Income

- Helps create regular income for long term

- Maturity Benefit applicable if Lump sum benefit opted

- Income Benefit Payout - a regular stream of income will be payable post 2 years of completion of PPT.

- Choose the Policy Term option available corresponding to the Premium Paying Term

- Premium Paying Term (PPT) options available (in years) – 5 | 8 | 10 | 12

- Policy Term (PT) options corresponding to the PPT above (in years) – 22,27,32,37 | 25,30,35,40 | 27,32,37,42 | 29,34,39. This includes the Income Payout duration.

- Critical Illness Benefit Option available with Family Income Benefit.

Option 4 – Retirement

- Helps create regular income for retirement.

- Maturity Benefit applicable on survival.

- Income Benefit Payout - a regular stream of income will be payable post 2 years of completion of PPT for 20 years.

- Choose the Policy Term option available corresponding to the Premium Paying Term.

- Premium Paying Term (PPT) options available (in years) – 5 | 8 | 10 | 12

- Policy Term (PT) is 80 minus entry age. This includes the Income Payout duration.

- Critical Illness Benefit Option available with Family Income Benefit.

Choice of 6 Riders⁹

Choice of 6 Riders⁹

Accidental Death Benefit Rider

This rider provides financial security in the form of an additional life cover to your loved ones in case of demise due to an accident.

Accidental Total and Permanent Disability Rider

With this rider, you can get a lump sum amount to manage your expenses in case total or permanent accidental disability has hindered your earning capacity.

Payor Waiver Benefit Rider

With this rider, if the proposer of the policy suffers from an unfortunate event like death, disability or critical illness, all future premiums are waived off and the policy continues for the life insured.

Hospital Cash Benefit

This rider gives a daily allowance in case you are hospitalized for any necessary treatment of an illness or injury.

Edelweiss Tokio Life - Accidental Death Benefit Rider - UIN 147B002V04

You never know when an accident can befall you, and lead to unfortunate circumstances. By definition, an Accidental Death is a traumatic death caused solely due to an accident, occurring independently of any other causes and within ninety (90) days of such trauma, proved to the satisfaction of the insurer.

It is a sudden situation, which can often leave your loved ones scrambling to make arrangements for their future. By opting for this Rider, you can make sure your loved ones get financial security in these unforeseen circumstances.

The entry age for this rider spans between the age of 18 till 65. This rider looks out for your family’s financial needs in case of an accident causing your unfortunate demise. The policy term for this rider ranges between 5 to 52 years with maturity age between 23 to 70 years. You can carry out your payments through options like Single Pay, Regular Pay and Limited Pay but the frequency of these payments must match your selections in the base plan. The annual premium amount for this rider is Rs. 0.50 (excluding service tax) for a Sum Assured of Rs. 1000. The minimum Sum Assured received from this rider is Rs. 10,000, while there is no limit on the maximum Sum Assured value, subject to Reinsurance capacity.

Edelweiss Tokio Life - Accidental Total and Permanent Disability Rider - UIN 147B001V04

Accidents are unpredictable and can have long-lasting impacts. In case you are left with a total and permanent disability due to an accident, it can affect your ability to continue your occupation and can hamper your efforts to provide for your loved ones. This Rider provides aid in the form of a lump sum amount, so you can manage your expenses. It comes into effect after 180 days of your condition being presented.

The entry age for this rider can range between 18 to 65 years. This rider provides financial security in case of total and permanent disability caused by an accident. The policy term for this rider ranges between 5 to 52 years with maturity age between 23 to 70 years. You can carry out your payments through options like Single Pay, Regular Pay and Limited Pay but bear in mind that the frequency of these payments must match your selections in the base plan. It is important to note that the total rider premiums should not exceed 30% of the base plan premium. The minimum Sum Assured received from this rider is Rs. 1,00,000, while there is no limit on the maximum Sum Assured value, subject to Reinsurance capacity . However, the maximum sum assured cannot exceed the value of the Sum Assured of the base plan.

