CPSTest

Menu Display

- Customer Service

- Our Products

- Capital Secure+ - A Combination Of Market-Linked And Guaranteed Returns

- Edelweiss Tokio Life –Wealth Rise+ – A double-advantage ULIP

- Edelweiss Tokio Life – Premier Guaranteed Income – A guaranteed income plan

- Edelweiss Tokio Life –Wealth Secure + - A new generation ULIP

- Edelweiss Tokio Life- Zindagi Protect - A Comprehensive Term Plan

- All Products

- Resume Application

- Insurance Guide

- Knowledge Center

- About Us

Menu Display

-

Our Products

- Capital Secure+ - A Combination Of Market-Linked And Guaranteed Returns

- Edelweiss Tokio Life –Wealth Rise+ – A double-advantage ULIP

- Edelweiss Tokio Life – Premier Guaranteed Income – A guaranteed income plan

- Edelweiss Tokio Life –Wealth Secure + - A new generation ULIP

- Edelweiss Tokio Life- Zindagi Protect - A Comprehensive Term Plan

- All Products

Menu Display

Breadcrumb

Capital Secure Plus Sticky Menu

Reasons Why This is a Smart Solution for Your Investment!

Reasons Why This is a Smart Solution for Your Investment!

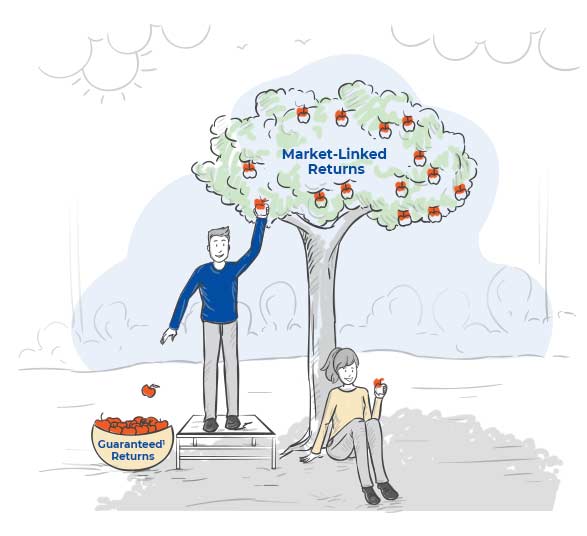

The Best of Both Worlds

Savings with market-linked returns and guaranteed¹ money-back on your total investment in one solution

Financial Planning for Your Junior

Provide for your child’s future with Little Star Benefit option & Edelweiss Tokio Life – Payor Waiver Benefit Rider⁹, even in your absence

Protection for Your Loved Ones

Life Cover 10X of annualized premium for the entire policy term, for your loved ones

Systematic Withdrawal Plan#

Option to make partial withdrawal and receive part of your fund value in a systematic way

Key Features of Capital Secure+

Key Features of Capital Secure+

-

Capital Guarantee: Market-Linked + Guaranteed

Safeguard Your Capital!Here is your solution for a safe investment. Avail market-linked

returns by investing your wealth in 7 diverse fund options. Also, get your total invested

premiums back at maturity of the policy with guaranteed¹ benefits. This combo

solution secures your money while also provides the potential for better returns

-

Benefits for Your Little Star

Unleash your child’s potential! Choose Little Star Benefit option and Edelweiss Tokio Life

Life - Payor Benefit Rider⁹ to secure your child’s dreams. Even in case of your demise,

policy benefits continue with all future premiums waived off.

-

Strategize Your Portfolio

Choice of 2 investment strategies#! You can manage your funds in 2 ways—with a self-

managed strategy or a life stage and duration-based strategy. With the Self-Managed

Strategy, you can get unlimited switches to decide where you want to allocate your

funds by yourself. With the Life Stage and Duration Strategy, we’ll do this for you and

manage your funds.

