Four Ways You Can Determine Surrender Value of Your ULIP’s Fund

Blog Title

2991 |

ULIPs, or Unit Linked Insurance Plans are hybrid investments that offer a combination of insurance and investment under a single plan. A portion of the premiums that you pay towards this plan is utilised to provide life cover for you, and the rest is invested in market-linked financial instruments of your choice. You can select from a diverse pool of funds that comprises equity, debt, and balanced funds. ULIPs are great long-term investments, and if you stay invested for a long period, you can protect your family against uncertain events in the future while also accumulating a large corpus through high ULIP returns.

Each ULIP insurance comes with a five-year lock-in period and a pre-defined maturity horizon. You cannot access your accumulating corpus during the lock-in period, but it is possible to make partial withdrawals from it after the period ends. These partial withdrawals can be helpful when you urgently need funds. However, due to financial uncertainty or any other circumstance, such as an all-time high/low fund value, you might be prompted to exit or surrender the ULIP plan before its maturity. To know the value of your ULIP policy, you should know the surrender value of the plan.

Here is everything you need to know about surrendering your ULIP plan and the four ways you can use to determine the surrender value of your ULIP policy:

What is the surrender value of a ULIP policy?

The surrender value of a ULIP plan is the amount paid by the insurance company if you decide to terminate your ULIP policy before its set maturity date. If you surrender your plan before the lock-in period, you get a sum of your allocated savings along with the earnings received till the date of surrender. However, the insurance company will deduct a surrender charge from this amount. The surrender charge varies from company to company.

Furthermore, prior to the Budget 2021 proposal, any gains on ULIPs were completely tax-free; however, the maturity amount will now only be tax-free if the total yearly premium is less than ₹2.5 lakh. Any annual premium income that exceeds ₹2.5 lakh is liable to capital gains tax.

The ULIP policy surrender amount is taxable, according to experts; if surrendered before the minimum lock-in term of five years, the complete surrender value is deemed income for the current fiscal year. As a result, it is included in the fiscal year's total gross income. The applicable tax slab is determined based on this value, and the individual must pay taxes accordingly.

If you surrender the ULIP scheme after the five-year mandatory lock-in period, life insurance companies cannot levy any surrender charge. As per the directive of the IRDAI (Insurance and Regulatory Development Authority of India), if the policyholder surrenders the value post the expiry of the lock-in period, the insurer cannot impose any surrender charge. In such cases, the policyholders will receive the fund value of the ULIP investment.

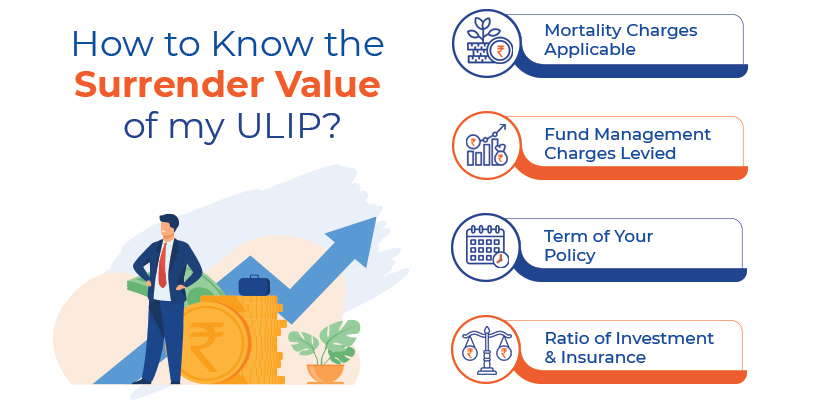

Four ways you can use to determine the surrender value of your ULIP fund

To know the surrender value of your ULIP investment, you should determine the following:

- Mortality charge: In a ULIP plan, the insurance company provides a fixed sum to the nominee in case of the policyholder's untimely demise. Mortality charges cover the cost of providing life cover to the insurer. These are also known as the cost of providing insurance.

Mortality charges are determined as per the policyholder's health, age, and gender and are deducted monthly from the invested ULIP funds. Generally, mortality charges are minimal and are deducted from your premiums but paid back at the end of the policy maturity.

If you surrender your ULIP plan, the insurance company deducts the mortality charge from the premiums paid until the surrender date.

- Fund Management charge: Funds management charges are levied by the insurance company for managing your investment funds and ensuring you get good returns. They are computed before computing your fund's net asset value (NAV). These charges are deducted as a percentage of your NAV.

As per the IRDAI (Insurance Regulatory Development Authority of India), insurance companies cannot levy more than 1.35% of the fund value per annum as fund management charges.

When you surrender your ULIP policy, the insurance company will subtract the fund management charges from the premiums paid.

- Policy duration: To determine the surrender value of your ULIP investment, you can consider the term of your policy. The premiums paid until now add to the base value of your ULIP plan, increasing its overall valuation.

In case of policy surrender, you can calculate the premiums paid to date and deduct the mortality and fund management charges from the total sum. However, this is only a rough estimate, as you would also need to know the overall ratio of your ULIP insurance and investment.

- The ratio of investment: If you know the ratio of investment and insurance in your ULIP plan, you can approximately determine the ULIP surrender value. The ratio of investment to insurance specifies the allocation of your paid premiums in market-linked funds and insurance cover.

Once you know this, you can find out the amount of insurance reserved from your ULIP plan.

Once you determine all the above factors, you can easily put them in a simple formula to know the approximate surrender value of your ULIP insurance.

First, take the total premiums you have paid till now and determine the insurance value from the sum.. Once done, subtract the mortality and fund management charges to determine your ULIP plan's surrender value. However, as specified, this method can only provide a close estimate, not the precise surrender value. Moreover, you might not have ready information on all the four parameters mentioned above. You would need to contact your insurance company and get these details.

Should you surrender your ULIP?

Even though surrendering the policy might seem like the most viable option in some cases, you must remember that if you choose to surrender the ULIP plan, you will lose out on significant ULIP benefits. As a result, you will be eroding your ULIP investment value and giving up on your long-term financial goal. Further, you will miss out on the ULIP taxation benefits under Section 80C (premiums up to ₹1.5 lacs per year are exempt from taxation) of the Income Tax Act 1961, which were previously claimed against the ULIP plan.

Staying invested for a longer duration in a ULIP scheme helps you reap the benefits of market regularization. Your corpus also benefits from the power of compounding, which makes your investments grow exponentially in the long run. Moreover, you will be able to distribute different ULIP charges, such as mortality, fund management, administration, guarantee, etc., throughout the policy tenure. These payments are usually high in the initial years but their impact on the overall returns becomes negligible in the long run. Hence, longer ULIP investments have the potential to offer better returns and high fund value.

So, irrespective of how tempting it is to surrender your ULIP policy, it is always wiser to think religiously before taking this step. That said, if your wish to revive your plan after surrendering, you can do so within a maximum of two years of surrender, subject to some conditions.

For efficient wealth creation, competitive ULIP benefits, attractive returns, and secure insurance coverage, choose the ULIP Plans of Edelweiss Tokio Life Insurance. For example, you can choose Edelweiss Tokio Life - Wealth Secure+, a comprehensive new-age ULIP that is affordable and flexible. You can easily bear the premium payments for this plan without putting a burden on your finances and reap all the benefits that come with a ULIP.

Aastha Mestry - Portfolio Manager

An Author and a Full-Time Portfolio Manager, Aastha has 6 years of experience working in the Insurance Industry with businesses globally. With a profound interest in traveling, Aastha also loves to blog in her free time.