Edelweiss Tokio Life - Payor Waiver Benefit Rider - UIN 147B014V05

Unforeseen circumstances like diagnosis of a critical illness or disability can have long-reaching effects. It can change your lifestyle and can have an adverse effect on your everyday processes. This Rider provides assistance in such a case - diagnosis of one of listed critical illnesses, a total and permanent disability caused by an accident or death. In such a case, all your remaining premium payments will be waived off and your policy benefits will continue unaffected. This Rider is applicable on plans where the life insured and proposer of the policy are different people.

This optional benefit has an entry age of 18 to 65 years and its maturity age is 70 years. Your payment frequency and term for this rider should coincide with the selection made for the base plan. The minimum premium amount you will have to pay is Rs. 3.40, while the maximum premium will be restricted to 30% of the base product premium. The minimum premium amount that will be waived off through this rider is Rs. 1000, whereas there is no limit for the maximum premium amount.

This Rider covers the following critical illnesses - Cancer of Specified Severity, Open Chest CABG, Myocardial Infarction (First Heart Attack of specific severity), Open Heart, Replacement OR Repair of Heart Valves, Kidney Failure Requiring Regular Dialysis, Third Degree Burns, Major Organ / Bone Marrow Transplant, Permanent Paralysis of Limbs, Stroke Resulting in Permanent Symptoms, Surgery of Aorta, Coma of Specified Severity and Blindness. This Rider offers a 15-day Free Look period and the Grace Period is the same as the base plan.

Edelweiss Tokio Life Hospital Cash Benefit UIN No.: 147B006V03

Diagnosis of a critical illness leads to a number of new changes. Today, healthcare costs are rising at a rapid rate, making it important to opt for an additional health cover. Hospitalization can be costly, but the real issue lies in the costs that come during recovery and rehabilitation. To counter these difficulties, you can opt for this Rider. With this, get a minimum of Rs. 1000 and maximum of Rs. 6000 from the first day of hospitalization under the Daily Cash Benefit. This is independent of actual hospital expenses and will be available throughout your hospitalization duration. Additionally, 1% of your Sum Assured value will be provided to you for every day spent in the ICU. You also receive a lump sum amount equal to 4% of your Sum Assured value post your discharge from the hospital as a Recuperating Benefit. This plan looks out for your hospitalization expenses through entry age spanning between 18 to 65 years and maturity age of 23 to 70 years. You can get this optional benefit for 5 till 52 years and make your payments via different options like Single Pay, Regular Pay and Limited Pay. The frequency of payments should coincide with the selection made on the base plan. The minimum Sum Assured you get from this rider is Rs. 100,000 and the maximum amount is Rs. 600,000. This rider also requires a waiting period of 60 days before activation.

Get Guaranteed¹ Income in just 4 steps!

Get Guaranteed¹ Income in just 4 steps!

Pick the Basics

- Select your plan option

- Choose the amount you want to start saving

- Choose your policy term, premium paying term & frequency (Note-Sum Assured on Death and Sum Assured on Maturity will be determined based on the above inputs plus your age & gender)

Customize Your Plan

- Opt for Family Income Benefit on Critical illness or Family Income Benefit on Critical illness & Death

- This can be opted for at policy inception only

Enhance Your Plan

- Choose from six riders

- Get enhanced protection with the rider(s) selected

Sit Back and Relax

- Submit the requested documents

- Let us verify your details so you can start getting guaranteed income!

Asset Publisher

More Products You'd Love to Explore

Capital Guarantee¹: Assurance Amidst Market Fluctuations

Market-linked returns, with an additional benefit of guaranteed¹ return of your total invested premium at maturity

Benefits of market-linked returns and guaranteed¹ lumpsum in one plan

Enhanced cover option with sum assured & booster additions

Little Star Benefit option to protect your child’s future

Tax benefits³ u/s 80c & 10(10d) to shield your savings

Income Assured. Promises Secured with Regular Guaranteed¹ Income!

Pandemic, Recession, or anything – keep your guaranteed¹ income flowing!

Regular Guaranteed¹ Income + Life Cover + Tax Benefits³ up to ₹46,800* in one plan

Option to start a Regular Stream of income from 2nd policy year⁶

Choice of 2 plan options – Flexible Income or Large Income

Option to avail additional Lumpsum pay-out at the time maturity

Savings Ke Liye Effective Solution!