-

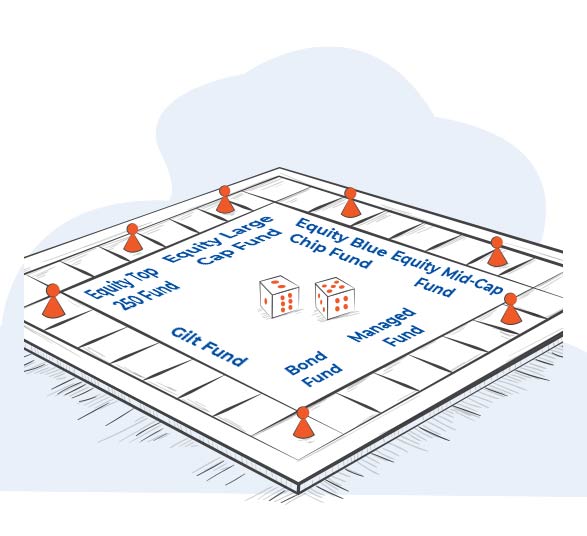

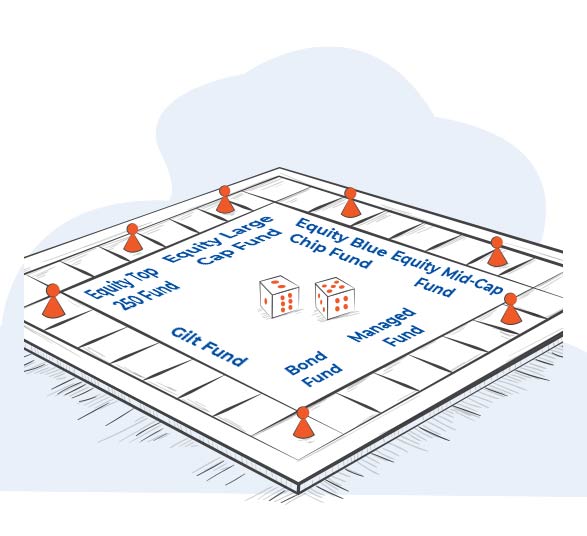

7 Funds to Match Your Preference

Fund! Fund! Which fund do you choose? A diversified bouquet of 7 funds, including

Equity & Debt, to cater to every investor’s risk appetite. The funds available are Equity

Large Cap Fund, Equity Mid Cap Fund, Equity Top 250, Equity Blue Chip

Fund, Bond Fund, Managed Fund and GILT Fund.

-

Generate Income from Your Returns

Easy Liquidity, anytime! Make partial withdrawals from your funds in a systematic way

with Systematic Withdrawal Plan option#. This provides liquidity to fulfil any monetary

requirement for various short-term and long-term goals in life. Under this option, the

pre-decided percentage of fund value is paid as per the frequency chosen by you, till

the end of the policy term

-

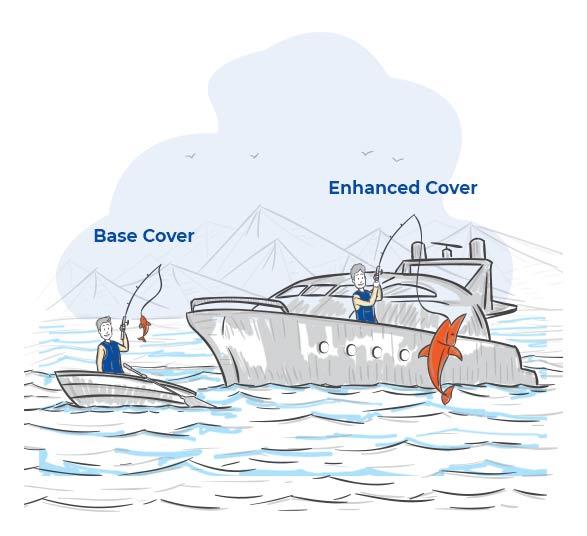

Customize Your Plan

Get in control of your plan! Under Base Cover, you can pay your premium with for a

limited period of 5, 8, 10 ,12 years. At inception of the policy, you have the flexibility to

choose Little Star Benefit and Edelweiss Tokio Life – Payor Waiver Benefit Rider⁹

together, policy term, premium paying term and premium paying mode (monthly,

quarterly, semi-annually, or annually)

-

With Your Family, Always

Protection for your loved ones! Secure your family’s future with the benefit of 10X life

insurance coverage of annualized premium, that too throughout the policy duration

