Should You Buy Multiple Life Insurance Policies for Tax Purposes

Blog Title

310 |

You already have a life insurance policy to protect the financial future of your loved ones. Will taking another policy help in any way? A lot of people opt for life insurance due to the tax benefits it offers. That’s among the reasons why the premium income from life insurance policies in India grew by 10% in FY22 to a whopping ₹6.93 lakh crores. Despite this terrific growth, the penetration of insurance in India stands at a low 4.2%, with the majority coming from the life insurance sector.

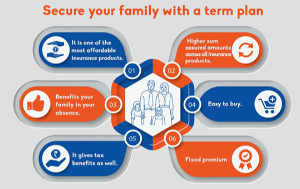

You may already know how important life insurance is for your family’s future. But insurance also plays a critical role in tax planning. You can claim deductions of premiums paid from your taxable income under Section 80C of the Income Tax Act, 1961. This is true even if you have more than one life insurance policy. Read on to learn more.

Life Insurance Tax Benefits in India

As your career progresses, lifestyle improves and responsibilities increase, you may need more cover to protect your family’s changing needs. The good news is that there are no restrictions on how many life insurance policies you can have. Here’s a look at the tax deductions:

Section 80C: Whether you’re a resident of India or an NRI, you can claim deductions of the premiums under Section 80C. The limit is ₹1.5 lakhs in a financial year. This is available along with FDs, NSC, PPF, and ELSS. To enjoy these, you must opt for the old tax system since tax deductions on these investments are not allowed under the new tax regime.

Deductions are only allowed for premiums up to 20% of the sum assured. This is levied on policies issued before March 31, 2012. Deductions are not available for premiums paid over 10% of the sum assured for policies issued on or after April 1, 2012.

Section 10 (10D): This act determines whether your insurance maturity proceeds are tax-free. Death benefits are always tax-free. However, your policy may cover you for disabilities. Disabled and severely disabled individuals can claim deductions of ₹75,000 and ₹1,25,000, respectively, under Section 80U of the Income Tax Act, 1961. Individuals suffering from diseases like hearing impairment, mental retardation, blindness, or locomotor disability can also claim deductions under Section 80DDB.

However, there may be situations when the maturity proceeds are not tax free. According to the latest rules announced in Budget 2023, the maturity amount of a life insurance policy purchased on or after April 1, 2023, will be taxable if the premium paid in a fiscal year exceeds ₹ 5 lakh. These rules will apply to all life insurance policies except Unit-linked insurance policies (ULIPs). For ULIPs, the maturity proceeds are taxable if the premium for any given year goes beyond ₹ 2.5 lakh. The tax liability will be calculated as per the income tax slab of the policyholder.

Tax exemption is offered for premiums for multiple life insurance policies for yourself or your spouse, children, and parents. The younger you are, the better are the terms of the policy. The premiums are lower since insurers perceive young people at a lower risk of disease and death.

Tax Benefits of Multiple Life Insurance Policies

If you have multiple life insurance policies, the cumulative premium will not be tax-exempt if it exceeds ₹5 lakhs in a financial year. This rule has been introduced in the Union Budget 2023. You can consider policies for your spouse and children for a much lower cover. If the premiums do not exceed ₹5 lakhs in a year, the money paid will be exempted from tax.

Things to Know When Considering Multiple Insurance Plans

Buying more than one life insurance policy may offer you more tax benefits. But you must know a few other things to ensure maximum benefits from the policy.

- Different plans will mature at different points in your life. Keep track of these to claim the amount. Remember to send the documents to your insurance provider to help them process the claim. The proceeds will be sent directly to your bank account.

- Remember to opt for benefits like Better Half Benefit on different life insurance plans. This makes sure your partner is financially secure in your absence.

- Don’t forget to add riders to each life insurance for enhanced protection. Pick from accidental death benefit rider, accidental total and permanent disability rider, critical illness rider, and waiver of premium rider.

- Consider investing for different life goals. This way, taking more than one insurance policy will come naturally.

- Set up an auto-debit facility for your premium payment. This way, you do not have to remember the due dates for multiple life insurance policies. The amount will be debited from your bank account or credit card, whatever you choose.

Besides the tax benefits, more than one policy is helpful in many ways. You can take care of the increased financial responsibilities of your family without worries. For instance, if one claim is rejected, you have another policy to fall back on.

Tax laws are subject to changes from time to time. Seek help from professionals to stay updated with the rules. To qualify for multiple insurances, declare your health status honestly. Submit the correct documents for verification. All of these can lower the chances of rejection.

Neha Panchal - Financial Content Writer

Neha used to be an Engineer by Profession and Writer by passion, which is until she started pursuing full-time writing. She's presently working as a Financial Content Writer, with a keen interest in all things related to the Insurance Sector.