Gcap

Menu Display

- Customer Service

- Our Products

- Capital Secure+ - A Combination Of Market-Linked And Guaranteed Returns

- Edelweiss Tokio Life –Wealth Rise+ – A double-advantage ULIP

- Edelweiss Tokio Life – Premier Guaranteed Income – A guaranteed income plan

- Edelweiss Tokio Life –Wealth Secure + - A new generation ULIP

- Edelweiss Tokio Life- Zindagi Protect - A Comprehensive Term Plan

- All Products

- Resume Application

- Insurance Guide

- Knowledge Center

- About Us

Menu Display

-

Our Products

- Capital Secure+ - A Combination Of Market-Linked And Guaranteed Returns

- Edelweiss Tokio Life –Wealth Rise+ – A double-advantage ULIP

- Edelweiss Tokio Life – Premier Guaranteed Income – A guaranteed income plan

- Edelweiss Tokio Life –Wealth Secure + - A new generation ULIP

- Edelweiss Tokio Life- Zindagi Protect - A Comprehensive Term Plan

- All Products

Menu Display

Breadcrumb

Don’t Just Think Of Future Dreams; Think Of Future Realities!

promise of free pizza if not delivered under 30 minutes or a plan that

gives you a guarantee¹ on your returns! With Edelweiss Tokio Life GCAP,

you get guaranteed¹ returns and a life cover.

Product Enquiry

Take a step ahead to secure your goals

No response from Server, Please try again.

Thank you!!

Thank you for sharing your details with us.

Our product expert will get in touch with you soon to understand your life insurance needs.

GCAP product broucher

A Multiple of single/annualized premium as life cover at all time during policy tenure

GCAP Reasons Why This Plan Is A Guaranteed¹ Hit!

Reasons Why This Plan Is A Guaranteed¹ Hit!

No Surprises, Only Guaranteed¹ Returns

This plan has the advantage of letting you know exactly what kind of returns you get upon investing.

Thoda Extra Makes Sabkuch Better

Get Guaranteed Accrual Additions (GAA) on your returns from your 9th policy year

The “Made for Everyone” plan

Starting at Rs 1500/month, this is an affordable plan for everyone to begin their investment journey.

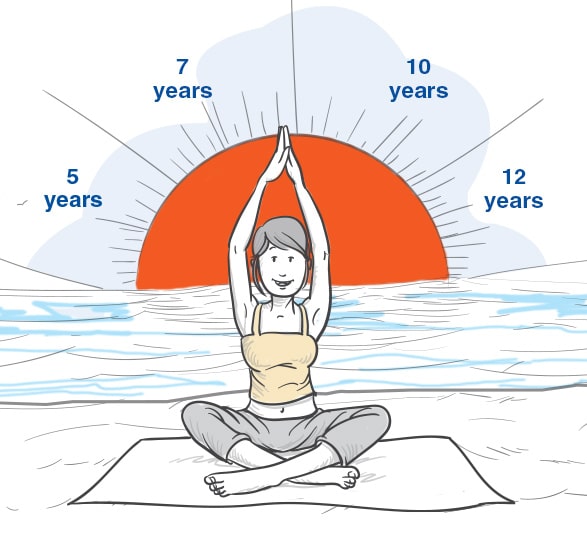

Choice Hi Choice

Choose your policy term and your premium paying term to suit your needs. You can also opt for single payment or via installments.

GCAP Benefits of GCAP

Benefits of GCAP

-

Guaranteed¹ Returns

No surprises here! With Edelweiss Tokio Life GCAP, get guaranteed¹ returns no matter the circumstance, on your investment. The advantage with this plan is that you know exactly how much you’re getting out of it, so you can plan your future goals accordingly.

-

Guaranteed Accrual Additions

Long-term friends get better gifts! We love treating those who are with us for longer by giving guaranteed accrual additions. These additions start from the 9th policy year.

