Wealth Rise+

Menu Display

- Customer Service

- Our Products

- Capital Secure+ - A Combination Of Market-Linked And Guaranteed Returns

- Edelweiss Tokio Life –Wealth Rise+ – A double-advantage ULIP

- Edelweiss Tokio Life – Premier Guaranteed Income – A guaranteed income plan

- Edelweiss Tokio Life –Wealth Secure + - A new generation ULIP

- Edelweiss Tokio Life- Zindagi Protect - A Comprehensive Term Plan

- All Products

- Resume Application

- Insurance Guide

- Knowledge Center

- About Us

Menu Display

-

Our Products

- Capital Secure+ - A Combination Of Market-Linked And Guaranteed Returns

- Edelweiss Tokio Life –Wealth Rise+ – A double-advantage ULIP

- Edelweiss Tokio Life – Premier Guaranteed Income – A guaranteed income plan

- Edelweiss Tokio Life –Wealth Secure + - A new generation ULIP

- Edelweiss Tokio Life- Zindagi Protect - A Comprehensive Term Plan

- All Products

Menu Display

Breadcrumb

"IN THIS POLICY, INVESTMENT RISK IN THE INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER"

Give Your Wealth a Boost of Guarantee¹!

invest in market-linked returns with an additional guaranteed1

lumpsum option.

Product Enquiry

Take a step ahead to grow your savings

No response from Server, Please try again.

Thank you!!

Thank you for sharing your details with us.

Our product expert will get in touch with you soon to understand your life insurance needs.

Sticky Menu Wealth Rise Plus

A multiple of single/annualized premium as life cover at all times during policy tenure

Secure your future by starting now and gaining a comprehensive understanding of the plan.

Reasons Why This Plan Helps Your Wealth Grow

Reasons Why This Plan Helps Your Wealth Grow

Start Small,

End Big!

Starting small can have a big impact on your investment. Set aside Rs. 3000/month² to start your journey towards wealth creation.

Savings with the

Power of Guarantee¹!

We understand how much you like certainties! Base Cover option includes an additional guaranteed¹ lumpsum at maturity.

Additions that

Boost Your Savings!

Loyalty, Booster & Maturity Additions⁵ – these little extras from our end go a long way to help you accumulate wealth.

Safety for Your

Little Ones' Dreams!

Optional benefit^² to fulfil your child’s dreams with future premiums waived off and policy benefits intact, even in your absence.

Enhanced Security for Your Loved Ones!

Higher Coverage with a minimum of 7X or, at least 15X of premium paid with Base and Enhanced Cover options, respectively.

Benefits Wealth Rise Plus

Benefits of Edelweiss Tokio Life-Wealth Rise+

-

Multiple Benefits. One Plan.

Benefits that make your income grow! With this plan, we help you accumulate wealth with market-linked returns, guaranteed1 lumpsum at maturity, additional fund boosters5 and tax benefits3.

-

Guaranteed¹ Lumpsum

Savings with security! Add a safety net to your market-linked returns with guaranteed¹ lumpsum available with the Base Cover option. Guaranteed¹ Lumpsum will be payable to the fund value at the time of maturity.

