Protect Your Life and Your Health in a Single Plan

Blog Title

546 |

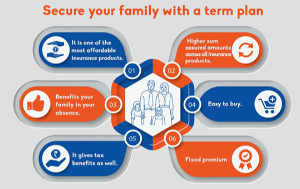

The benefits of a life insurance plan are well-documented. A plan which protects your family’s financial security in case of your demise.

However, with the rise in unhealthy lifestyles and increasing level of stress, you shouldn’t stop with the purchase of a plain vanilla term insurance plan. What you should go for instead is a term insurance with a critical illness cover.

A few insurance plans offer add-on critical illness rider as an option while some attach it as an inbuilt accelerated critical illness cover.

Whatever be the case, they are a must to have. Here is why.

1. Be financially prepared against critical illnesses

Whenever one is diagnosed with a critical illness, the main cause of worry is the medical bills; the cost involved in treating critical illnesses is exorbitantly high. With insurance plans that offer cover for such illnesses, a certain percentage of the total sum assured is paid as a lump sum amount upon diagnosis.

2. Premiums Are Waived Off Too

A term plan pays out a percentage lump sum of the total sum assured upon diagnosis of a critical illness. While this is an effective benefit, there is one more. Most plans suspend future premiums upon diagnosis. The policyholder can use the premium money towards the treatment charges or day to day expenditures.

3. Alternate Income Source

A critical illness is one that requires recurrent treatments. This hampers the patient’s ability to continue with his/her current employment. The lump sum payout helps in regular treatment costs and household expenses. Thus it acts as an income replacement.

4. Includes Disability and Accidental Death too

Make sure to go for a comprehensive term plan that offers riders for accidental permanent disability and death too. These riders will pay out an appropriate sum in case of the above-mentioned incidents take place.

Life insurance is important but it is time to upgrade it with a plan that provides comprehensive protection against death, disease, and disabilities.