-

Affordable Premiums

It’s the plan that fits into every budget! We want everyone to take advantage of getting a guaranteed¹ income at all times which is why Edelweiss Tokio Life GCAP starts at only Rs. 1500 p.m.

-

Waiver of Premiums

Even when things seem blue, we’re there to show you the silver lining! In case you are diagnosed with a listed critical illness or are suffering from a permanent disability due to an accident, this optional benefit rider will waive off payment of future premiums for you if added to your plan.

-

Protection Against Critical Illnesses

We’re always ready to help out in any situation! With this optional benefit rider, we make sure you get a lump sum payment to deal with any expenses when diagnosed with any one of the 12 listed critical illnesses that include Heart Attack, Cancer, Strokes, Bone marrow transplant and more.

-

Loan² Facility Against Policy

Don’t let financial trouble stop you from your goals!We want you to live your zindagi unlimited, even if you need a little support to do it. That is why Edelweiss Tokio Life GCAP offers you the choice to avail a loan for urgent need of cash flow

-

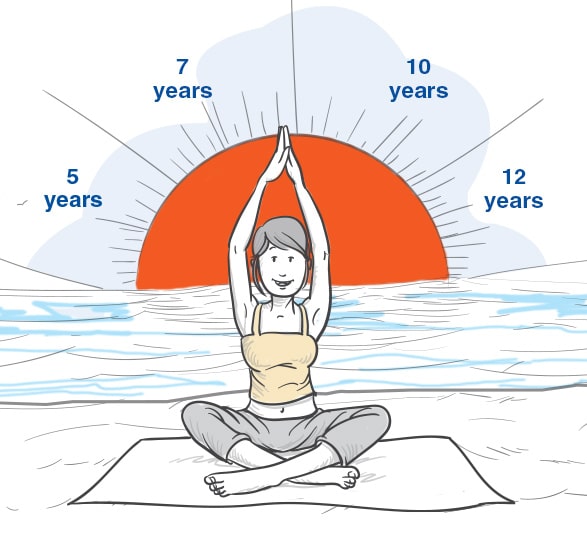

Flexibility

This plan is as flexible as playing dough! Customize the plan according to your needs by choosing your preferred policy term and no. of years for paying the premium. You can choose your policy term from 10, 15, 20, 25 or 30 years and your policy paying term (PPT) from 5, 7, 10 or 12 years. Additionally, depending on the variant, you can decide whether you want to pay in one go or through regular installments.

-

Tax Benefits³

We dislike deductions as much as you. You get tax benefits on premiums paid under section 80 (C) and on the maturity benefit under section 10 (10D).

Guaranteed¹ Returns

No surprises here! With Edelweiss Tokio Life GCAP, get guaranteed¹ returns no matter the circumstance, on your investment. The advantage with this plan is that you know exactly how much you’re getting out of it, so you can plan your future goals accordingly.

Guaranteed Accrual Additions

Long-term friends get better gifts! We love treating those who are with us for longer by giving guaranteed accrual additions. These additions start from the 9th policy year.

Affordable Premiums

It’s the plan that fits into every budget! We want everyone to take advantage of getting a guaranteed¹ income at all times which is why Edelweiss Tokio Life GCAP starts at only Rs. 1500 p.m.

Waiver of Premiums

Even when things seem blue, we’re there to show you the silver lining! In case you are diagnosed with a listed critical illness or are suffering from a permanent disability due to an accident, this optional benefit rider will waive off payment of future premiums for you if added to your plan.

Protection Against Critical Illnesses

We’re always ready to help out in any situation! With this optional benefit rider, we make sure you get a lump sum payment to deal with any expenses when diagnosed with any one of the 12 listed critical illnesses that include Heart Attack, Cancer, Strokes, Bone marrow transplant and more.