-

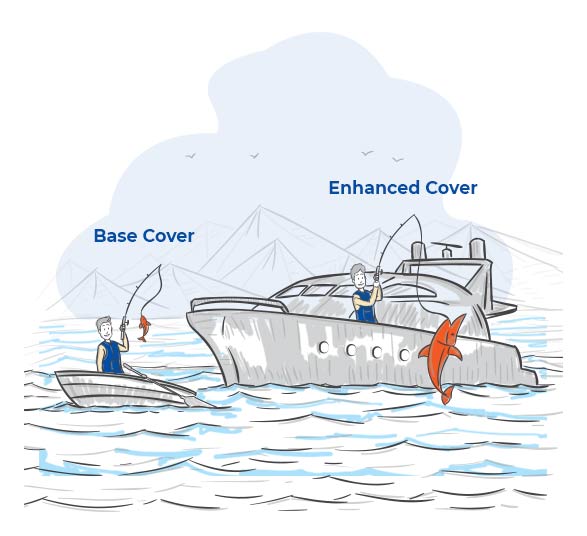

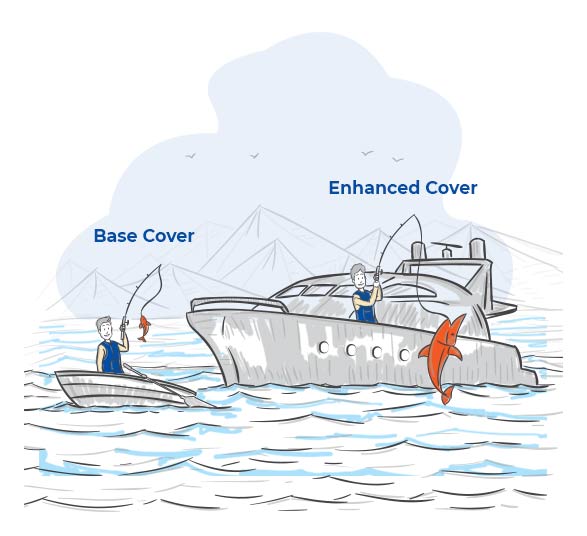

Customized Coverage for Your Needs

2 plan options to choose from! The product offers following two Plan Options - Base Cover and Enhanced Cover. Under Base Cover option, you get life cover of either 7 times to 10 times annualized premium on individual life depending on the annualized premium chosen. If you choose enhanced cover option, you get minimum 15 times of annualized premium as life cover on individual life. And you can choose a higher multiple as life cover subject to board approved underwriting policy.

-

Investment Strategy Options

Your choice or ours? You can opt for the self-managed investment strategy, where you get unlimited switches between funds using switch option. Alternatively, we offer Life Stage and Duration based STP (here we manage your funds according to your life stage). This strategy ensures that money is moved from equity-oriented fund to debt-oriented fund as the age increases, and the remaining policy term reduces.

-

Additions to the Plan

We help you grow your fund value! Under Base Cover option, you can receive Loyalty

Additions to maximize your returns, applicable from the 6ᵗʰ policy year till the end of

premium paying term. Similarly, booster additions are added at the end of 10ᵗʰ policy

year and every 5ᵗʰ policy year thereafter till the policy maturity. The Maturity

Addition is available for premium paying term greater than and equal to 10 years.

Under Enhanced Cover option, the Booster Additions will be added, at the end of each

policy year, to the fund value in form of addition of units starting from the end of 11ᵗʰ

policy year till maturity.

