Here's Why ULIPs are the Best Monthly Investment Option?

Blog Title

1029 |

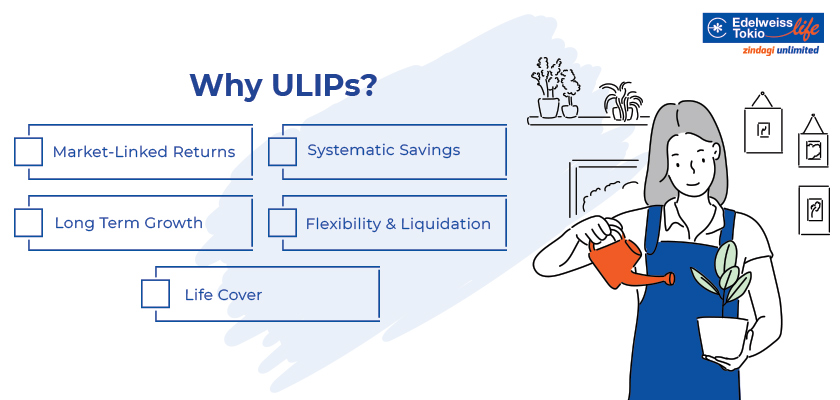

Unit Linked Insurance Plans (ULIPs) combine the power of investment and insurance into a single plan. Since ULIPs are life insurance products, they offer tax benefits as well. This is a significant advantage over conventional wealth generation methods. It not only increases the value of your money, but also safeguards the future of your loved ones from unforeseen events.

Do you find yourself scrolling through the internet reading about various investment methods that can help you save money on taxes while also provide a good return? What most people don’t know is that a ULIP allows investors to invest in annual, quarterly, or monthly basis, depending on their comfort level. There are various benefits of choosing a ULIP, or Unit Linked Insurance Plan as your monthly investment plan.

Why Should You Invest in a ULIP?

Here are a few things about ULIPs that you must know to help you prepare for long-term savings goal and financial security.

- Now is Always a Good Time for Investment: According to Albert Einstein, the eighth marvel of the world is the ‘ability to compound’. It is important to start investing as soon as possible because the rewards from your market-linked investment directly depend on the tenure of your commitment.

For example, as shown below,Mr. Sameer was able to earn more by investing for a longer period of time than Mr. Neeraj because he recognised the value of compounding.

Factors Considered Mr. Sameer Mr. Neeraj Invested Amount (Monthly) 5000 10000 Tenure (Years) 25 15 Rate of Returns (%) 8 8 Maturity Amount (INR) ~ 47.55 Lacs 34.60 Lacs

- The Power of Systematic Savings: When you cannot time the market, it is best to spend more time in the market. What does that mean? By paying a monthly premium, you will easily average the market ups and downs. This means you may end up purchasing more units when the market is down and fewer when the market is at a high. It evens out the market volatility and helps you get a better rate of return on your investment, also known as rupee cost averaging.

Let’s assume that you invest ₹2000 every month. In one month you purchase 200 units at the cost of ₹10 per unit. However, due to the negative market condition, most stocks in the ULIPs saw a decline in the portfolio over the next month. Meaning the value of those 200 units will now be ₹8 per unit. By investing the same ₹2000, you now acquire 250 units in that month.

- Small Payments, Big Potential: ULIPs are a flexible investment option as you canstart small and win big. You don’t need to look far into your pockets to purchase a ULIP. All you need to start is around ₹1000 per month and choose an appropriate plan according to your risk-taking appetite. You also have the flexibility to increase your investment amount over time and make the most of the market conditions.

- Diversification is the Key: With a ULIP, you get to choose from a collection of seven different funds that will aid you in building wealth. Apart from this, some ULIPs allow you to have infinite switches with the Self-Managed Strategy, so you may choose where to invest your money on your own. With some ULIPs, a fund manager will manage your money and take care of this for you with the Life Stage and Duration Strategy.

- Liquidity As You Like! Look no further if monthly investing is your style. You can choose to invest for 5 years with Edelweiss Tokio Life’s Unit Linked Insurance Plans and end the policy term in 5 years. This withdrawal may be systematic or partial. Not only this, but you can also opt to liquidate part of your funds in case of any urgent financial needs after the 5th policy year, no matter how long your policy term is!

- Complete Protection: ULIPs provide a life cover in addition to the aforementioned advantages. The nominee receives a lump sum payment of life insurance and current fund value in the event of the policyholder's death. You can extend your plan with a personal accident rider and benefit from coverage in the event of disability. Additionally, your family will receive twice the amount assured if you pass away in an accident. In this way, ULIPs provide you with two advantages: life insurance protection and wealth building.

ULIPs are a good investment choice for those who want to build long-term wealth and insurance coverage. The maturity sum can be used for retirement, marriage, college for the kids, and other financial objectives. You receive savings and insurance protection under a single plan.

Let’s look at some of the reasons why making a monthly investment in a ULIP is a feasible option for many -

- For investors who are earning a monthly income, the monthly approach is more convenient.

- It facilitates increased overall savings in a systematic manner.

- You don’t have to worry about saving a corpus at the end of the fiscal year.

- Since your ULIP investment will be tax deductible, choosing an automated monthly saving option or SIP, might help you avoid last-minute trouble each fiscal year.

You now know there are enough reasons to choose the monthly choice if you're unsure of how often to invest in ULIPs. Also, since the amount will be smaller as compared to quarterly or annual payments, a ULIP can help you with staying invested in the market for fruitful results.

Therefore, you should consider investing in a ULIP and stepping up your goals. Contact us to find out more.

Aastha Mestry - Portfolio Manager

An Author and a Full-Time Portfolio Manager, Aastha has 6 years of experience working in the Insurance Industry with businesses globally. With a profound interest in traveling, Aastha also loves to blog in her free time.