Loan² Facility Against Policy

Don’t let financial trouble stop you from your goals!We want you to live your zindagi unlimited, even if you need a little support to do it. That is why Edelweiss Tokio Life GCAP offers you the choice to avail a loan for urgent need of cash flow

Flexibility

This plan is as flexible as playing dough! Customize the plan according to your needs by choosing your preferred policy term and no. of years for paying the premium. You can choose your policy term from 10, 15, 20, 25 or 30 years and your policy paying term (PPT) from 5, 7, 10 or 12 years. Additionally, depending on the variant, you can decide whether you want to pay in one go or through regular installments.

Tax Benefits³

We dislike deductions as much as you. You get tax benefits on premiums paid under section 80 (C) and on the maturity benefit under section 10 (10D).

GCAP Choice of 6 Riders⁹

Choice of 6 Riders⁹

Accidental Death Benefit Rider

This rider provides financial security in the form of an additional life cover to your loved ones in case of demise due to an accident.

Accidental Total and Permanent Disability Rider

With this rider, you can get a lump sum amount to manage your expenses in case total or permanent accidental disability has hindered your earning capacity.

Income Benefit Rider

Get the power of providing financial security in the form of regular income to your family when you’re no longer around with this rider.

Payor Waiver Benefit Rider

With this rider, if the proposer of the policy suffers from an unfortunate event like death, disability or critical illness, all future premiums are waived off and the policy continues for the life insured.

Edelweiss Tokio Life - Critical Illness Rider - UIN 147B005V04

Diagnosis of a critical illness can be a bitter pill to swallow, forcing you to make drastic changes to provide for your loved ones. By opting for this Rider, you can be better prepared in case you face such a situation. Thus, upon diagnosis of a critical illness, we will provide you with the Sum Assured amount to manage your expenses.

The critical illnesses covered under this Rider are - Cancer of Specified Severity, Open Chest CABG, Myocardial Infarction (First Heart Attack of specific severity), Open Heart Replacement OR Repair of Heart Valves, Kidney Failure, Requiring Regular Dialysis, Third Degree Burns, Major Organ / Bone Marrow Transplant, Permanent Paralysis of Limbs, Stroke Resulting in Permanent Symptoms, Surgery of aorta, Coma of Specified Severity and Blindness.

With an entry age spanning from 18 to 65 years, this optional benefit’s term period can last anywhere between 5 to 52 years. The maturity age of Edelweiss Tokio Life Critical Illness rider is between 23 to 70 years of age. You can choose different payment options like Single Pay, Regular Pay and Limited Pay to purchase this rider, but this frequency will depend on the choice you have made in your base plan. The maximum Sum Assured you will get from this optional benefit is Rs. 50,00,000. The benefit is payable only once during the term of the policy. The cover under this rider will cease after a claim under this rider is paid.

Edelweiss Tokio Life - Accidental Total and Permanent Disability Rider - UIN 147B001V04

Accidents are unpredictable and can have long-lasting impacts. In case you are left with a total and permanent disability due to an accident, it can affect your ability to continue your occupation and can hamper your efforts to provide for your loved ones. This Rider provides aid in the form of a lump sum amount, so you can manage your expenses. It comes into effect after 180 days of your condition being presented.

The entry age for this rider can range between 18 to 65 years. This rider provides financial security in case of total and permanent disability caused by an accident. The policy term for this rider ranges between 5 to 52 years with maturity age between 23 to 70 years. You can carry out your payments through options like Single Pay, Regular Pay and Limited Pay but bear in mind that the frequency of these payments must match your selections in the base plan. It is important to note that the total rider premiums should not exceed 30% of the base plan premium. The minimum Sum Assured received from this rider is Rs. 1,00,000, while there is no limit on the maximum Sum Assured value, subject to Reinsurance capacity . However, the maximum sum assured cannot exceed the value of the Sum Assured of the base plan.

