Know Your Rights as a Life Insurance Policyholder

Blog Title

267 |

An insurance policy is a serious financial contract between you and the insurer, and that means that you have certain de jure rights that cannot be revoked by any company or agent. Knowing your rights as a policyholder can help you avoid malicious terms and conditions that are detrimental to you. Plus, nobody will be able to mislead you if you already understand the basic rights available to you by law.

However, you, as the policyholder, also have to adhere to certain responsibilities to avoid any misunderstanding between you and your insurer. Failure to meet these responsibilities can often result in rejected claims, which can be detrimental to your family. Let’s take a look at some of the basic rights and responsibilities that you need to be aware of as a life insurance policyholder.

Free Look Period

All insurance policies come with a free look period during which you can cancel the policy and get back all premiums paid. If an insurance policy is not meeting your expectations, then it is best to cancel it during the free look period itself. The free look period for a policy can differ based on the term and conditions of the insurer. Edelweiss Tokio Life Insurance offers a free look period of 15 days from the date of the receipt of the policy document.

However, any policy sold through distance marketing/electronic policies have a free look period of 30 days. While you get back your premiums during the free look period, the insurer can deduct some money to recoup the cost of medical tests that they paid for.

Grace Period

Don’t panic if you are unable to pay your premiums immediately! All insurance policies have a grace period within which your policy remains active even after you miss a premium payment. The duration of the grace period differs from policy to policy. Edelweiss Tokio Life Insurance offers a grace period of 15 days for monthly pay policies, and a period of 30 days for in all other cases. There is no grace period for single premium pay policies, as the entire premium amount is already paid for. Your policy will lapse (terminate) if you fail to pay your due premiums within the grace period.

Tax Benefits

Thanks to certain provisions in the Income Tax Act, all life insurance policies are subject to tax benefits! However, some tax exemptions can only be claimed if your policy meets the terms & conditions stipulated by the Government of India. Below are two of the main sections in the Income Tax Act that deal with life insurance tax benefits.

- Section 80C- This section states that premiums paid for life insurance policies are tax deductible. You can deduct up to ₹1.5 lakhs per year, but taxes will have to be paid if your total premium exceeds that amount.

- Section 10(10D)- This section covers tax exemptions on life insurance benefits. According to Section 10(10D), death benefit/life cover is always exempt from taxes, so your family will always receive the full sum assured in case of your untimely death. Insurance maturity benefits are also subject to tax exemptions, provided that your policy meets the term & conditions mentioned in the section.

Remember that tax laws change in accordance with government policies. The deductions and exemptions available now may or may not be available in the future.

Maturity Benefit Claim

In savings plans, maturity benefits are rewarded to a policyholder once the policy reaches the end of its term. If you have paid all your premiums, and your policy has matured (term end), then you have the right to get your maturity benefits once you submit the relevant documents. Unlike the death claim, maturity benefit cannot be denied or contested by the insurer, provided that your policy is in-force when it reaches maturity.

ULIP Funds

Funds invested in Unit Linked Insurance Plans (ULIPs) are not locked-in forever! If your policy has been active for five years or more (past lock-in period), then you can withdraw some of your funds from the ULIP. Depending on the policy terms, the maximum amount of funds you can withdraw ranges from 10% to 20% of the total SIP premium you have paid.

Policy Surrender

You can cancel/surrender your insurance policy at any time, irrespective of whether you are in the free look period or not. However, if you surrender your policy after the free look period, you are unlikely to get back the premiums you have paid. Once your policy is active for three years or more, it accumulates a surrender value. It is best to cancel a policy after it has accumulated some surrender value, as you will at least get back some of the money you have put in.

Responsibilities as a Policyholder

Properly fulfilling your responsibilities as a policyholder can drastically improve your claim settlement chances. Below are some of the key responsibilities that you need to be aware of before buying an insurance policy:

- Submit the required documents and proposal form. Ensure that all the details are correct and up to date.

- Double check the policy tenure, premium amount, and sum assured before finalising your purchase.

- Never obscure information from your medical test.

- Ensure that the details of your nominees are properly filled. Even minor errors can become problematic later down the line. It is best to fix any errors immediately so that your family can quickly get the claim settlement amount in case of your absence.

- Keep your original policy document secure. In case you lose your policy document, you can always ask your insurance company for a replacement. However, you should demand a replacement as soon as possible to avoid any issues in the future.

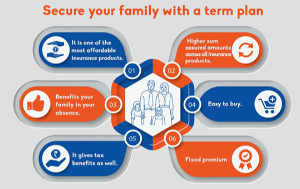

Learn your rights and duties as a policyholder to have the best experience possible! If you have never purchased a life insurance before, then a simple term plan like Edelweiss Tokio Life- Zindagi Protect might be ideal for you.

Swati Tumar - Travel & Finance Writer

Swati is a Writer in the day and an illustrator at night. Among her interests, she is quite fond of art and all things creative. She often indulges herself in creating doodles, illustrations, and other forms of content. She identifies herself as an avid traveler and shameless foodie.