-

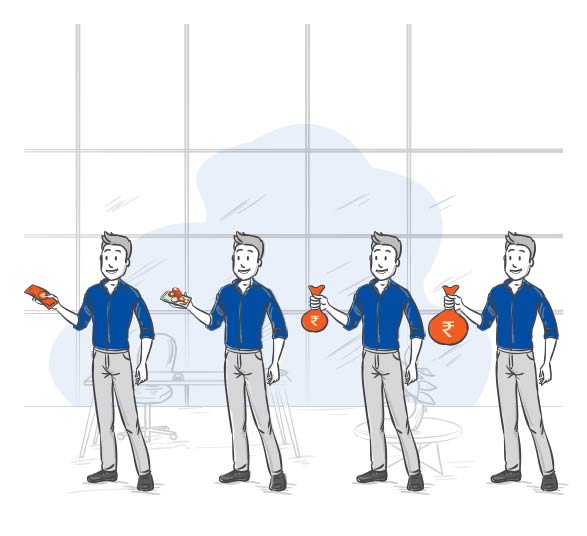

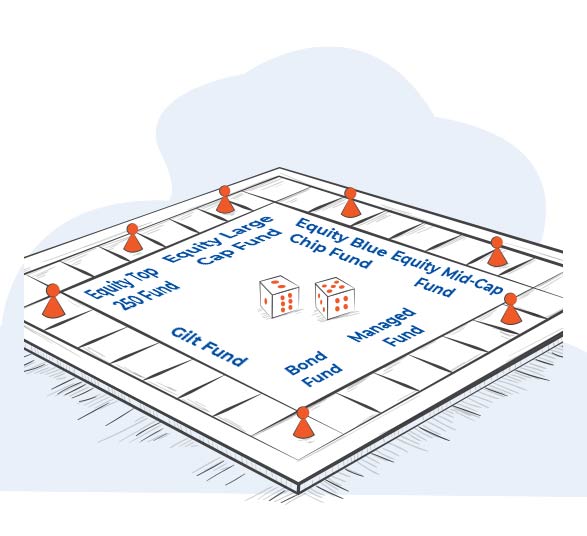

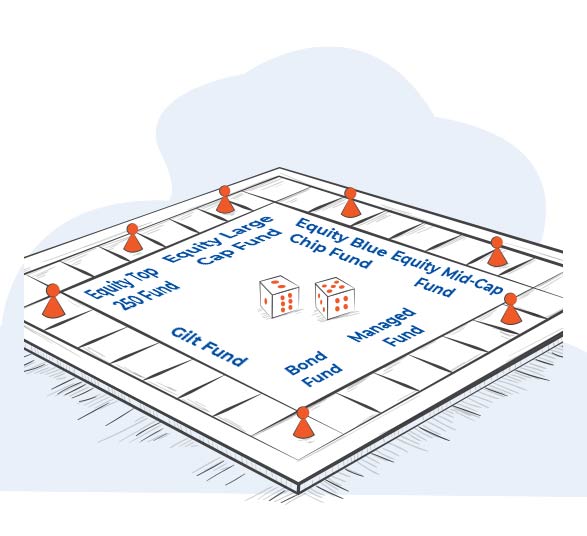

Bouquet of 7 Funds

Select the funds of your choice! We’ve got a bouquet of diverse funds that will help you

in your journey of wealth accumulation, if you opt for self-managed strategy. Following

7 Unit Funds are offered under this plan - Equity Large Cap, Equity Top 250, Bond Fund,

Managed Fund, Equity Mid Cap Fund, Equity Blue Chip Fund and GILT Fund

-

Little Star Benefit Option

Build a bright future for your champ! Children carry the hope of a brighter future, and

nothing should diminish their potential. That is why, in case you are no longer around,

this optional benefit, if opted, waives off any future premiums and keeps the policy

benefits intact.

-

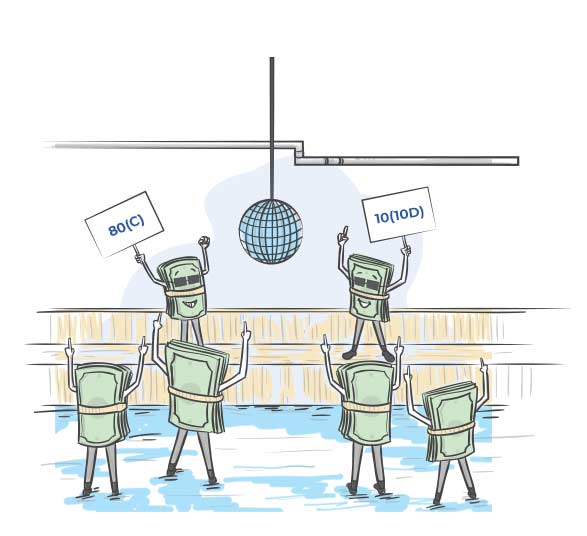

Tax Benefits³

No Deductions, no worries! Premium amount you pay towards ULIP is eligible for tax

benefits³ under Sections 80C and returns upon maturity are exempt if conditions of

section 10(10D) of Income Tax Act, 1961, are fulfilled

Multiple Benefits. One Plan.

Benefits that make your income grow! With this plan, we help you accumulate wealth with market-linked returns, guaranteed1 lumpsum at maturity, additional fund boosters5 and tax benefits3.