Edelweiss Tokio Life - Income Benefit Rider - UIN 147B015V02

You are one of the pillars of support for your loved ones, but unforeseen circumstances can take you away from them. In such cases, it is important to make arrangements for your family, so their future is protected. Thus, this Rider helps provide them with a monthly income so they can manage their expenses when you’re no longer around to support them.

With an entry age spanning from 18 to 65 years, this rider’s term can last anywhere between 5 to 52 years. The maturity age is between 23 to 70 years of age. The minimum premium amount for this rider is Rs. 101 and the maximum amount is based on age, gender, policy term, premium paying term and Sum Assured. Bear in mind that this amount cannot exceed beyond 30% of your base plan’s premium. You can choose different payment options like Single Pay, Regular Pay and Limited Pay to purchase this rider, but this frequency will depend on the choice you have made in your base plan. The minimum Sum Assured you will get from this optional benefit is Rs. 75,000. There is no limit on the maximum Sum Assured value. On death of the life assured, a monthly death benefit amount equal to 1% of the sum assured would be paid for the next 150 months to his or her family.

Edelweiss Tokio Life - Payor Waiver Benefit Rider - UIN 147B014V05

Unforeseen circumstances like diagnosis of a critical illness or disability can have long-reaching effects. It can change your lifestyle and can have an adverse effect on your everyday processes. This Rider provides assistance in such a case - diagnosis of one of listed critical illnesses, a total and permanent disability caused by an accident or death. In such a case, all your remaining premium payments will be waived off and your policy benefits will continue unaffected. This Rider is applicable on plans where the life insured and proposer of the policy are different people.

This optional benefit has an entry age of 18 to 65 years and its maturity age is 70 years. Your payment frequency and term for this rider should coincide with the selection made for the base plan. The minimum premium amount you will have to pay is Rs. 3.40, while the maximum premium will be restricted to 30% of the base product premium. The minimum premium amount that will be waived off through this rider is Rs. 1000, whereas there is no limit for the maximum premium amount.

This Rider covers the following critical illnesses - Cancer of Specified Severity, Open Chest CABG, Myocardial Infarction (First Heart Attack of specific severity), Open Heart, Replacement OR Repair of Heart Valves, Kidney Failure Requiring Regular Dialysis, Third Degree Burns, Major Organ / Bone Marrow Transplant, Permanent Paralysis of Limbs, Stroke Resulting in Permanent Symptoms, Surgery of Aorta, Coma of Specified Severity and Blindness. This Rider offers a 15-day Free Look period and the Grace Period is the same as the base plan.

GCAP 4 Steps To Happiness And An Unlimited Future

4 Steps To Happiness And An Unlimited Future

Make your choice

- Choose the amount you want to start saving

- Choose your premium paying term

- Choose your policy term

Decide how you want to pay

- Pick your preferred Premium Paying Frequency

Enhance your plan

- Choose from six riders

- Use them to customize your plan as per your needs

Sit back and relax

- Submit the requested documents

- Let us verify your details so you can start getting guaranteed¹ returns!

EdelweissPremiumReturnsCaculatorWeb

Plan Your Financial Growth With GCAP

Rahul invested

₹every year for

Year

By the end of 20 years , Rahul receives a maturity benefit of

and ₹ 1,03,000 for next 4 years

Annual Premium Amount: Rs 50,000

Policy Term 20 Years

Fund Value Rs 0

This is a sample illustration. *In above example, we have taken 30 year old non-smoker male.

Need expert advice

Need expert advice?

GCAP Reasons Why You’re Bound To Love Us Back

Reasons Why You’re Bound To Love Us Back

We’ve got experience in helping people make their Zindagi unlimited

We’ve got the expertise in helping you grow your wealth

We constantly innovate our offerings to get better results for you

Reasons Why You’re Bound To Love Us Back

We’ve got experience in helping people make their Zindagi unlimited

We’ve got the expertise in helping you grow your wealth

We constantly innovate our offerings to get better results for you

Here's Why Our Customers Adore Us

Here's Why Our Customers Adore Us

Look at what people had to say about our services

Asset Publisher

He was very much clear about the issue and the importance of it.. Thanks rohit

Anisha Shashidharan

(sr.associate)

Your customer support is doing excellent job.keep up the good work.