The affordable way to start growing your wealth, fulfilling your goals and protection needs.

All you need to start is Rs. 1000 p.m.

Life cover till you’re 100

Option to get maturity benefits in just 5 years

Tax Benefits³ u/s 80(C) on premiums paid & u/s 10(10D) on maturity benefit

Need expert advice

Need expert advice?

Reasons Why You’re Bound To Love Us Back Premier Guaranteed Income Customize

Reasons Why You’re Bound To Love Us Back

99.20% Claim Settlement Ratio**

Our Promise of Integrity- 99.20% Claim Settlement Ratio** for FY 2023

Best Customer Experience

Customer Experience Excellence in CX 2022 – Economic Times CX Summit^³

Reasons Why You’re Bound To Love Us Back

99.20% Claim Settlement Ratio**

Our Promise of Integrity- 99.20% Claim Settlement Ratio** for FY 2023

Best Customer Experience

Customer Experience Excellence in CX 2022 – Economic Times CX Summit^³

Here's Why Our Customers Adore Us

Here's Why Our Customers Adore Us

Look at what people had to say about our services

Asset Publisher

He was very much clear about the issue and the importance of it.. Thanks rohit

Anisha Shashidharan

(sr.associate)

Your customer support is doing excellent job.keep up the good work.

Nilesh Pawar

(manager)Fire Away Queries

Fire Away Queries

Like teachers say, there are no silly questions

Why should I invest in a guaranteed¹ income plan?

A plan that offers guaranteed¹ returns ensures that you have a source of income, no matter the circumstances. This plan caters to your need for stable wealth accumulation, along with providing protection for your family and giving tax³ benefits. With these benefits, you can ensure your achievement of future goals, whether it be a happy retirement or paying for your child’s education

Was this helpful?

What should I opt for Edelweiss Tokio Life Premier Guaranteed¹ Income plan?

Edelweiss Tokio Life – Premier Guaranteed Income is a life insurance plan designed to provide a protection to your family from any financial loss in case of an untimely death or diagnosis of covered Critical Illness, and also offers a guaranteed¹ regular income and / or guaranteed¹ lump sum to you and your family, provided all due premiums are paid. It has four plan options to help you customize the plan as per your requirement.

Was this helpful?

What goals can I meet with this plan?

You may want an early retirement which can be enjoyed in style with regular guaranteed¹ income, or it could be an international education course for your child. It would be ideal to invest in a plan which helps you accumulate wealth / generate income via guaranteed returns to achieve these goals, even in your absence.

Was this helpful?

Are all the benefits guaranteed¹?

Yes, all the benefits in this plan are guaranteed¹.

Was this helpful?

Is the Life Cover available throughout the policy term?

Life Cover is available throughout the policy term, provided all premiums are paid and the policy is in-force.

Was this helpful?

How many plan options are available?

This plan offers 4 plan options to choose from – Lump sum, Short term Income, Long Term Income & Retirement Income, basis your life goals. You could want an early retirement that you could enjoy in style with regular guaranteed income through the Retirement Income option, or you could gift your child a regular higher education tuition fees through Short Term Income option or Long Term Income option, or it could be an international education course for your child for which you may need a lump sum guaranteed¹ payout.

Was this helpful?

Are there any additional benefits available?

With all Plan Options, there is an additional optional benefit of Family Income Benefits. This benefit ensures that in case of an unfortunate event of death or diagnosis of covered Critical Illness of the Life Insured, you and your loved ones don’t have to compromise on your dreams as you/they will continue to receive benefit. There are two options available under the Family Income Benefits - Family Income Benefits on Critical Illness and Family Income Benefits on Critical Illness and Death.

Was this helpful?

What is the Premium Paying Term (PPT) for this plan?

For all plan options, the Premium Paying Term (PPT) options are 5, 8, 10 & 12

Was this helpful?

What is the Policy Term for this plan?

