Capital Secure+

IN UNIT LINKED INSURANCE POLICIES, INVESTMENT RISK IN THE INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER. This advertisement is designed for combination of Benefits of two or more individual and separate products named (1) Edelweiss Tokio Life - Guaranteed Savings STAR UIN (147N074V02), A Non-Linked, Non-Participating, Individual, Savings, Life Insurance Plan (2) Edelweiss Tokio Life – Wealth Rise+ UIN (147L076V02), A Unit Linked, Non-Participating, Individual, Life Insurance Product. These products are also available for sale individually without the combination offered/suggested. This benefit illustration is the arithmetic combination and chronological listing of combined benefits of individual products. The customer is advised to refer to the detailed sales brochure of respective individual products mentioned herein before concluding sale.

Steps to Guaranteed¹, Growing Happiness!

Choose for Enhanced Protection!

- Add Little Star Benefit & Edelweiss Tokio Life – Payor Benefit Rider⁹

Customize Away!

- Choose your preferred premium

- Choose your preferred premium payment frequency

- Choose your policy term

- Choose your premium paying term

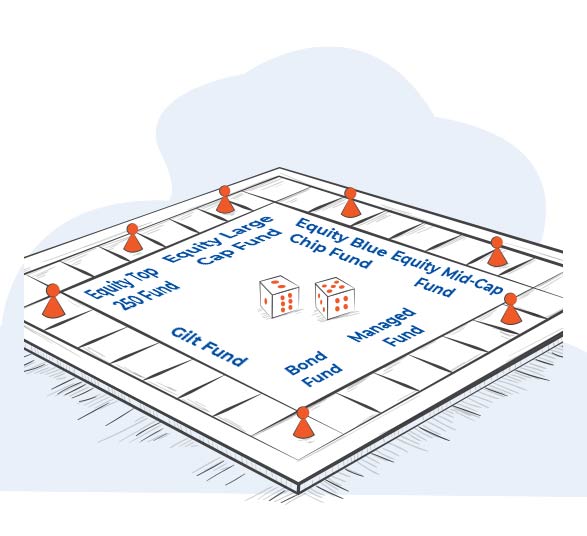

Your Fund Management, or Ours?

- Choose between the Self-managed strategy or the Life Stage and Duration

- The first option gives you the freedom and unlimited switches to make your own choices

- The latter choice gives us the opportunity to do this for you

Sit Back and Relax

- Submit the requested documents

- Let us verify your details and start your wealth accumulation journey!

More Products You'd Love to Explore

Market-linked Returns with Guaranteed¹ Lumpsum Option!

Maintain a diversified portfolio by investing in the market, while also receiving a guaranteed¹ payout at maturity.

Benefits of market-linked returns and guaranteed¹ lumpsum in one plan

Enhanced Cover option with higher sum assured & booster additions

Little Star Benefit option to protect your child’s future

Tax benefits³ u/s 80C & 10(10D) to shield your savings

Har Sapna Karo Poora with Guaranteed¹ Savings!

Guaranteed¹ returns, enhanced cover option, tax benefits³, and more… all with premiums just Rs. 3,000/month^².

Choice to receive guaranteed¹ returns as lumpsum or in 5 equal annual instalments

Enhanced Cover option to secure your family with 20x the premium^⁴ paid

Guaranteed¹ savings & life cover for a policy term as high as 40 years

Family Income Benefit option to ensure your family doesn’t have to compromise on dreams

Future Guaranteed¹ Income, now possible!

Makes sure nothing gets in the way of you and your dreams.

Guaranteed¹ Income + Protection + Tax Benefits³ in one plan

Pick from 4 plan options basis life goals – Lumpsum, Short Term Income, Long Term Income & Retirement Income

Family Income Benefit option ensures your family doesn’t have to compromise dreams

6 Riders available to enhance your plan⁹

Need expert advice?

We are always there for you

For queries, write to onlinesales@edelweisstokio.in

Contact us on 022 6611 6092

The Linked Insurance Products do not offer any liquidity during the first five years of the contract. The policyholder will not be able to surrender/withdraw the monies invested in Linked Insurance Products completely or partially till the end of the fifth year.

1- This is applicable only if all due premiums are paid and the policy is in-force.

3- As per provisions of Income Tax Act, 1961. Tax benefits are subject to changes in tax laws.

9- Riders are available at extra cost. Please refer rider brochure for more details.

Edelweiss Tokio Life – Payor Waiver Benefit Rider is only the name of the Individual, Non-Linked, Non-Par, Pure Risk Premium, Life Insurance Rider. UIN 147B014V05

#- This benefit is applicable under Edelweiss Tokio Life Wealth Rise+, A Unit Linked, Non-Participating, Individual, Life Insurance Product. This product is also available for sale individually without the combination offered/suggested.

Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. The premium paid in unit linked life insurance policies are subject to investment risk associated with capital markets and the unit price of the units may go up or down based on the performance of investment fund and factors influencing the capital market and the policyholder is responsible for his/her decisions. Edelweiss Tokio Life Insurance Company Limited is only the name of the Insurance Company and Edelweiss Tokio Life – Wealth Rise+ is only the name of the unit-linked life insurance contract and does not in any way indicate the quality of the contract, its future prospects, or returns. Please know the associated risks and the applicable charges from your Personal Financial Advisor or the Intermediary or policy document of the Insurer. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. Tax benefits are subject to changes in the tax laws. UIN: 147L076V02

Edelweiss Tokio Life - Guaranteed Savings STAR is a Non-Linked, Non-Participating, Individual, Savings, Life Insurance Plan. Tax benefits are subject to changes in the tax laws. The tax benefits under this Policy may be available as per the prevailing Income Tax laws in India. For more details on risk factors and terms and conditions, please read sales brochure carefully before concluding a sale. UIN: 147N074V02

ARN: WP/3505/Oct/2023