-

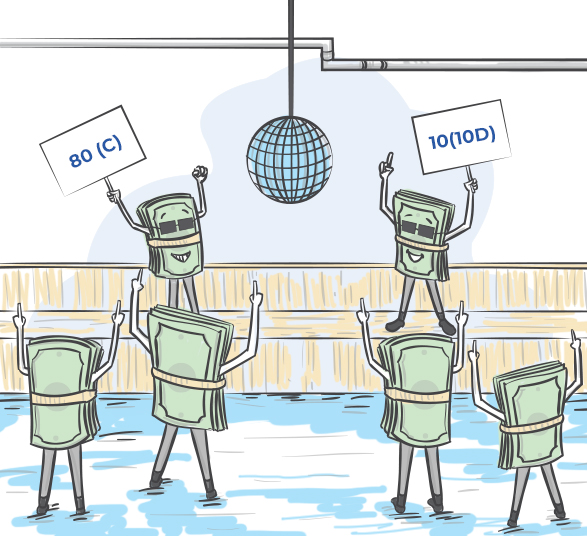

Tax Benefits³ for the Win

No deductions, no worries!Premium amount you pay towards this plan is eligible for

tax benefits³ under Sections 80C and returns upon maturity are exempt if conditions of section 10(10D) of Income Tax Act, 1961, are fulfilled.

Capital Guarantee: Market-Linked + Guaranteed

Safeguard Your Capital!Here is your solution for a safe investment. Avail market-linked

returns by investing your wealth in 7 diverse fund options. Also, get your total invested

premiums back at maturity of the policy with guaranteed¹ benefits. This combo

solution secures your money while also provides the potential for better returns

Benefits for Your Little Star

Unleash your child’s potential! Choose Little Star Benefit option and Edelweiss Tokio Life

Life - Payor Benefit Rider⁹ to secure your child’s dreams. Even in case of your demise,

policy benefits continue with all future premiums waived off.

Strategize Your Portfolio

Choice of 2 investment strategies#! You can manage your funds in 2 ways—with a self-

managed strategy or a life stage and duration-based strategy. With the Self-Managed

Strategy, you can get unlimited switches to decide where you want to allocate your

funds by yourself. With the Life Stage and Duration Strategy, we’ll do this for you and

manage your funds.

7 Funds to Match Your Preference

Fund! Fund! Which fund do you choose? A diversified bouquet of 7 funds, including

Equity & Debt, to cater to every investor’s risk appetite. The funds available are Equity

Large Cap Fund, Equity Mid Cap Fund, Equity Top 250, Equity Blue Chip

Fund, Bond Fund, Managed Fund and GILT Fund.

Generate Income from Your Returns

Easy Liquidity, anytime! Make partial withdrawals from your funds in a systematic way

with Systematic Withdrawal Plan option#. This provides liquidity to fulfil any monetary

requirement for various short-term and long-term goals in life. Under this option, the

pre-decided percentage of fund value is paid as per the frequency chosen by you, till

the end of the policy term

Customize Your Plan

Get in control of your plan! Under Base Cover, you can pay your premium with for a

limited period of 5, 8, 10 ,12 years. At inception of the policy, you have the flexibility to

choose Little Star Benefit and Edelweiss Tokio Life – Payor Waiver Benefit Rider⁹

together, policy term, premium paying term and premium paying mode (monthly,

quarterly, semi-annually, or annually)

With Your Family, Always

Protection for your loved ones! Secure your family’s future with the benefit of 10X life

insurance coverage of annualized premium, that too throughout the policy duration

Tax Benefits³ for the Win

No deductions, no worries!Premium amount you pay towards this plan is eligible for

tax benefits³ under Sections 80C and returns upon maturity are exempt if conditions of section 10(10D) of Income Tax Act, 1961, are fulfilled.

Steps to Guaranteed¹, Growing Happiness!

Steps to Guaranteed¹, Growing Happiness!

Choose for Enhanced Protection!

- Add Little Star Benefit & Edelweiss Tokio Life – Payor Benefit Rider⁹

Customize Away!

- Choose your preferred premium

- Choose your preferred premium payment frequency

- Choose your policy term

- Choose your premium paying term

Your Fund Management, or Ours?

- Choose between the Self-managed strategy or the Life Stage and Duration

- The first option gives you the freedom and unlimited switches to make your own choices

- The latter choice gives us the opportunity to do this for you

Sit Back and Relax

- Submit the requested documents

- Let us verify your details and start your wealth accumulation journey!

Asset Publisher

More Products You'd Love to Explore

Market-linked Returns with Guaranteed¹ Lumpsum Option!

