A term plan & a critical illness plan provides complete protection

Blog Title

334 |

Your family is a source of strength and inspiration to you. Whenever you are faced with making a decision in life, your parameters are inevitably how this decision is going to affect your family. Their future is something that you would always like to invest in, is it not? Would it not be prudent to invest in something that will shield them from the uncertainties of the future?

Give them financial security.

How do you provide a financial shield for your family. Look at it this way. You need to provide them with an umbrella that keeps them protected against the sun as well as the rains. Opt for a term life insurance plan along with a critical illness plan and ensure that they stay protected. Read on if you want to know how these two types of plans can help you in your endeavour to shield your family from financial distress.

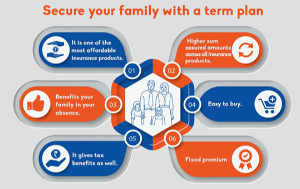

Term life insurance plans

A term insurance is insurance in it’s purest form. Simply put, it is a life insurance policy that gives you only death benefits. So, if for instance, you buy a term life insurance policy with a Sum Assured of Rs.1 cr with a term of 40 years, and you meet with an untimely demise anywhere during this period, your family will get the Sum Assured in full either as a lumpsum or as a monthly payout. This will ensure that they are not burdened by the financial liabilities of paying home EMI’s, children’s education cost and living expenses, in general. Although the loss of a loved one will alter their life emotionally, you will have ensured that financially they are taken care of.

Riders

To further strengthen the cover that you are providing them, you could opt for a few riders like:

- Waiver of Premium Rider This rider will ensure that in the event of a disability due to an accident, your policy continues without you having to pay the premiums. This ensures that even though you are unable to pay premiums owing to your income earning capacity being hindered, your family’s financial protection remain unaffected.

- Accidental Death Benefit Rider This ensures that on account of your unfortunate demise, 100% of the rider Sum Assured is paid in addition to the basic Sum Assured. This enhances the base cover of the term plan.

- Accidental Total & Permanent Disability Rider If you meet with an accident which results in you becoming permanently disabled, you get the rider sum assured and your policy still remains in force. This ensures that you get a financial cushion when in distress.

Critical illness plan

A critical illness plan provides a shield when there is loss of income owing to a pre-specified critical illness. If you are diagnosed with a heart ailment that requires you to undergo a Coronary Artery Bypass Grafting(CABG) procedure that demands you to stay at home, away from work for 2-3 months, you may face a period of forced lay-off. This will severely hamper you and your family’s financial make-up and you may struggle to meet the hospitalization and other expenses. Even if you have a mediclaim to cover your hospitalization expenses, other expenses like rent, home EMI’s and children’s school fees etc will not be taken care of. A critical illness plan ensures that all these are taken care of. If you have a critical illness insurance, you get paid a lumpsum payment on the diagnosis report of a medical practitioner. It does not require you to get hospitalized. What’s more? You can use this money in any manner that you may deem fit. No need of providing any supporting documents like bills, photographs etc. Just on the basis of a diagnosis report, you would be able to claim the Sum Assured.

Conclusion

Keep yourselves totally protected against any eventuality by buying a term insurance plan and a critical illness policy.