New To Term Insurance? Complete Guide on Buying Term Insurance.

Blog Title

1140 |

Term Insurance is a pure life insurance product that is super easy on your pockets. Today, term insurance is a necessity and one of the most affordable ways to provide financial security to your family. You get a life cover for a sum assured, and you pay a periodic premium (monthly, quarterly, half-yearly, or annually) to the insurance provider. The sum assured is then paid out as a death benefit to your nominees in case of your unfortunate demise during the policy term. You can attain great peace of mind knowing that any misfortune to you will not result in a financial strain on your family, and those who depend on you will still be able to maintain their quality of life and fulfill any long-term goals they might have.

If you are a professional with a steady income, chances are that you have heard of term insurance and why it is so important in your portfolio. But then comes the hard part—choosing an ideal term plan from the many available options and then buying it. Although approaching an agent and relying on their advice is still the preferred method for buying term insurance for many people, purchasing insurance policies online has become much more convenient in recent years. Nowadays, it is as easy as buying anything else on the internet, though slightly different.

We have done the hard work and compiled a step-by-step guide on how to buy term life insurance plan online. Once you go through it, the process will hopefully seem straightforward, and you will be able to buy your preferred term insurance plan online.

Before You Start the Process

It is essential to figure out a few things before you can start the purchasing process. These include -

- Determine The Ideal Cover Amount: Not having adequate insurance coverage can be detrimental to your family’s future in case of your absence. Ensure the cover amount is enough after thoroughly deliberating your family’s requirements. As a rule of thumb, the coverage should be 15-20 times your annual salary. However, everyone’s needs are different, and you should carefully determine your ideal cover amount.

- Decide On The Policy Tenure: If you are buying a term insurance plan during the early years of life, go for a longer tenure. On the other hand, if you are in your mid-life, go for a shorter policy tenure. Ideally, you should determine the remaining years of service and opt for a policy tenure that lasts until you retire. This is because of the general assumption that as long as you have an income, your family is dependent on you, and thus you need to have life cover.

- Figure Out Your Budget: A policy that fits your budget is essential, as you can comfortably keep it active. If you go for a policy that offers more in exchange for a higher premium, you might risk losing coverage if you cannot pay the premiums on time. Hence, it is recommended to buy term insurance early in life. The earlier you buy it, lesser the premium amount.

- Compare Different Plans: The internet has facilitated the availability of a lot of information at your fingertips. When looking for a term insurance plan online, you must make the most of it. Compare different plans and see which one has the features that would benefit you the most.

Once you have finalized a plan, you can begin the process of buying it from the insurer’s website.

Steps To Buy Term Insurance Online

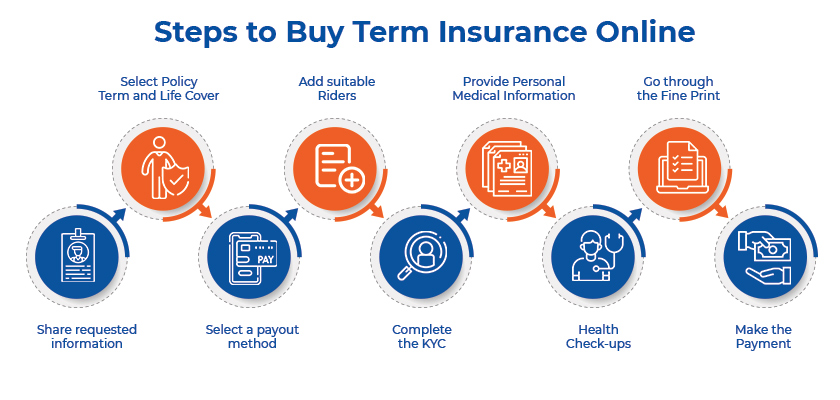

Since most insurers have a slightly different process designed for buying life insurance online, it is not possible to define a standard procedure for how to buy term insurance online, yet, the following steps are sure to be there in one form or the other:

- Provide The Requested Information: To begin the process, you will need to provide basic personal information, like your name, age, gender, health related details and contact information.

- Specify The Desired Policy Term And Life Cover: Depending on the insurer’s process, this might be required in the first step, or you will be asked to specify this in step 2. You can select the ideal policy term that you have determined for yourself. You can also choose from multiple cover options to get the desired coverage. Note that this will have an impact on the premiums.

- Select A Payout Method For The Death Benefit: Term insurance plans offer you the choice of having the death benefit paid out to your nominees as you see fit. You can choose from a lump sum payout or a periodic payout.

- Add Suitable Riders: Riders are add-ons that can provide extra coverage for events not covered by the base policy. They can be included by paying a nominal additional charge with your premiums. Riders can be used to cover critical illness, accidental deaths, partial/total disability due to an accident, etc.

- Complete The KYC: You will need to upload all relevant documents, like a valid Id, income proof, tax returns, and any other information required by the insurance company. You can be asked to upload these documents at the time of purchase or later through email.

- Provide Personal Medical Information: Since your lifestyle plays a role in determining your premiums, you will be asked about any alcohol or tobacco consumption, any past medical history, etc. You must fill this out accurately to avoid any rejection of claims later on.

- Health Checkups: Some insurers require you to undergo medical tests to determine your health status before the policy is finalized. In the case of online insurance, you can buy some policies without any health checkups.

- Go Through The Fine Print: Before going through with the payment, you must read and understand the terms and conditions of your policy.

- Make The Payment: Finally, after ensuring everything has been done correctly, you can make the premium payment. You can do it through credit cards, debit cards, or net banking. A digital copy of your insurance papers is mailed to you when completed. The hard copy will be posted later.

Some Tips To Choose The Right Term Insurance Plan for Your Needs

Getting a term plan without proper due diligence might leave you underinsured and your family vulnerable to financial hardships if something unforeseen happens. Thus, keep the following in mind while planning your term insurance purchase:

- Buy A Policy Early: It is never too early to buy term insurance, as the earlier you opt for it, the lower your premiums will be. As the premiums for most term plans are fixed, you will enjoy the same low premiums for the entire policy term.

- Make The Most Of The Tax Benefits: With a term insurance plan, you can also save tax through Section 80C of the Income Tax Act, which allows for the deductions of total premiums paid (up to ₹1.5 lacs) in a year. Moreover, the death benefit received by your nominees will also be exempt from taxation under Section 10(10D).

- Consider All The Requirements Of Your Family: We discussed how you should know the ideal cover amount for the term insurance plan you are going for. That must include the family’s current expenses, future life goals, and any liabilities you might have, like personal or home loans. Of course, you should also factor in the effects of inflation.

- Add Suitable Riders: Riders can significantly enhance the scope of your base plan, and you should not skip adding any relevant riders to it. Riders covering critical illness, accidental deaths, and accidental total/partial disability are some essential riders you can include per your requirements.

- Check The Credentials Of The Insurer: Finally, you must ensure that the insurer has a credible track record by checking its claim settlement ratio(CSR). A high CSR will indicate a higher chance of your’s nominees’ claim being settled swiftly.

Conclusion

Thus, you can buy a term plan very quickly from the comfort of your home. As you can see, the process requires research and careful consideration from your end, but in the end, it pays off. Online term life insurance can also be a more affordable alternative to offline term insurance, as no intermediary commissions are involved.

Chirag Iyer - BFSI Enthusiast

Chirag is a writer and an avid reader who loves to drink coffee! His other interests include boxing, karate, and singing.