Guide to Section 10(10D) of Income Tax Act, 1961

Blog Title

53814 |

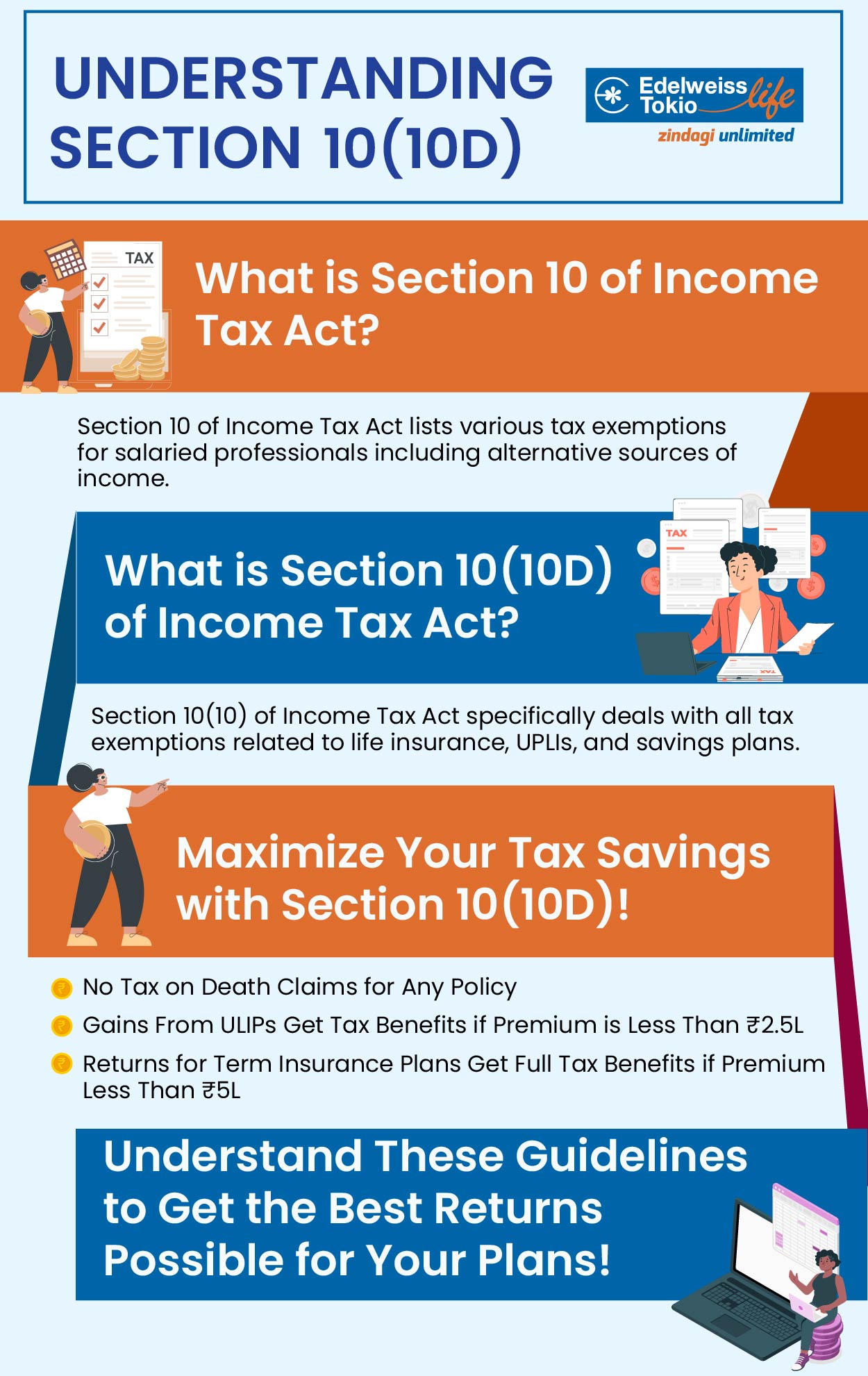

When examining insurance tax benefits, we frequently evaluate the benefits of the tax deductions for insurance premiums paid under Section 80C for Life Insurance and Unit Linked Insurance Plans. There are also Section 80D tax breaks for health insurance premium payments. However, there is another part of the Income Tax Act that allows tax breaks for insurance payouts. This is the less well-known Section 10(10D) of the Income Tax Act.

This provision exempts from income tax on any income received from your life insurance policy, and this deduction is available for all forms of life insurance policies. What makes it even more intriguing is that the deductions under section 10 (10D) have no maximum limit and also include bonuses and surrender values.

Section 10 (10D) of the Indian Income Tax Act provides an opportunity for taxpayers to reduce their taxable income. Let us unravel this section in detail.

What is Section 10 (10D) of the Income Tax Act?

Individuals can claim tax exemption on the sum assured and accrued bonus (if any) received through their life insurance policy claim under Section 10 (10D) of the Income Tax Act of 1961. (maturity or death benefit). This exemption also applies to ULIP returns and is available on all types of life insurance policy claims.

