Life Insurance Too Early for the 20’s?

Blog Title

832 |

Start Your Investment Planning in Your 20’s with Life Insurance

In the early 20’s of your life, you’re at the beginning of your professional journey. Financial independence comes in as a new factor in your life, which brings along the need to make important and responsible decisions. A lot of young people remain either unaware or oblivious about a major long-term investment of their lives – life insurance.

The primary question that could come to your mind is why would someone as young and healthy as you, ever need a life insurance? So, you may like to leave it as a concern for your future. What follows years later, is regret for a poor financial decision.

Why Do You Need a Life Insurance Policy Right Now?

Here’s what your future has to say to your present about investment planning:

- Low Premiums

When you start looking for a life insurance plan, insurers take into consideration several factors. For instance, your age, health condition, family background, lifestyle etc. This is in order to determine the risk of death of the life insured.

If a person has a lower risk of mortality, he/she has to pay lower premiums for the insurance policy. Every year as your age increases, the premium charged also increases.

So, if you buy a life insurance policy when you’re young, you’ll be paying a lower premium, as compared to when you’re older.

- Investing Early

In your early 20s, you do not have a lot of financial burden. The money that is earned is usually spent on day to day expenses or luxury items. However, by spending your hard-earned money on short-lived pleasure, you miss the opportunity to save for something worthwhile in the future.

By ‘opportunity’, we are talking about the opportunity to grow your wealth by investing some part of your salary regularly. Interestingly, true financial independence comes when you’re not entirely dependent on your salary to make money.

ULIPs (Unit Linked Insurance Plans)are one such product category that offers dual benefit. Premiums paid are further invested as per your risk taking capacity, into shares, bonds or other securities. Plus, you get a life cover.

- Additional Source of Income

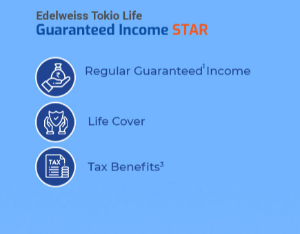

Apart from providing life security, insurance can also be a source of additional income. For instance, Edelweiss Tokio Life Active Income Plan. It is one such product that provides the dual benefit of regular income and life cover.

By investing in this product, you can start earning from the 2nd policy year till age 99. This plan will abolish the unpredictability of your salary, and can take care of your expenses in case there’s a shortfall in your savings. This kind of a systematic plan increases your capacity to spend, so that you can enjoy the small pleasures of life.

- Fulfilling Your Dreams

Amidst the hustle to do something big in life through job promotions and increments, your dreams may take a backseat. In a country like ours, youngsters are often pushed towards living a secured and stable life and their dreams are left neglected.

If you have a dream, be it starting your own business or even travelling the world, investing in a life insurance policy can help you achieve that dream.

For instance, you invest in a ULIP right now. So, by the end of your policy term, you will receive a maturity amount that you can use to finance your big dream.

- Tax Saving

A great way to save tax on your income is by putting your money in life insurance. According to Section 80(C) of Income Tax Act, premium paid on insurance is exempt from taxes. Also, as per section 80(D), income received on insurance is exempt from taxes up to Rs. 1,50,000. So, by investing early, you can save money on taxes.

- Financial Security

No one likes to think about death. But what if it does happen? The Coronavirus Pandemic has largely shown us the unprecedented nature of death, unaffected by time and age. This makes life insurance even more relevant, especially to ensure the financial security of your family after your demise.

The sudden demise of a person can leave their family to bear the brunt of hefty bills. The liability of your education loan, EMIs or rent can put your family in a difficult spot. A life insurance policy can help them sail through smoothly, be it a spouse, parent or children, especially if they were dependent on you.

- Riders

Riders are add-on benefits that an individual can choose to put on their insurance plan according to their needs. They enhance your insurance policy by providing additional benefits. For instance, Edelweiss Tokio Life Critical Illness Rider.

Subject to the insurance policy you choose, you receive financial protection against various critical illnesses. At this age, you might not feel any threat towards your health. But with lifestyles getting stressful these days, it’s important to take a decision to safeguard your health for the future.

Therefore, if something severe were to happen to your health, let your life insurance plan cover for you!

Let Your Life Make You a Smart Investor

20’s marks the beginning of a new chapter of your life. It’s very natural to feel clueless about certain things, such as handling your finances. A life insurance plan makes you more responsible towards yourself and the people around you.

If something were to happen to you, ensure that you’ve got your loved ones covered, even in your absence.

We know that young, wild and free souls like you aspire to achieve a lot of things in life. So, in this journey of your life, you are the driver and life insurance, your seat belt.