The policy term for this plan depends on the plan option selected -

Lump Sum

For 5 PPT: 10, 15 & 20 For 8 PPT: 10, 15 & 20 For 10 PPT: 12, 15 & 20 For 12 PPT: 15 & 20

Short Term Income

For 8 PPT: 18 For 10 PPT: 22 For 12 PPT: 26

Long Term Income

For 5 PPT: 22, 27, 32 & 37 For 8 PPT: 25, 30, 35 & 40 For 10 PPT: 27, 32, 37 & 42 For 12 PPT: 29, 34 & 39

Retirement Income

80 minus entry age

Was this helpful?

What is a Rider?

A rider is an additional benefit that you can opt for, to enhance your plan. These are available at a nominal extra cost.

Was this helpful?

Are there any Riders available?

Following are the riders available with this plan:

● Edelweiss Tokio Life - Accidental Death Benefit Rider

● Edelweiss Tokio Life - Accidental Total and Permanent Disability Rider

● Edelweiss Tokio Life - Critical Illness Rider

● Edelweiss Tokio Life - Waiver of Premium Rider

● Edelweiss Tokio Life - Payor Waiver Benefit Rider

● Edelweiss Tokio Life - Income Benefit Rider

Was this helpful?

Can I get a loan through this plan?

Yes, you can get a policy loan once policy acquires surrender value. Policy loan is subject to terms & conditions of the product. Refer product sales brochure for more details.

Was this helpful?

What is the free look period of this policy?

You have a period of 15 days from the date of the receipt of the policy document. Policies sold through Distance Marketing & electronic policies will have a free look period for 30 days.

Was this helpful?

Are there any exclusions?

In case of death due to suicide within 12 months from the risk commencement date or from the date of revival of the policy, your beneficiary shall be entitled to receive at least 80% of the Total Premiums Paid, provided the policy is in in-force.

Was this helpful?

Do I get any Grace Period?

Grace period of 15 days, where you pay the Premium monthly, and 30 days in all other cases, is available.

Was this helpful?

Any Queries For Premier Guaranteed Income

We are always there for you!

For queries, write to onlinesales@edelweisstokio.in

Contact us on 022 6611 6017

Premier Guranteed Income Videos

1- This is applicable only if all due premiums are paid and the policy is inforce.

2- Policy loan are subject to terms & conditions of the product. Refer product brochure for more details.

3- As per provisions of Income Tax Act, 1961. Tax benefits are subject to changes in tax laws.

9- Riders are Optional and available at extra cost. Please refer rider brochure for more details.

^ The Returns will differ since it is calculated basis the age, gender chosen for a healthy non-smoker of policy term of 25 years with premium paying term of 10 years, plan option chosen as ‘Lumpsum’ and the distribution channel is Online Sales.

~ Premium (exclusive of taxes) calculated for 30 year old male, DOB 01/01/1991, non-smoker, for a policy term of 20 years with Rs. 1CR life cover, premium paying term 10 years, payment frequency annually, plan option selected as Lumpsum and the distribution channel is Online Sales.

^² - https://cloud-user-recordings-ffmpeg-converted-prod.s3-ap-south-1.amazonaws.com/recordings/ccd117b0-be48-11eb-9782-b590083730e8/3b7e25a3-b9b4-47b0-9f68-70eeb8062d60/ccd117b0-be48-11eb-9782-b590083730e8_0001_474830a2.mp4 (Quantic Business Media)

^³ - Excellence in CX-2022 has been received at the 3rd Edition of The Economic Times CX Summit. This award has been given to those organisations who have demonstrated excellence in Customer Experience in FY22.

Edelweiss Tokio Life – Premier Guaranteed Income is only the name of an Individual, Non-Linked, Non-Participating, Savings, Life Insurance Product and does not in any way indicate the quality of the plan, its future prospects or returns. Please know the associated risks and the applicable charges from your Personal Financial Advisor or the Intermediary. Tax benefits are subject to changes in the tax laws. The tax benefits under this Policy may be available as per the prevailing Income Tax laws in India. For more details on risk factors and terms and conditions, please read sales brochure carefully before concluding a sale.

IRDAI Reg. No.: 147. CIN: U66010MH2009PLC197336. UIN: 147N072V03.

ARN: WP/3444/Oct/2023

View Download

View Download