Maintain a diversified portfolio by investing in the market, while also receiving a guaranteed¹ payout at maturity.

Benefits of market-linked returns and guaranteed¹ lumpsum in one plan

Enhanced Cover option with higher sum assured & booster additions

Little Star Benefit option to protect your child’s future

Tax benefits³ u/s 80C & 10(10D) to shield your savings

Har Sapna Karo Poora with Guaranteed¹ Savings!

Guaranteed¹ returns, enhanced cover option, tax benefits³, and more… all with premiums just Rs. 3,000/month^².

Choice to receive guaranteed¹ returns as lumpsum or in 5 equal annual instalments

Enhanced Cover option to secure your family with 20x the premium^⁴ paid

Guaranteed¹ savings & life cover for a policy term as high as 40 years

Family Income Benefit option to ensure your family doesn’t have to compromise on dreams

Future Guaranteed¹ Income, now possible!

Makes sure nothing gets in the way of you and your dreams.

Guaranteed¹ Income + Protection + Tax Benefits³ in one plan

Pick from 4 plan options basis life goals – Lumpsum, Short Term Income, Long Term Income & Retirement Income

Family Income Benefit option ensures your family doesn’t have to compromise dreams

6 Riders available to enhance your plan⁹

Need expert advice

Need expert advice?

Reasons Why You’re Bound to Love Us Back

Reasons Why You’re Bound to Love Us Back

We want our customers to be financially secured and enable them to achieve their financial goals.

We have the expertise in making you grow your wealth.

We constantly innovate our offerings to get better results to secure your future.

Reasons Why You’re Bound to Love Us Back

We want our customers to be financially secured and enable them to achieve their financial goals.

We have the expertise in making you grow your wealth.

We constantly innovate our offerings to get better results to secure your future.

Here's Why Our Customers Adore Us

Here's Why Our Customers Adore Us

Look at what people had to say about our services

Asset Publisher

He was very much clear about the issue and the importance of it.. Thanks rohit

Anisha Shashidharan

(sr.associate)

Your customer support is doing excellent job.keep up the good work.

Nilesh Pawar

(manager)Fire Away Queries

Fire Away Queries

Like teachers say, there are no silly questions

What is a Capital Guarantee Solution?

A solution that combines the benefits of Unit Linked Insurance Plans (ULIPs) and guaranteed returns plans. This type of a solution provides you the best of both worlds - security of your money invested and an opportunity to grow your money. Also, you get life cover for the entire policy duration ensuring that your family is protected even in your absence. If you are looking for a guarantee on your money invested along with additional returns to fulfil goals such as children’s education, retirement planning, child’s marriage etc., then this is a must-have solution for your savings and investment!

Was this helpful?

Why should I opt for Edelweiss Tokio Life Capital Secure+?

By combining the advantages of market linked returns (Edelweiss Tokio Life Wealth Rise+) and guaranteed returns (Guaranteed Savings Star), you can save and accumulate wealth for the future and enjoy the best of both worlds. It may be a great choice for someone who wants to keep a balanced and diversified portfolio with both market linked and guaranteed products.

You invest your money in various market-linked investment funds based on your risk profile while also ensuring that at the end of the policy duration, your capital is secured irrespective of the capital market changes. Additionally, this solution ensures that in case of any unfortunate event, your family stays protected.

Was this helpful?

Do I need 3 separate Plans for Financial Security?

Investing money can be challenging and we will help you simplify it. When planning your portfolio, to diversify it, three major product types are a must- 1) a plan that offers life cover, 2) market-linked returns and 3) and guaranteed returns. Capital Secure+ is a 3-in-1 solution for all these requirements. So, if you are looking for a balanced portfolio, Capital Secure+ is the ideal solution for you. No need to be hassled in managing 3 separate plans when you can get all the benefits in one.

Was this helpful?

What goals can I achieve with this plan?

This plan can help you save for all kinds of goals—short term or long term, with policy term starting from 10 years to 40 years.

With the Systematic Withdrawal Plan, you may choose to withdraw capital at regular pre-decided intervals based on your life-stage requirements. And you may also withdraw capital for any emergency.

Was this helpful?

Can I buy these combo products individually?

You, as a customer, have the choice of purchasing any one or both products as per your need and choice. There is no compulsion whatsoever that these products are to be taken together as suggested by the insurer and presented in this proposed product combination.

