Understanding The Importance of Life Insurance

Blog Title

2839 |

Did you know that India stands at 10th in the global life insurance market with a 3.2% penetration, ahead of China and the UK, as per a recent research report published by Benori Knowledge, a research and analytics company? This means that the recent pandemic and the economy's fragility have highlighted the necessity to invest in financial instruments, one of which is life insurance. Having a life insurance policy in place can actually help you feel financially secured. Life insurance offers the ability to meet some of the economic difficulties we have today, like volatility and inflation, and can assist provide families with financial security, as it did during the pandemic.

Why Do You Need a Life Insurance Policy for Your Financial Security?

Chances are you have already seen at least one advertisement where the insurance company creates a "what-if" scenario to stress the importance of life insurance. Indeed, life insurance is not just a financial tool, it is a solution that offers you and your loved one’s peace of mind. It is a solution that keeps the dreams of your loved ones alive just in case you are no longer able to provide for them.

A little financial planning is necessary at every stage of life to achieve your goals. Consider your greatest financial aspirations, such as purchasing a home, sending your children for higher education, or setting up money for retirement. Life insurance can offer defence against the unforeseen as you and your family save for these milestones. A life insurance would give your family a tax-free cash payout that they can spend for whatever they need in the event of your untimely death. That money can be used to pay for daily expenses, lessen financial obligations, and accomplish the objectives you've been working so hard to reach together. Let’s look at some of the reasons as to why life insurance is important for you and your family’s’ future.

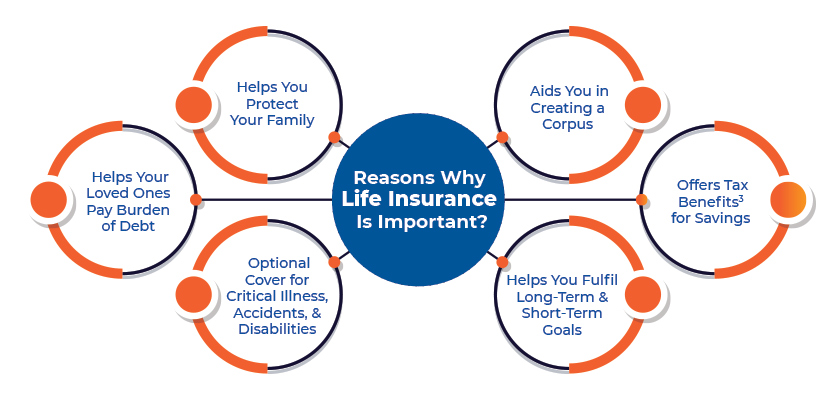

Reasons Why Life Insurance Is Important?

- It Can Help You Protect Your Family.

Having a life insurance policy in place means having your peace of mind. Imagine if you had an unfortunate accident, God forbid, resulting to a casualty. Your family may have to struggle to cover their basic living expenses, maintain their current lifestyle, or pay comfortably for your child's education! Tragic, right? Hence, your life insurance policy ensures that your family will continue to enjoy living their life without any compromises, even in your absence. - It Can Help You in Creating a Corpus.

If you purchase a wealth creation plan like Unit Linked Insurance Plans (ULIPs) or a guaranteed income plan, you will be able to create a safety blanket against unexpected eventualities of life. Various savings life insurance plans allow you to invest a portion of your investment in equity or debt markets while the remainder is used to provide you with life insurance. These investment opportunities can create an income stream overtime that you can enjoy during your retirement years. - It Offers Tax benefits3 for Savings.

For tax purposes, the premiums paid towards your life insurance policy are eligible for a tax deduction under section 80(C), of the Income Tax Act, 1961. And the maturity amount received is also exempt from taxes under Section 10 (10D) if the premiums do not exceed 10% of the sum assured. This means you enjoy the dual benefits of protection and tax benefits3. - It Can Help You Fulfil Long-Term & Short-Term Goals.

Planning your dream vacation with your spouse or family or, buying that dream house – these goals give you energy and purpose to work hard every day. A life insurance plan can help you make your dreams come true. A savings life insurance plan like ULIPs or Guaranteed Returns Plans can be helpful in systematic investment for your goals. - It Can Offer Optional Cover for Critical Illness, Accidents, and Disabilities.

Many insurance companies, like Edelweiss Tokio Life Insurance, provide additional insurance coverage, also known as riders9. These riders, when combined with your life insurance policy, can enhance your coverage. For example, an Accidental Death Benefit Rideroffers an additional sum assured in case you lose your life in an accident. With critical illness rider, if you are diagnosed with a critical illness, you will be able to get a lumpsum pay-out that you can use to take care of your expenses when you need the most. Various riders available with Edelweiss Tokio Life include Group Critical Illness Rider, Income Benefit Rider, Critical Illness Rider, Accidental Total & Permanent Disability Rider, Accidental Death Benefit Rider, Payor Waiver Benefit Rider, Hospital Cash Benefit Rider, and Waiver of Premium Rider. - It Can Help Your Loved Ones Pay Burden of Debt.

If you are someone with financial liabilities and you don’t want to put a burden on your family in your absence, a life insurance policy can help your family pay off loans and get rid of financial burden. The death benefit ensures that your family receives the amount in case of loss of life to reduce the financial burden. Life insurance is an affordable way to financially protect the people you love most. - It Can Help You Leave Inheritance for your Loved Ones.

Want to leave your children or grandchildren something to support their own financial aspirations? One of the simplest and most economical ways to accomplish it is through life insurance. A charity or other non-profit organisation may also receive an inheritance.

The significance of life insurance becomes more apparent if you start earning money and have family members who depend on you for their well-being. Sometimes life might be too unpredictable but being financially prepared can be really useful.

Check out various life insurance plans provided by Edelweiss Tokio Life Insurance and select the plan that suits your needs and goals today!

Aastha Mestry - Portfolio Manager

An Author and a Full-Time Portfolio Manager, Aastha has 6 years of experience working in the Insurance Industry with businesses globally. With a profound interest in traveling, Aastha also loves to blog in her free time.