Maturity Benefits Vs Death Benefits: Understanding the Differences

Blog Title

1623 |

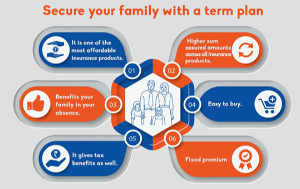

Most life insurance plans in India provide two essential services, the first is providing financial security for your loved ones via life coverage, and the second is long term savings. If you have been looking to buy life insurance, then you would have undoubtedly come across the terms ‘maturity benefits’ and ‘death benefits’. These two benefits are the most important aspects of any life insurance plan, and you should only buy a policy with benefits that satisfy your financial requirements.

Before finalising your life insurance purchase, it is important to understand what maturity benefit and death benefit mean. Understanding the differences between these two terms will help you select a plan that is financially beneficial to you no matter what happens in the future.

Understanding the Basics

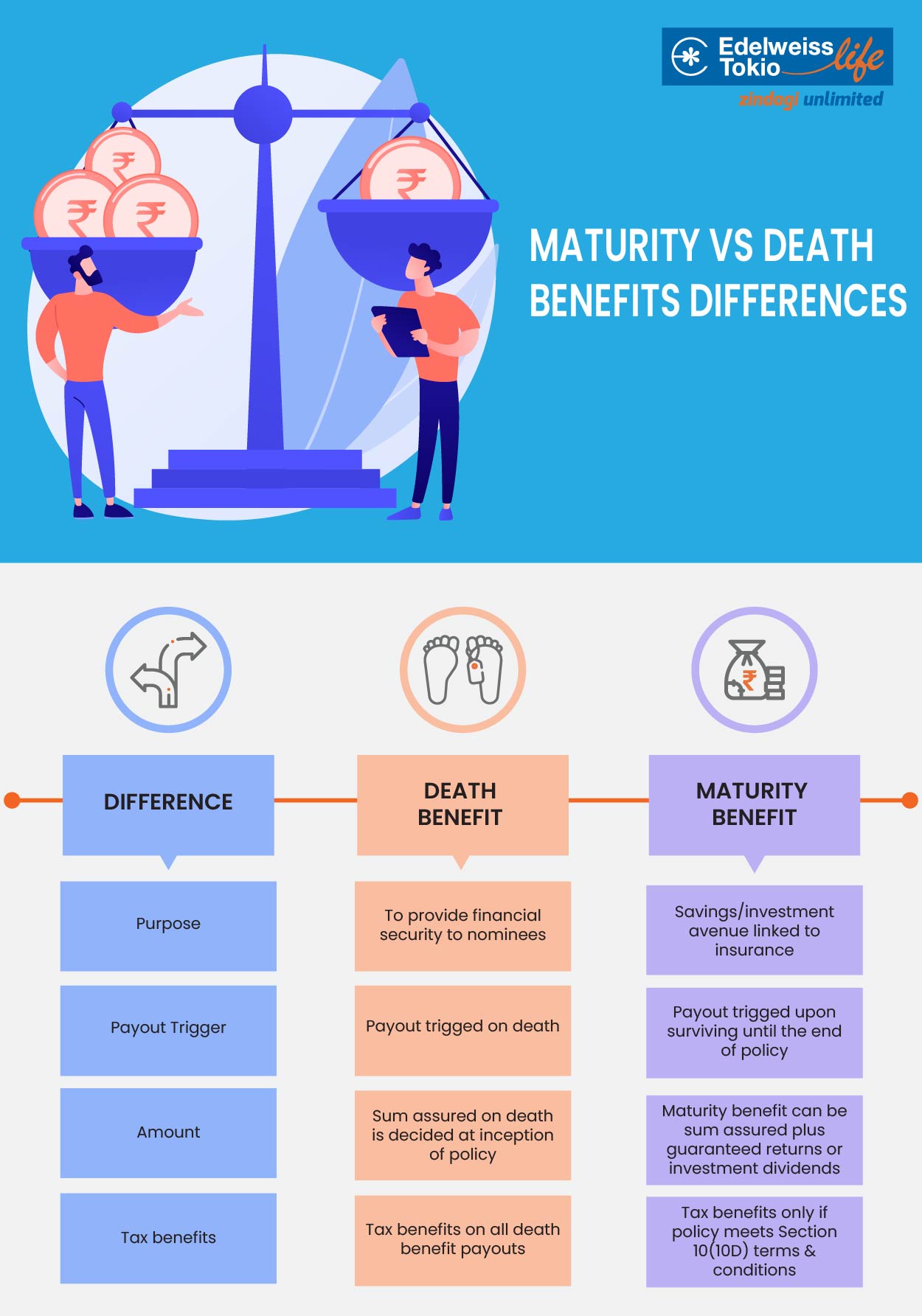

What is Death Benefit?- As the name implies, death benefit is only trigged if the unfortunate event of your passing. One of the main selling points of any life insurance policy is the life coverage they provide to your loved ones in case of your death. When you pass away, your nominees can make a claim on your insurance policy and trigger the death benefit to get the money promised to them under your insurance policy. Death benefit is generally paid out as a lumpsum, but some plans allow you to select period payments to ensure that your family gets steady income for years to come.

What is Maturity Benefit?- A large number of potential insurance buyers still think that the money they paid in premiums is lost forever if they survive to the end of their policy term. While that might be true for basic term plans, many modern life insurance policies also include maturity benefits alongside the basic death benefit. A maturity benefit is the money returned to you if you survive to the very end of your policy term.

Maturity benefit adds a long-term savings element to life insurance plans, and generally, the maturity benefit paid back to you will be greater than the total premium you have paid over the course of your term. Maturity benefits can either be guaranteed (meaning that you know how much money you will get back), or they can be paid as bonuses/dividends if you have opted for Unit Linked Insurance Plans (ULIPs). While the maturity benefit is generally paid as a lumpsum at the end of the term, some plans also offer periodic payments in the form of income benefits.

