ULIP - Know the Difference Sum Assured & Fund Value

Blog Title

366 |

Sum Assured means the amount that an insurer guarantees to the family members or loved ones (nominees) of the policyholder, in the case of their unfortunate demise.

Fund Value means the Net Asset Value (NAV) on the day it is being calculated multiplied by the number of units held by you.

Unit Linked Insurance Policies, or ULIPs in short, are plans that combine life insurance with market-linked investments. The premiums you pay for a ULIP also act as your investments, which can be put into any of the funds offered within your policy terms. Some ULIPs even allow you to switch between various funds to maximise your profits.

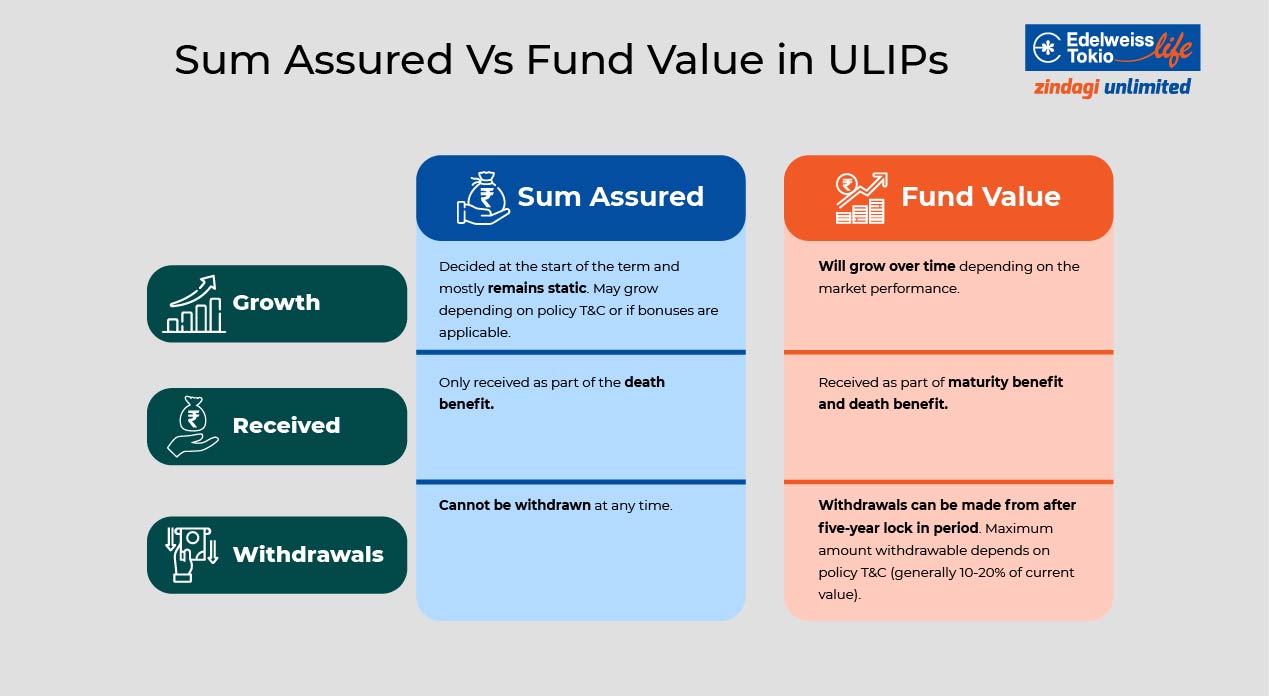

Each ULIP has two primary values that you need to be aware of- the Fund Value and the Sum Assured. In most insurance plans, the sum assured is the primary value that is added to your death benefit, i.e., the money your family will get in your unfortunate absence. However, in ULIPs, even the fund value can be equally important while deciding your death benefit.

What is Sum Assured in ULIPs?

Sum assured refers to the minimum amount of money your family will receive when you are gone. The sum assured is also known as life cover and it is the main reason why most people purchase life insurance. Just like in any other insurance plan, the sum assured of your ULIP will depend on your annual premium, age, lifestyle, and health.

What is Fund Value in ULIPs?

The key difference between ULIPs and other savings plans is that you actively invest in market-linked funds. Your returns will completely depend on how well these funds are performing. The fund value of a ULIP is the total worth of your investments. Unlike the sum assured, which is a static value decided at the start of the policy term, the fund value is everchanging and can rise and fall basis the Net Asset Value.

If your investments are performing well, then your fund value will also increase accordingly. When your policy term comes to an end, your fund value will be returned to you as a maturity benefit. Moreover, you can also make withdrawals from your fund value after the five-year lock in period.

How is Death Benefit Calculated in ULIPs?

Death benefit is the final payout your family (nominees) get when you pass away during the policy term. The first thing to note is that there are two types of ULIPs that differ based on how the death benefit is calculated. In Type 2 ULIPs, the death benefit is equal to your sum assured plus the fund value currently invested, meaning that your family will get double the benefits.

On the other hand, in Type 1 ULIPs the death benefit can be:

Sum Assured

Fund Value

105% of total Base Premiums paid till the time of death

Whichever value is higher at the time of your death.

This means that for a Tye 1 ULIP, the fund value plays an equally important role to the sum assured while calculating your family’s death benefit payout. Making the right investments in a ULIP can drastically increase your fund value, which not only increases your maturity benefit but also boosts the death benefit your family will receive in case you pass away.

To read more about Type-1 and Type-2 ULIPs, click here.

Sum Assured Vs Fund Value in ULIPs

Which Type of ULIP Should You Choose? Type 1 or Type 2?

Both Type-1 and Type-2 ULIPS have pros and cons that need to be taken into consideration before you make your final decision. Below are some key factors to keep in mind while buying a ULIP:

Type 1 ULIP-

Type 1 ULIPs are generally more affordable as the premium rates are lower. Moreover, Type 1 ULIPs are also beneficial for the insurer, as the risk borne by the insurer keeps decreasing as your fund value increases (as fund value is your investment). If your fund value surpasses the sum assured, then the insurer has to pay little out of their own pocket to settle the death benefit.

Type 2 ULIP-

The death benefit payout for Type 2 ULIPs is much greater than Type 1, as you nominees will get both the sum assured and the fund value. However, this means that the risk for the insurer is greater (as the sum assured has to be no matter what). This is why Type 2 ULIPs generally have higher premium rates. Moreover, Type 2 ULIPs may also have stricter terms & conditions and more exclusions when compared to Type 1 ULIPs.

If you want more affordable premium rates, then Type 1 ULIPs are the right choice. However, if you don’t mind higher premiums and want to thoroughly safeguard your loved ones, then go with a Type 2 ULIP plan. Remember that both the sum assured, and fund value are equally important, irrespective of whether you select a Type 1 or Type 2 ULIP. If you need an affordable ULIP that also provides extra benefits for your little ones, then check out Edelweiss Tokio Life- Wealth Rise Plus.

Aastha Mestry - Portfolio Manager

An Author and a Full-Time Portfolio Manager, Aastha has 6 years of experience working in the Insurance Industry with businesses globally. With a profound interest in traveling, Aastha also loves to blog in her free time.