Guaranteed¹ Lumpsum

Savings with security! Add a safety net to your market-linked returns with guaranteed¹ lumpsum available with the Base Cover option. Guaranteed¹ Lumpsum will be payable to the fund value at the time of maturity.

Customized Coverage for Your Needs

2 plan options to choose from! The product offers following two Plan Options - Base Cover and Enhanced Cover. Under Base Cover option, you get life cover of either 7 times to 10 times annualized premium on individual life depending on the annualized premium chosen. If you choose enhanced cover option, you get minimum 15 times of annualized premium as life cover on individual life. And you can choose a higher multiple as life cover subject to board approved underwriting policy.

Investment Strategy Options

Your choice or ours? You can opt for the self-managed investment strategy, where you get unlimited switches between funds using switch option. Alternatively, we offer Life Stage and Duration based STP (here we manage your funds according to your life stage). This strategy ensures that money is moved from equity-oriented fund to debt-oriented fund as the age increases, and the remaining policy term reduces.

Additions to the Plan

We help you grow your fund value! Under Base Cover option, you can receive Loyalty

Additions to maximize your returns, applicable from the 6ᵗʰ policy year till the end of

premium paying term. Similarly, booster additions are added at the end of 10ᵗʰ policy

year and every 5ᵗʰ policy year thereafter till the policy maturity. The Maturity

Addition is available for premium paying term greater than and equal to 10 years.

Under Enhanced Cover option, the Booster Additions will be added, at the end of each

policy year, to the fund value in form of addition of units starting from the end of 11ᵗʰ

policy year till maturity.

Bouquet of 7 Funds

Select the funds of your choice! We’ve got a bouquet of diverse funds that will help you

in your journey of wealth accumulation, if you opt for self-managed strategy. Following

7 Unit Funds are offered under this plan - Equity Large Cap, Equity Top 250, Bond Fund,

Managed Fund, Equity Mid Cap Fund, Equity Blue Chip Fund and GILT Fund

Little Star Benefit Option

Build a bright future for your champ! Children carry the hope of a brighter future, and

nothing should diminish their potential. That is why, in case you are no longer around,

this optional benefit, if opted, waives off any future premiums and keeps the policy

benefits intact.

Tax Benefits³

No Deductions, no worries! Premium amount you pay towards ULIP is eligible for tax

benefits³ under Sections 80C and returns upon maturity are exempt if conditions of

section 10(10D) of Income Tax Act, 1961, are fulfilled

Making Plans for the Financially Secure Future in 4, 3, 2, 1 - Go!

Making Plans for the Financially Secure Future in 4, 3, 2, 1 - Go!

Start Your Edelweiss Tokio Life - Wealth Rise+ Journey Here!

- Choose Your Variant – Base Cover or Enhanced Cover

- Choose your policy term, premium paying term, mode and sum assured multiple

Choose Your Fund Strategy

- You have an option to allocate your premium in any one of the two Investment Strategies – Self Managed and Life Stage and Duration based strategy.

Customize Your Plan

- Choose your policy term (number of years for which you want to stay protected and then you receive your savings). You can choose a fixed policy term from 5,10,15,20,25,30,35 or 40 years

- Select Little Star Benefit Option

Sit Back and Relax

- Submit the requested documents

- Let us verify your details to help you start with your wealth accumulation journey!

EdelweissPremiumReturnsCaculatorWeb

Plan Your Financial Growth With Wealth Rise+

Rahul invested

₹every year for

Year

By the end of 15 years , Rahul receives a fund value of

@

Annual Premium Amount: Rs 50,000

Policy Term 15 Years

Fund Value Rs 0

This is a sample Illustration. Some benefits are guaranteed, and some benefits are variable with returns based on the future performance of the your Insurer carrying on life Insurance business. If your policy offers guaranteed benefits, then these will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable benefits then the illustrations on this page will show two different rates of assumed future investment returns. These assumed rates of return are not guaranteed, and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance.