Some term insurance plans provide a ‘Return of Premium’ benefit where you get back the total premium paid at the end of the term. If saving money for the future is one of your primary goals, then look for an insurance plan with good maturity benefits. Guaranteed returns plans will always reveal the rate of growth during the inception of the policy, while the maturity benefits for ULIPs completely depends on share market rates.

Features of Death Benefits

- Immediate financial assistance- Life insurance is essential to ensure that your dependents are not financially burdened in your absence. The lumpsum amount provided by the death benefit will allow your family to maintain their standard of living and pay off any liabilities.

- Tax benefits- All death benefit payouts (except in case of keyman insurance) are subject to tax exemptions under Section 10(10D) of the Income Tax Act.

- Riders to enhance your benefits- Many life insurance policies also come with optional riders that further enhance the security provided by the policy. For example,critical illness riders allow you to trigger your benefits early if you are diagnosed with a serious illness. Or an accidental death rider can enhance your death benefit coverage if you pass away due to an unexpected accident.

- Available for every life insurance policy- It is important to remember that death benefit is the primary feature of every single life insurance policy. Of course, the amount of coverage provided will differ from policy to policy, but every single life insurance plan will provide death benefits as one of the core features.

Features of Maturity Benefits

- Savings and investment- Life insurance plans with maturity benefits act as a long-term savings avenue, as the premium you pay for your plan is eventually returned to you along with certain bonuses or assured returns. ULIPs are a great way to get life coverage along with share market investments, and the potential for growth is also high if the market is doing well. On the other hand, if you are risk averse then you can opt for a guaranteed returns plan where you know the exact rate of growth that will be added to your maturity benefit at the end of the term.

- Tax benefits- Life insurance maturity benefits are also subject to tax exemptions under Section 10(10D) of the Income Tax Act, provided that the policy meets the terms and conditions. ULIPs that have an annual premium greater than Rs 2.5 lakhs will not be tax exempt under Section 10(10D). Similarly, savings plans only get tax exemptions if the annual premium is less than Rs 5 lakhs.

