A Step-by-Step Guide to Renewing Term Insurance

Blog Title

330 |

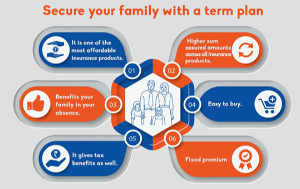

As per a recent study, close to 65% of urban Indians have purchased a life insurance policy, but only one out of five people has bought term insurance, so the level of protection is very low. The India Protection Quotient (IPQ) stands at 35

But if you are one of the people who have purchased this form of life coverage, then you must note that your job is not fully done! Term insurance is not a ‘get it and forget it’ type of investment. You must periodically review your needs and see if the coverage is still adequate. Furthermore, you must renew your term plan in case the coverage period ends. But how to go about this? Very few are aware that they can effortlessly renew the term or even convert it into life insurance. Learn how in this guide.

Why Renew Your Term Insurance?

A term insurance policy secures an individual for a fixed term only. After the fixed duration, the policy and the money paid need not simply lapse. You can add another term by renewing your policy, given that your policy allows for renewal.

In case a policyholder is diagnosed with a critical illness close to the policy expiration date, an extension helps secure the dependents. With such health conditions, it is difficult to get a new policy cover. If the policy document provisions for a renewal, the insurance provider is bound to process it according to the policy terms. By renewing the policy, you get the same benefits without having to undergo the tiresome process of obtaining a new policy. Here are the ways to renew a term insurance plan.

Auto-Renewal via Premium Payment

You can purchase a renewable term insurance plan and get it renewed automatically for another term till you attain a certain age. In most cases, the change in premium amount is determined by your age, health condition, and the terms of renewal in the policy document. The premium may increase annually, or for every term, as mentioned in the policy’s terms and conditions. Generally, renewed plans do not have any waiting period.

You would usually receive a reminder for autorenewal to ensure that your linked bank account has enough funds to automatically deduct the payment.

Manual Renewal

If you have not opted for a renewable policy, you will be notified a few months before the term expires. Most insurance providers remind you to renew your term insurance. You can choose to renew your term insurance offline or online.

Follow the steps below to renew your term insurance plan online:

Step 1: Open the website or the mobile app and log into your account.

Step 2: Search for existing term policies.

Step 3: Look for the Renew option and carefully read the terms and conditions.

Step 4: Check the premium amount and documents to be submitted.

Step 5: Submit all required documents.

Step 6: Complete the premium payment through your chosen method.

You will receive a renewed policy once your documents are verified and payment processed.

You Have One More Option: Conversion to a Whole Life Policy

Your financial goals change as you age and as your income grows. A term insurance plan, with a low premium, may be good enough till your home loan is paid off. After a certain time, one prefers an extended policy that provides financial security to their loved ones in the case of the policyholder’s untimely demise.

Do you need to get a new life insurance policy for this? No. You can convert your term plan into a whole life plan and take advantage of the history you have built over the years with timely renewals and maintaining good health. Moreover, it is better to convert an existing policy than to start the process all over again after so many years.

A term insurance plan typically offers a conversion option. However, different insurance providers may have varying conditions. There may be a period within which it can be converted to a life plan. For instance, if you take a term insurance plan for 5 years at the age of 25, you can only convert or renew it till you reach 40. Or, if you purchase term insurance of 20 years, you can convert it to a life insurance plan only within the first 10 years. Therefore, knowing the policy terms and staying in contact with your insurance agent or customer manager is critical to making the most of your policy.

While conversion is possible online, it is better to consult a representative of the insurance provider to know the details of conversion. You can also get to know about all your options, which may include reducing the life insurance premium and getting a lower coverage, retaining the coverage with a slightly higher premium, or increasing the coverage by paying a larger premium amount. Understanding all the terms and conditions, lock-in periods if any, and exclusions can help you make an informed decision and secure your loved ones.

Chirag Iyer - BFSI Enthusiast

Chirag is a writer and an avid reader who loves to drink coffee! His other interests include boxing, karate, and singing.