Individuals (both salaried and non-salaried), Hindu Undivided Families (HUFs), Associations, Trusts, Companies, Bodies of Persons, Foreign Companies, and others are eligible to claim these exemptions.

However, the tax benefits under Section 10(10D) of the Indian Income Tax Act 1961 can only be availed under the following terms and conditions:

- The tax deductions are applicable on every sum received under a life insurance plan, such as death benefit, maturity benefit, or the bonus received from life insurance policies

- For the life insurance policies bought between 1st April 2003 and 31st March 2012, the premium paid for any year cannot be more than 20% of the sum assured

- For policies purchased after 1st April 2012, the premium cannot be more than 10% of the sum assured

- If an individual suffers from a severe disability or disease, and their policy was issued on or after 1st April 2013, then the 10% limit for them has been revised to 15%. This applies to individuals under the following criteria:

- Disabled or severely disabled, as specified under Section 80U of the Income Tax Act, 1961

- Suffering from any disease as specified under Section 80DDB of the Income Tax Act, 1961

- This also includes any returns from single premium life insurance policies and unit-linked insurance plans (ULIPs) (if the aforementioned conditions are met).

Exceptions under Section 10 (10D) of the Income Tax Act, 1961

It is important to be mindful of the exceptions to Section 10(10D) of the Income Tax Act, 1961. These include:

- Any amount received under a Keyman insurance policy, meaning a life insurance policy taken by an employer:

- On the life of a current or former employee

- On the life of an employee who is or was connected with the business

- Amount received under sub-section (3) of Section 80DD or sub-section (3) of 80DDA of the Income Tax Act

- For the life insurance policies bought between 1st April 2003 and 31st March 2012, if the premium paid for any year exceeds more than 20% of the sum assured

- For policies purchased after 1st April 2012, if the premium exceeds more than 10% of the sum assured

- Considering that the provisions of sub-clauses (c) and (d) shall not apply to any sum received on the death of a person and

- To calculate the actual capital sum assured under sub-clause (c)

Salient Eligibility Criteria for Section 10 (10D) of the Income Tax Act, 1961

Some of the most important eligibility criteria for deductions under Section 10(10D) are:

- Tax deductions can be availed on life insurance policy claims, such as death or maturity benefit and accrued bonuses if any.

- There is no upper limit on the claim for life insurance policies

- The tax deductions are available for insurance purchased from Indian as well as foreign life insurance companies

Can you save Income Tax through Life Insurance?

Taxpayers frequently inquire about the tax advantages that term insurance provides. They frequently inquire as to which section of the Income Tax Act term insurance falls under. Of course, the vast majority of people are aware that these benefits are available under Section 80C. Life insurance premiums paid during any fiscal year are exempt from taxable income under section 80C of the Income Tax Act, 1961, up to a maximum of INR 1.5 lakh. However, it is not the only section that proves to be beneficial to taxpayers. This is due to the fact that certain tax benefits are available under section 10 (10D) of the Income Tax Act of 1961.

What about TDS on Life Insurance?

Unless the maturity amount is exempt under section 10 (10D) as insurance tax benefits, any money received from an insurance provider under a life insurance policy is subject to TDS (Tax Deduction at Source) at a rate of 1% under section 194DA of the Income Tax Act, 1961. Furthermore, if a PAN card is not submitted, then the rate of TDS becomes 20%.

This indicates that policy proceeds exempt under section 10 will not be subject to the TDS (10D). Additionally, the insurer is exempt from paying TDS if the earnings are taxable under section 10(10D) but do not exceed Rs 100,000.

Tax Benefits with Edelweiss Tokio Term Plan

Edelweiss Tokio offers Edelweiss Tokio Life - Saral Jeevan Bima, a low-cost term insurance plan that offers numerous benefits, including applicable tax benefits. You can get tax deductions of the premium paid for the policy under Section 80(C) of the Income Tax Act, 1961. Additionally, the death benefit payable under the plan is exempt from taxation under Section 10 (10D) of the Act.

You can calculate the premium required for Edelweiss insurance using the free term plan calculator available on the website. Edelweiss term insurance – Saral Jeevan Bima combines contemporary financial needs such as COVID-19 death claims, seamless term cover, and low premiums, making it an affordable term insurance cover for all.

Summing Up

While affordability is an important factor in looking for suitable insurance, providing financial protection for your family is the foundation of every term plan. Additionally, be aware of the term plan tax benefits that you can avail of from your plan.

Be mindful of future requirements and incorporate components such as inflation and changing financial needs before you buy term insurance.

Swati Tumar - Travel & Finance Writer

Swati is a Writer in the day and an illustrator at night. Among her interests, she is quite fond of art and all things creative. She often indulges herself in creating doodles, illustrations, and other forms of content. She identifies herself as an avid traveler and shameless foodie.