- Added bonuses- Some insurance plans also provide additional bonuses to further incentivise policyholders to keep their plan active until maturity date. Some common bonuses include revisionary bonus (annual bonus added to sum assured), cash bonus (payout given to policyholder annually), and terminal bonus (added to maturity benefit at the end of policy term).

- Retirement planning- Some long-term life insurance plans are designed to help the policyholder retire. Retirement plans generally provide the maturity benefit in the form of pension payments. You can also find pension plans that continue to provide pension payments until the policy holder’s death.

Key Differences Between Death and Maturity Benefits

How to Make Death and Maturity Claims On Life Insurance?

Death claims can only be made by the nominees of an insurance plan in the event of the insured person’s death. To make a death claim, the nominee must first inform the insurance company of the insured’s passing. The insurance company will then ask for relevant document proof. Provide all documents that the company asks for. Some mandatory documents include death certificate of insured person, identity proof of nominee, FIR (in case of unnatural death), and claim forms.

Maturity claims can only be made by the policyholder after the end of the policy term. To claim maturity benefits on your policy, you will need to share the policy discharge form, original policy document, ID and age proof, and your bank account details with your insurance provider.

How to Choose the Right Policy?

The right life insurance policy for you depends on your financial needs and future plans. If financial growth is your main concern, then a ULIP will be more suitable for you. However, if you do not want to put your money into investments and would rather have assured returns, then look for a guaranteed savings plan. Pick a plan with maturity benefits that can help you fulfil your ambitions. Also, ensure that the death benefit provided by an insurance plan is sufficient enough to financially secure your dependents in your absence.

Edelweiss Tokio Life Insurance provides multiple insurance plans with both savings and investment elements. If you are risk averse and want steady growth along with life cover, then consider buying Edelweiss Tokio Life Insurance- Guaranteed Growth Plan. Alternatively, you can also find various ULIP plans if you want to dabble in long-term share market investments.

FAQs

1. Is sum assured the same as death benefit?

The sum assured is the minimum life cover amount provided by your life insurance policy. Death benefit not only includes the sum assured but also adds any bonuses you might have received over the course of your policy term. If your policy does not have any bonuses, then the death benefit will be equal to the sum assured.

2. Is survival benefit the same as maturity benefit?

Both survival benefits and maturity benefits are received only if the policyholder is alive, which is why many people get confused and think that the two terms mean the same thing. Maturity benefits are provided at the very end of the term, also known as policy maturation. However, survival benefits are rewards that are granted if the policyholder survives for a specific number of years during the term.

For example, if you have a 10-year insurance policy, then your survival benefits will be given to you after five years, while your full maturity benefits will only be given out after the 10-year term ends.

3. What policies offer maturity benefits?

Not all policies offer maturity benefits. Maturity benefits are usually included in savings plans, ULIPs, retirement plans, and whole life insurance plans. Basic term insurance plans generally do not have any maturity benefits, though newer term plans are now coming with optional return of premium benefits where you will get back your total premium paid at the end of your term.

4. How is maturity benefit calculated?

Different insurance plans have different rates and formulas for calculating the final maturity benefit. In general, you can expect your maturity benefit to be equal to the sum assured (at maturity) plus any accrued bonus.

5. Can you claim both death and maturity benefit on a policy?

Death benefit can only be claimed if the insured person passes away, while maturity benefit can only be claimed if the policyholder is still alive at the end of the term. Meaning that it is generally not possible to claim both death and maturity benefits on the same policy, as an insurance policy is terminated once the death claim is paid. However, some plans may come with optional riders or benefits that allow the nominees to hold on to the policy even after claiming the death benefit, in which case the nominees will also be able to benefit from the returns provided at maturity.

Swati Tumar - Travel & Finance Writer

Swati is a Writer in the day and an illlustrator at night. Among her interests, she is quite fond of art and all things creative. She often indulges herself in creating doodles, illustrations, and other forms of content. She identifies herself as an avid traveler and shameless foodie.