Term Plan Cover for Housewives

Blog Title

2794 |

A housewife is the powerhouse and go-getter of any family! Imagine a day where she is not there to make your breakfast of choice, or to take care of the children and looking after the needs of all. A homemaker does it all and excels at every task at hand! But what happens when she is not there? Her absence will surely create a vacuum that cannot be filled by anyone else! It could cause much financial hassle to your family as now they may have to divide their time between managing work and home.

The most obvious situation in which a housewife should purchase a term insurance policy is when they are your family's only source of income. Your family would want financial support if they were to pass away, as they would be dependent on you for their survival.

One thing that many people don’t know is that the benefits from term plans are available to anyone who supports their family financially or, including housewives and other primary caregivers. As this article has shown, a term plan can be one of the most important tools for a housewife because it offers a variety of advantages.

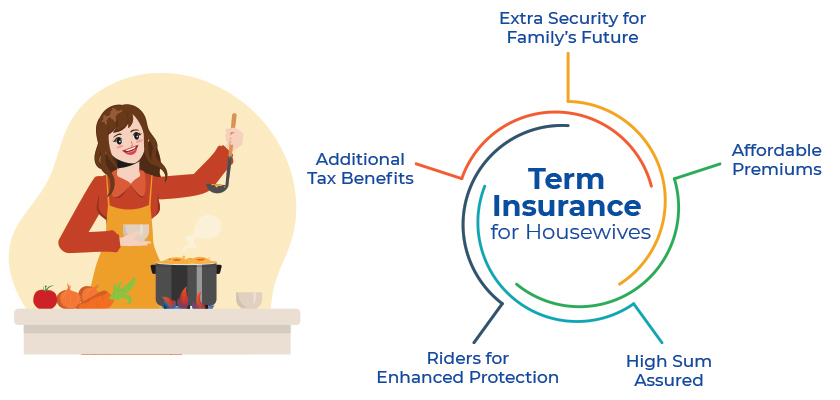

Term Insurance Plan Benefits for Housewives

A term plan can come with the following benefits:

You can buy an online term insurance plan at affordable rate. In India, life expectancy of women is more than that of men. Which means a lower risk for Insurance companies to provide life cover to women. This results into lower premium rates for females. Also, the sooner you purchase a term plan, the lower would be its premium as premiums tend to rise with age.

You can buy a plan that offers high sum assured at very low premiums. This is primarily because a term insurance policy is a pure protection plan with no investment component. The entire premium is invested towards the sum assured that is paid to the nominee upon death during the policy term.

Term insurance offers many additional benefits apart from life protection. You can add riders, such as a critical illness rider, a permanent disability rider, or an accidental death rider. Riders like the critical illness benefit can, in fact, offer housewives health insurance and protect them against the costs of healthcare. Other riders can benefit the family with higher payouts and other things.

The tax benefits of term insurance contribute to further savings. You can claim tax exemption under Section 80C, Section 80D, and Section 10(10D) of the Income Tax Act, 1961.

- Affordable Premiums:

- High Sum Assured:

- Riders for Enhanced Protection:

- Tax Benefits:

- Section 80C: The premium paid towards a term insurance plan is tax-deductible up to a limit of ₹1.5 lakhs per annum.

- Section 80D: The premium for a critical illness benefit is also tax-deductible up to ₹25,000 (₹50,000 for senior citizens) per annum.

- Section 10(10D): The death benefit is tax-free, subject to conditions.

Reasons Why housewives need to Buy a Term Insurance Plan?

Term insurance is a financial instrument that provides a cushion to your family in the absence of the policyholder. Not many people realize this, but a housewife does most of the work in a house, and her presence is undeniably irreplaceable. Moreover, their absence can cause more than just an emotional void.

A housewife needs to buy a term plan for the following reasons:

Housewives generally take care of all chores in the house. Right from cooking and cleaning to purchasing groceries, maintaining the house’s budget, and a lot more. All of these chores may go unnoticed sometimes. But if you were to quantify them, you will realize the massive contribution of housewives towards the family. Their absence can leave a family in emotional and economic despair. A term life insurance plan can help here. The funds from the insurance plan can be used to hire someone to carry out these duties.

Housewives who are also mothers spend a major part of their day taking care of their children. Hiring a babysitter can cost around 14000 a month, that is a lot of money over the long run. However, housewives help eliminate this expense with their undying love and attention for their children. This service can be expensive, but one can buy term insurance to cover the costs.

Just like children, the elderly can also require help and assistance with age. As their reflexes slow down with age, their dependency on others increases. Whether it is cooking for them or taking care of their routine needs, a housewife takes care of most of their needs. In their absence, it becomes essential to hire an attendant. This can cost a family around 15,000 every month. One can buy term insurance online to provide for these costs with simple premium payments.

Not only do housewives take care of children, but they also teach them and help them with their school and college studies. They can be tutors and caretakers at the same time. Filling in these shoes can be a difficult job and also cost a lot of money. The maturity benefit from the term plan can help a guardian focus more on their children and share the financial burden.

When you want to buy something important and are short on budget, the pending amount magically appears from that hidden repository of the home maker. Housewives understand the needs of their loved ones and the importance of an emergency fund. In her absence, think of the sum secured as a way to bridge this gap and give your family members the crucial financial safety net.

Whether it is bargaining with the street peddler for groceries or sensibly buying an electronic appliance for home, housewives keep record of every penny spent. When there is no one around to take care of these spends, the expenditures naturally increase and hence the need for term insurance arise. You need a plan in place that can help you with a corpus for the increased future lifestyle expenditures that may occur.

- Housewives do all the housework:

- Housewives take care of the children:

- Housewives take care of the elderly:

- Housewives are role models as well as teachers:

- Housewives have emergency funds:

- Housewives possess the art of spending wisely:

Should Housewives Get A Term Insurance Plan?

Yes, housewives should definitely invest in a term insurance plan. With a rise in health issues like breast cancer, Polycystic Ovarian Disease (PCOD), etc., a term insurance policy can offer a much-needed financial support in today’s times. Term insurance plans with added riders like a critical illness benefit can also help housewives cover their medical expenses and enhanced protection.

Moreover, there are many types of term insurance plans like traditional term insurance plans, term insurance with return of premium plans, etc. So, there is a wide selection to choose from.

Edelweiss Tokio Life’s Term Insurance plans also offers great benefits for you as a housewife and your family. The term plan can offer a high sum assured at an affordable premium. The premium payment method is flexible and can be used as per the nominee’s preference and need for funds. All in all, a term insurance policy can be a great financial addition for any family.

Conclusion

Term plan benefits for housewives make for a long list. So, go and ahead and get a good term plan if your family members are greatly dependent on you. While no one can compensate for the loss of a person, financial assistance surely does make things simpler and better with time. A high sum assured can also help children achieve their goals and settle down in life, helping housewives leave a legacy behind for their kids. To check out a term plan suitable for your goals and needs, click here.

Chirag Iyer - BFSI Enthusiast

Chirag is a writer and an avid reader who loves to drink coffee! His other interests include boxing, karate, and singing.