Was this helpful?

What are the cover options available with this plan?

Under this plan, you get life cover of 10 times annualized premium depending on the annualized premium chosen.

Was this helpful?

What are the 7 fund options available to choose from?

The 7 fund options are as follows:

- Equity Large Cap Fund

- Equity Top 250 Fund

- Equity Mid-Cap Fund

- Managed Fund

- Bond Fund

- Equity Blue Chip Fund

- GILT Fund

Was this helpful?

Which is the best fund for me?

The 7 funds are mixed in a way to suit your risk appetite. Some people like to play with higher risks, while others prefer to take moderate risks. Funds like Equity Large Cap Fund, Equity Top 250 Fund, Equity Mid-Cap Fund, and Equity Blue Chip Fund, Bond Funds have high risks, Managed Funds have medium risks, and GILT Fund has low to medium risks

Was this helpful?

What is the lowest premium that can be paid for this plan?

You can start your savings at just ₹1,000 per month.

Was this helpful?

What are the premium paying terms offered?

The premium paying term when you opt for the ‘base cover’ is 5, 8, 10, 12 years, Regular Pay and Single Pay.

Was this helpful?

What are the policy term options available in the plan?

The Policy Terms (PT) available under the product are as follows:

Base Cover - 5, 10, 15, 20, 25, 30, 35, 40 years and ‘To Age 100’ where policy term is (100 – ‘Age at Entry’) years.

Was this helpful?

What will the child get from the Little Star Benefit + Edelweiss Tokio Life –Payor Waiver Benefit Rider?

On the death of the policyholder under ‘Little Star Benefit’:

For a premium paying policy, Death Benefit equal to the sum of all the future modal Premiums, if any, shall be added to the respective unit linked funds in the same proportion as the fund value held in the unit linked funds at the time of additions.

After the crediting of death benefit to fund value:

• The Policy will continue till Maturity or death of Life Insured, whichever is earlier.

• No future premiums are required to be paid.

• Policy will not move in discontinued status, as the policy will be treated as fully paid-up policy, wherein all future premiums are assumed to have been paid.

• Loyalty Additions will be added till end of the premium paying term provided the policy was in in force as on the date of death of policyholder.

• Maturity Additions, Booster Additions and Guaranteed Lumpsum will be added as and when due.

• Life Cover on Life Insured will continue

• Relevant charges like Policy Administrative Charges, Fund Management Charges and Mortality charges on

Sum at Risk on the life of Life Insured will continue to be levied as and when due.

For a fully paid-up policy, reduced paid-up policy and policies in discontinuance status, death benefit is not available on death of policyholder.

Payor Waiver Benefit is applicable on the death of the policy holder. In such a case, all your remaining premium payments will be waived off and your policy benefits will continue unaffected. This Rider is applicable on plans where the life insured, and proposer of the policy are different people.

Was this helpful?

Do I have to pay any plan charges?

There are no charges on premium allocations, top-up allocations, switching funds, premium redirections, or partial withdrawals. Fund management charges are a percentage of the asset value of the relevant fund and will be reflected in the NAV of the respective fund. Policy administration charges are also applicable up to 10th policy year, irrespective of the premium paying term.

Was this helpful?

What are the guaranteed benefits with this solution?

Capital Secure+ offers guaranteed return of premiums at maturity. In case of demise of the policyholder during the policy term, the life cover is guaranteed.

Was this helpful?

What is the free look period?

You have a period of 15 days from the date of the receipt of the policy document. Policies will have a free look period for 30 days in case of electronic policies and policies obtained through distance mode/marketing.

Was this helpful?

Are there any exclusions?

In case of death due to suicide within 12 months from the date of commencement of policy or from the date of revival, your nominee or beneficiary shall be entitled to the available fund value as on date, of the intimation of death.

Was this helpful?

What is the Grace Period available?

Grace period of 15 days is available for monthly premium payment mode and 30 days for all other premium payment mode.

Was this helpful?

Is the Life Cover available throughout the policy term?

Yes, Life Cover of 7 times to 10 times annualized premium on individual life depending on the annualized premium chosen is available throughout the policy term, provided all premiums are paid and the policy is in-force.

Was this helpful?

Capital Secure Plus any query

We are always there for you

For queries, write to onlinesales@edelweisstokio.in

Contact us on 022 6611 6092