Nilesh Pawar

(manager)GCAP Fire Away Queries

Fire Away Queries

Like teachers say, there are no silly questions

Why should I invest in a guaranteed¹ returns plan?

A plan that offers guaranteed¹ returns ensures that you have a source of income, no matter the circumstances. This plan caters to your need for stable wealth accumulation, along with providing protection for your family and giving tax benefits. With these benefits, you can ensure your achievement of future goals; whether it be a happy retirement or paying for your child’s education

Was this helpful?

What should I opt for Edelweiss Tokio Life GCAP?

GCAP helps you accumulate wealth for meeting those grand plans to celebrate your achievements. What makes our offering special is that we understand that you need to maximize the wealth you can generate from your hard-earned money and enjoy the best possible. The plan offers you a fully guaranteed maturity benefit, death benefit and a Guaranteed Accrual Addition.

Was this helpful?

What goals can I meet with this plan?

You may want an early retirement which can be enjoyed in style or it could be an international education course for your child. It would be ideal to invest in a plan which helps you accumulate wealth via guaranteed returns to achieve these goals, even in your absence.

Was this helpful?

Are all the benefits guaranteed¹?

Yes, all the benefits are guaranteed¹ upfront.

Was this helpful?

Are there any additional benefits available?

With this plan you will get additional benefits beginning from your 9th policy year in the form of Guaranteed Accrual Additions (GAA).

Was this helpful?

What are Guaranteed Accrual Additions?

Guaranteed Accrual Additions or GAA are additional benefits you get from this policy. The amount of GAA depends on a number of factors that include annualized premium, policy term, premium paying term, entry age and your gender. Every year, the amount under GAA is accrued, and this process starts from the 9th policy year till maturity, at the beginning of the year. This amount is given upon death or maturity. You can find more information about GAA factors in Annexure A of our brochure.

Was this helpful?

What is the policy term for this plan?

The policy term for this plan ranges between 10 to 30 years. Within this time frame, you can choose between 10, 15, 20, 25 or 30 years, depending on your goals.

Was this helpful?

What is the minimum and maximum entry age of this plan?

The minimum entry age of this plan is 91 days and the maximum entry age is 55 years.

Was this helpful?

What is the minimum and maximum maturity age of this plan?

You need to be at least 18 years of age to get this policy. The maximum age at which you can get it is 70 years.

Was this helpful?

What is the amount my nominee will receive as the death benefit?

The minimum amount that your nominee will get upon your death is Rs. 1,65,000. The maximum amount depends on the premium invested.

Was this helpful?

GCAP Message Box

We are always there for you

For queries, write to onlinesales@edelweisstokio.in

Contact us on 022 6611 6021

Related Articles & Resources

GCAP Video Slider

Videos

1- This is applicable only if all due premiums are paid and the policy is inforce.

2- Policy loan are subject to terms & conditions of the product. Refer product brochure for more details.

3- As per provisions of Income Tax Act, 1961. Tax benefits are subject to changes in tax laws.

9- Riders are available at extra cost.

Edelweiss Tokio Life - GCAP is only the name of the Individual, Non-Linked, Non-Par, Savings, Life Insurance Product and does not in any way indicate the quality of the plan, its future prospects, or returns. Please know the associated risks and the applicable charges from your Personal Financial Advisor or the Intermediary. Tax benefits are subject to changes in the tax laws. For more details on risk factors and terms and conditions, please read sales brochure carefully before concluding a sale.

IRDAI Reg. No.: 147. CIN: U66010MH2009PLC197336. UIN: 147N031V03

ARN: WP/3435/Oct/2023

View Download

View Download