Zindagi Plus Term Insurance Plan

Blog Title

873 |

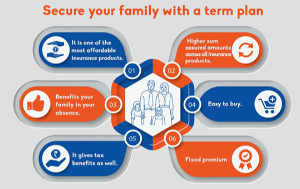

Providing financial security to your family becomes a key factor in your planning and fiscal arrangements. A basic type of protection called a ‘Term Plan‘ turns out to be necessary. A term insurance policy protects your dependents in your absence.

Zindagi Plus Term Insurance Plan: The best term insurance for you

Edelweiss Tokio Life has launched more than a term plan; Edelweiss Tokio Life Zindagi Plus makes you capable of giving a better life to your loved ones after your demise.

- You can choose a life cover as low as 25 lakhs and as high as 10 crores.

- The other advantage is of waiver of the premium benefit, i.e., the policyholder doesn’t need to pay the premium after 60 years of age if he so chooses. In this case, there is no burden to pay a premium when you are retired and not earning.

- The main highlight of the Zindagi Plus term insurance plan is the ‘Better Half Benefit.’ Under this, as the name suggests after the death of the policyholder, a life cover will start in his/her spouse’s name. This will be 50% of the life cover of the policyholder, up to an amount of Rs.1cr. The spouse won’t have to pay any premium and the nominee will also get the sum assured. An essential feature of this benefit is that it also covers homemakers. The policy will continue till the end of the actual policy term but the condition is, the spouse should be between 18-60 years of age and the difference between the couple can’t be more than 10 years.

- There is also the Top-up Benefit, which overcomes the problem of buying new policies again and again. With the Top-Up Benefit, your policy sum assured increases by 5% or 10% every year based on your selection. This way your term plan grows with your growing needs.

- The critical illness cover provides cover against 17 critical illnesses. It has two variants: Single Claim and Multi -Claim. In Single Claim, you’ll receive the selected amount once, and your policy will get terminated. In Multi Claim, you can claim the same amount THRICE and after the first claim, you won’t have to pay the critical illness cover premium again.

- Next, if you opt for Accidental Total and Permanent Disability, you’ll get the amount you have selected in case an accident causes permanent disability. This will take care of all your expenses, and the policy continues as usual.

- In the end, we have the Decreasing Sum Assured in which you can avail the same term insurance for premiums less than standard rates from Day 1. The life cover will reduce by 50% after you turn 60 years old. This is good news because, after retirement, your family won’t be as dependent on you as they are now.

In Conclusion: Buy the Zindagi Plus Term Insurance Plan today!

These are the essential aspects when you buy Zindagi Plus online which are crucial, and these are the aspects that you should know about a term plan to make a better choice for a better future. Get one from the Zindagi Plus term plans for you, today!