Asset Publisher

More Products You'd Love to Explore

Capital Guarantee¹: Assurance Amidst Market Fluctuations

Market-linked returns, with an additional benefit of guaranteed¹ return of your total invested premium at maturity

Benefits of market-linked returns and guaranteed¹ lumpsum in one plan

Enhanced cover option with sum assured & booster additions

Little Star Benefit option to protect your child’s future

Tax benefits³ u/s 80c & 10(10d) to shield your savings

Future Guaranteed¹ Income, now possible!

Makes sure nothing gets in the way of you and your dreams.

Guaranteed¹ Income + Protection + Tax Benefits³ in one plan

Pick from 4 plan options basis life goals – Lumpsum, Short Term Income, Long Term Income & Retirement Income

Family Income Benefit option ensures your family doesn’t have to compromise dreams

6 Riders available to enhance your plan⁹

Har Sapna Karo Poora with Guaranteed¹ Savings!

Guaranteed¹ returns, enhanced cover option, tax benefits³, and more… all with premiums just Rs. 3,000/month^².

Choice to receive guaranteed¹ returns as lumpsum or in 5 equal annual instalments

Enhanced Cover option to secure your family with 20x the premium^⁴ paid

Guaranteed¹ savings & life cover for a policy term as high as 40 years

Family Income Benefit option to ensure your family doesn’t have to compromise on dreams

Need expert advice

Need expert advice?

Reasons Why You’re Bound To Love Us Back

Reasons Why You’re Bound To Love Us Back

We want to enable our customers to achieve their financial goals and be financially secured.

We have the expertise in making you grow your wealth.

We constantly innovate our offerings to get better results to secure your future.

Reasons Why You’re Bound To Love Us Back

We want to enable our customers to achieve their financial goals and be financially secured.

We have the expertise in making you grow your wealth.

We constantly innovate our offerings to get better results to secure your future.

Testimonial Rating

Here's Why Our Customers Adore Us

Look at what people had to say about our services

Asset Publisher

He was very much clear about the issue and the importance of it.. Thanks rohit

Anisha Shashidharan

(sr.associate)

Your customer support is doing excellent job.keep up the good work.

Nilesh Pawar

(manager)FAQs Wealth Rise

Fire Away Queries

Like teachers say, there are no silly questions

What is a wealth accumulation plan?

A wealth accumulation plan is a financial product designed to help you fulfil your goals by growing your money. These plans come with tax benefits, life cover to protect you and your family from all future uncertainties and fulfil all your aspirations.

A wealth accumulation plan may help you in planning an early retirement that can be enjoyed in grand style. Or it could help you in saving for higher education for your child. Thus, it would be ideal to invest in a plan which takes care of financial security of your family and also helps you accumulate wealth with returns on maturity.

Was this helpful?

Why should I opt for Edelweiss Tokio Life Wealth Rise+?

Edelweiss Tokio Life Wealth Rise+ is an investment plan which offers market-linked returns along with a guaranteed lumpsum on maturity. Not only this, but you also get loyalty additions, booster additions and maturity additions to help you maximize savings. There are two plan options – base cover and enhanced cover which provides life cover 7-10 times of annualized premium and minimum 15 times of annualized premium respectively. Not only this, but you can also safeguard the future of your child by adding Little Star Benefit option. Overall, this plan helps you grow your wealth with benefits that protect your wealth.

Was this helpful?

What goals can I achieve with this plan?

Edelweiss Tokio Life Wealth Rise+ will help you fulfil your financial goals of life, like securing your child's future financial needs, child’s marriage or enjoying a stress-free retirement. You can also fulfil your goal to retire early and enjoy a life of leisure and travel. If you are a parent, this plan will help you save for your child’s future, so that they can fulfil their dreams even in your absence.

Was this helpful?

What funds are available with this plan?

Following Unit Funds would be offered under this plan:

- Equity Large Cap Fund

- Equity Top 250 Fund

- Bond Fund

- Managed Fund

- Equity Mid Cap Fund

- Equity Blue Chip Fund

- GILT Fund

Was this helpful?

