Decoding Life Insurance Cover Meaning, Types & Reasons to Buy

Blog Title

1389 |

You work hard and earn money, not just for yourself but for your family as well. Your loved ones are financially dependent on you, and as such, your life and income have a considerable part to play in their lives. If you think this way, there is a monetary value and potential to your life, and your family stands to lose this value in case an unfortunate incident robs them of your presence and support.

So, you need to make sure that there is a contingency plan in place to provide financial support to your loved ones in your absence. This is exactly what life insurance policies do, by giving you a life cover.

Let us unpack the meaning of life cover and understand how life insurance can lend peace of mind to you and financial safety to your family, in your absence.

What does Life Cover Mean?

In the simplest terms, a life cover is the lumpsum amount that is paid out by the insurer to your nominees in case of your untimely demise. . Whereas, Life insurance is a contract between you and the insurance company, wherein the insurer promises that a sum assured (also called death benefit) will be paid out to your nominees in case of your untimely demise. In exchange, you pay a premium to the insurer at a pre-decided payment frequency to keep the policy active. You can take a life cover policy for any duration of time (called the policy term), and the death benefit will apply for this period.

Any policy that provides a life cover can be categorized as a type of life insurance. The features and benefits offered, in addition to the life cover, determine the kind of life insurance.

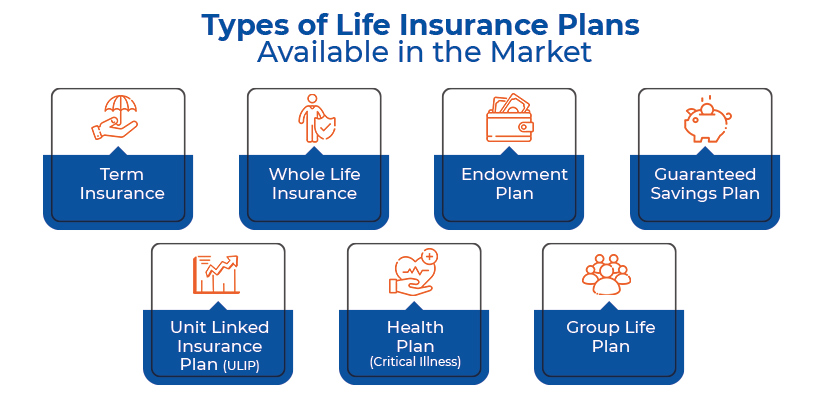

What Are the Various Types of Life Insurance Plans?

The Indian life insurance market is a vibrant place with plenty of innovation. As a result, many life insurance policies are available, each capable of serving a different purpose in your financial portfolio and providing you with life cover. Some of the most popular life insurance policies are:

- Term Insurance - It is the purest form of life cover that you can take. You can get life cover for a specific period, or term, at very affordable premiums. The sum assured is also on the higher side, giving your family comprehensive financial security. Your family is eligible for the death benefit payout in case of your unfortunate demise during the policy term. You get no maturity benefits except in the return of premium term insurance plan, where the premiums you pay are returned if you survive the policy term.

- Whole Life Insurance - This type of life insurance can give you life cover for your entire life, up to 100 years. It can be ideal for you if you wish to leave a legacy for your family, and it generally comes with maturity/survival benefits that you can receive if you outlive the policy term.

- Guaranteed Savings Plans - If you want a plan that gives you life cover and an opportunity to build guaranteed savings, a guaranteed savings plan is an ideal solution. At the time of maturity, the savings accrued over the policy duration will be paid out as maturity benefits. In case of your untimely demise during the policy term, your family will receive the sum assured

- Unit Linked Insurance Plans (ULIPs) - ULIPs are hybrid life insurance products that also provide a component of market-linked investments. The premiums you pay are utilized partly to provide you with life cover for a sum assured, while the remaining portion goes into the investment instrument of your choice. You can choose from a diverse pool of funds, including various equity, debt, and balanced funds. This way, ULIPs enable wealth creation in the long haul and can be helpful in the fulfillment of many life goals like funding your child's higher education or serving as a retirement plan.

