Term Insurance Coverage Effective for the Short-Term?

Blog Title

262 |

Term insurance is a great option to protect the financial future of your loved ones. It offers a high value cover for a small premium. In fact, Edelweiss Tokio’s term Insurance offers a cover of ₹1 crore for as low as ₹19 per day. These plans offer life coverage for the term or duration of the policy.

Term plans are simple insurance products that can be easily aligned with your unique lifestyle and financial goals. Thanks for digitisation, you can apply for them and make premium payments online.

People often wonder whether term insurance plans are effective for short-term goals. Here’s a look at scenarios where term insurance plans are most effective in the short-term.

When is a Term Insurance Effective in the Short Term?

A term insurance can provide coverage for several years. Some even provide coverage till you turn 100! But can term insurance plans help in the short-term? The simple answer is yes. Here are a few scenarios in which term insurance plans become a boon in the short term:

- Malini started a new business using a significant share of her savings. By paying a small premium, she can get a term insurance plan to protect her loved ones while her business is in the nascent stages. She can then choose to buy a term plan with a longer duration or a whole life insurance policy.

- Joseph has just started earning and cannot afford a high premium plan. For him, a low one-time premium is a good option. This is a starting point to take responsibility of his family members and have a backup for them.

- Mukesh is retired and his kids are in well-paying jobs. He needs an insurance policy for some financial stability for his aging wife. He opts for a short duration term plan to give her security and maintain the desired financial flexibility.

- Sheela has purchased a car on a loan that needs to be paid back over the next five years. She worries about her children being burdened with EMIs in the event of her untimely demise. A term insurance plan provides her peace of mind that the loan will be paid off.

- Ali’s daughter is studying at an expensive college. He takes a term insurance plan to ensure that his daughter’s education is not compromised in case he is no longer there.

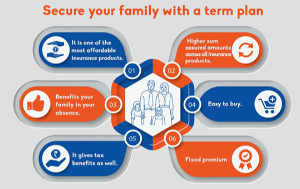

Advantages of Term Insurance

The global term insurance market size is forecasted to grow at a CAGR of 8.7% between 2023 and 2030. The individual term life insurance segment accounted for 75% of the revenue of this market in 2022. India is among the top APAC economies that commanded 30% of the market share that year. This is because there are multiple benefits of a term insurance plan:

- The premiums are low, although the coverage is high.

- Fits into any budget because of low premium.

- Generally have a very short waiting period.

- Can also be used as an additional layer of coverage.

- Most insurance providers have provision for adding riders to the policy.

- You can renew the term by paying the premium, right before the original term expires.

- You can get tax benefits under Sections 80C, 80D or 10D of the Income Tax Act.

Not All Term Policies Are Alike

Before buying term insurance, it’s important to carefully consider the duration. The term should not be so short that you have to renew it often, incurring additional premium payments. Also, ensure you are neither underinsured nor overinsured.

Compare plans, their features, and benefits before making a decision. Apart from providing higher coverage at lower premiums, there are insurance providers that offer several benefits like allowing to skip a few premium payments without affecting the cover, choice to get back your paid premiums at the end of the term to fulfil your goals, and money-back on all premiums if you wish to exit the policy after a specific period.

Do remember to read the policy document carefully so that there is no confusion during the claims process.

Siddhant Dubey - Writer & Photographer

Siddhant works as a freelance content writer who is interested in a wide range of spheres from photography and personal finance to cooking. He is also an aspiring photographer striving to showcase life around him through his vision.