What is the minimum and maximum entry age for this plan?

The minimum entry age is 18 years for this plan.

The maximum entry age for base cover option will vary based on premium paying term and policy term chosen.

Was this helpful?

What is the minimum and maximum maturity age?

The minimum maturity age – for base cover is 18 years and for enhanced cover is 33 years. The maximum maturity age for base cover option is 100 years and enhanced cover is 90 years.

Was this helpful?

What are the premium paying term options available?

Under the base cover option, the minimum premium payment term is 1 years for single pay, 5, 8, 10, 12, 15 & 20 years for limited pay and the equivalent of your policy term under regular pay.

Under the enhanced cover option, the premium paying term is 5, 8, 10, 12, 15 & 20 years for limited pay.

Please Note: For ‘To Age 100’, Single Pay & Limited Pay – 5 & 8 are not available.

Was this helpful?

What is the minimum and maximum policy term?

The minimum policy term is 5 years under base cover with single pay option.

The maximum policy term is ’to age 100’ under base cover with limited pay and regular pay.

Was this helpful?

What is Little Star Benefit?

Little Star Benefit is an optional benefit offered with this plan. If this benefit is opted, on the event of death of the Policyholder, the policy shall continue, and the child will receive the policy benefits as per the original plan.

Was this helpful?

What will the child get from the Little Star Benefit?

On the death of the policyholder under ‘Little Star Benefit’, Death benefit will be credited to the fund value.

- The Policy will continue till Maturity or death of Life Assured, whichever is earlier.

- No future premiums are required to be paid.

- Policy will stay continued, as the policy will be treated as fully paid-up policy, wherein all future premiums are assumed to have been paid.

- Loyalty Additions will be added till end of the premium paying term provided the policy was in in-force as on the date of death of policyholder.

- Maturity Additions, Booster Additions and Guaranteed Lumpsum will be added as and when due.

- Life Cover on Life Assured will continue

- Relevant charges like Policy Administrative Charges, Fund Management Charges and Mortality charges on Sum at Risk on the life of Life Assured will continue to be levied as and when due.

For a fully paid-up policy, reduced paid-up policy and policies in discontinuance status, death benefit is not available on death of policyholder.

Was this helpful?

Is there a Life Cover included with this plan?

There are 2 plan options.

Base Cover: In this variant, you get life cover of either 7 times to 10 times annualized premium on individual life depending on the annualized premium chosen.

Enhanced Cover: In this variant, you get minimum 15 times of annualized premium as life cover on individual life. And you can choose if you want a higher multiple as life cover subject to board approved underwriting policy.

Was this helpful?

Are all the benefits guaranteed upfront for this plan?

Edelweiss Tokio Life Wealth Rise+ being a market-linked return plan, offers returns that are dependent on market performance. However, under this plan, base cover option offers an additional ‘guaranteed’ lumpsum at maturity.

Was this helpful?

Are there any charges applicable for this plan?

Premium Allocation Charges are not applicable on base or top-up premium. Policy Administration Charges, Fund Management Charges, surrender discontinuance charges, mortality charges are applicable as per the policy.

Was this helpful?

What are Loyalty Additions?

Loyalty additions are one of the benefits we provide, where we periodically add to your fund to help you maximize your savings. These additions are applicable from the 6th policy year till the end of premium paying term. A percentage of last year's average of daily fund value is added at the end of 6th policy year and every year thereafter till the end of premium paying term (provided all the premiums which have fallen due have been paid in full). The Loyalty Additions percentage is 0.15% per annum. Loyalty Additions are not applicable for Single Pay policies and Limited Pay - 5 years.

Was this helpful?

What are Booster Additions?

Like loyalty additions, booster additions are also fund additions that help you maximize your savings. A percentage of last 5 years' average of daily fund value is added at the end of 10th policy year and every 5th policy year thereafter till the policy maturity.

Was this helpful?

What is Maturity Addition?