Why is Life Cover Important?

There are numerous benefits to taking a life insurance policy. We have already discussed the aspect of the peace of mind that you can get by having a life cover in place, so let us discuss some of the other advantages that you stand to gain:

- Affordability: Life insurance policies are easy on your pocket. No matter your budget, you can find a suitable policy that offers you life cover. Other life insurance policies have higher premiums than a term plan, but you also get maturity benefits from them. To get the lowest premiums, you must opt for a life insurance policy as early as possible.

- Protection from Liabilities: The loss of your income is not the only risk factor for your family. You might leave an unpaid debt, like a personal loan or a home loan. The burden of repayment can be too much to bear for your family, so it is prudent that you have a life cover, primarily to mitigate these liabilities.

- Retirement Planning: Life insurance policies like ULIPs and guaranteed savings plans allow for long-term wealth creation, resulting in a sizeable retirement corpus for you and your spouse.

- Flexibility: You can choose from multiple premium payment options, sum assured amounts, policy terms, riders, and more, customizing the policy as per your needs, preferences, and budget.

- Tax Benefits: You can avail of tax deductions on premiums paid (up to ₹1.5 lacs) under Section 80(80C) of the Income Tax Act, 1961. Furthermore, the maturity and death benefits are exempt from taxation under Section 10(10D).

- Additional Riders: Life insurance riders are add-ons that can help you enhance the scope of your policy and extend its coverage beyond a life cover. You can get coverage for critical illness, accidental death, permanent or partial disablement, and so on.

How can you calculate the ideal life cover?

Now that you understand the importance and need of a life cover, the natural question that arises is how much life cover is enough. First, of course, the amount needs to be enough to ensure that your family is comfortably placed for a significant period after your unfortunate demise. Although the general rule of thumb dictates that you must go for a cover amount equal to 15-20 times your annual income, there is no objective approach to figuring out the right coverage amount. However, you can determine your required coverage amount in the following steps:

- Consider the monthly expenses and lifestyle costs of the people who rely on you.

- Determine your total liabilities - outstanding debt obligations, personal loans, mortgages, etc.

- Evaluate the various life goals and events of your dependent family members. You must consider events such as your child's higher education, marriage, etc.

- Create a retirement plan for your spouse. It will let your spouse enjoy their golden years without worrying about money.

- Factor inflation for all of the above mentioned costs.

- Determine your current wealth, which includes savings and assets. This sum can be subtracted from the total amount required to calculate your required sum assured.

To understand this process better, let us take the example of Rahul. Rahul is 30 years old, and his current yearly income is ₹13.2 lacs. Suppose he has ₹45 lacs (15 years’ worth ) of remaining home loan, and ₹20 lacs in savings. In that case, we can determine his life cover like this:

(Yearly Income x 15) + Liabilities - Savings

So, (13,20,000 x 15) + 54,00,000 - 20,00,000 = 2,32,00,000

Therefore, the ideal cover amount for Rahul would be around ₹2.32 crores.

Conclusion:

Life cover, and that too an ideal life cover, can make a monumental difference in your family's life. It can help you rest assured that their quality of life will not be affected in case something unfortunate happens to you. The various types of life insurance can facilitate many more things besides fulfilling this requirement.

Edelweiss Tokio Life Insurance has an ideal product for all your life insurance needs. From our comprehensive ULIPs like Edelweiss Tokio Life - Wealth Secure+ to our affordable term plans like Edelweiss Tokio Life - Zindagi Plus, you will have all your requirements met. So, start your research on our website today!

Swati Tumar - Travel & Finance Writer

Swati is a Writer in the day and an illustrator at night. Among her interests, she is quite fond of art and all things creative. She often indulges herself in creating doodles, illustrations, and other forms of content. She identifies herself as an avid traveler and shameless foodie.