A percentage of last 5 years’ average of daily fund value is added at Maturity. The Maturity Addition is only available for PPT greater than and equal 10 years. The Maturity Addition percentage is 0.75%.

The fund value including the Loyalty Additions and Booster Additions, if any, already added till previous policy year will be considered to calculate the Maturity Addition.

Was this helpful?

What is Life Stage & Duration-Based Strategy?

In this investment type, we periodically adjust your investment fund as per your risk appetite. That is, it gets moved automatically from riskier fund to safer fund, as your age increases.

Was this helpful?

What is Self-Managed Strategy?

This is an option to self-manage your money, under this strategy, you can decide to put your money in your choice of fund(s) in any proportion. You can switch your money unlimited times amongst these funds using the switch option.

Was this helpful?

Is switching between funds allowed?

Under the self-managed strategy, you can move money between the funds any number of times depending on your financial priorities and investment outlook. This facility is called switching and is available free of cost.

Was this helpful?

Is partial withdrawal allowed in the policy?

The product offers an automated partial withdrawal facility (known as Systematic Withdrawal Plan). If this facility is chosen at the policy inception or anytime during the policy term, a sum of money can be systematically withdrawn regularly from the fund value. ‘Systematic withdrawal Plan’ will only be available for Base Cover Plan Option. This allows you to systematically withdraw your fund value every month/quarter/half-year/year from 11th policy year. It also provides much needed liquidity to fulfil any urgent fund requirements.

You can modify your existing SWP option during the policy term. Such request will be effective from the next policy year.

Was this helpful?

What is the free look period of this policy?

The policyholder has a Free look period of 15 days from the date of the receipt of the policy document and 30 days in case of electronic policies and policies obtained through distance mode/marketing.

Was this helpful?

Is there a Grace period available with this policy?

Grace period of 15 days is available for monthly premium payment mode and 30 days for all other premium payment mode. The policy will remain in force during the grace period. If any premium remains unpaid at the end of the grace period.

Was this helpful?

Are there any exclusions to this plan?

In case of death due to suicide within 12 months from the date of commencement of the policy or from the date of revival of the policy, as applicable, the nominee or the beneficiary of the policyholder shall only be entitled to the fund value, as available on the date of intimation of death.

Further any charges other than Fund Management Charges (FMC) and guarantee charges recovered subsequent to the date of death shall be added back to the fund value as available on the date of intimation of death.

Was this helpful?

We are always there for you!

We are always there for you!

For queries, write to onlinesales@edelweisstokio.in

Contact us on 022 6611 6018

Videos Wealth Rise Plus

Videos

The Linked Insurance Products do not offer any liquidity during the first five years of the contract. The policyholder will not be able to surrender/withdraw the monies invested in Linked Insurance Products completely or partially till the end of the fifth year.

^² This benefit is available only if little star benefit option is opted.

1- This is applicable only if all due premiums are paid and the policy is in-force.

2- The minimum premium amount under this plan is ₹500 per month.

3- As per provisions of Income Tax Act, 1961. Tax benefits are subject to changes in tax laws.

5- For more details please read the sales brochure separately.

Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. Edelweiss Tokio Life Insurance Company Limited is only the name of the Insurance Company and Edelweiss Tokio Life – Wealth Rise+ is only the name of the unit-linked life insurance contract and does not in any way indicate the quality of the contract, its future prospects, or returns. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. Please know the associated risks and the applicable charges from your Personal Financial Advisor or the Intermediary or policy document of the Insurer. The premium paid in unit linked life insurance policies are subject to investment risk associated with capital markets and the unit price of the units may go up or down based on the performance of investment fund and factors influencing the capital market and the policyholder is responsible for his/her decisions. Tax benefits are subject to changes in the tax laws. For more details on risk factors and terms and conditions, please read sales brochure carefully before concluding a sale.

IRDAI Reg. No.: 147. CIN: U66010MH2009PLC197336. UIN: 147L076V02

ARN : WP/3501/Oct/2023

View Download

View Download