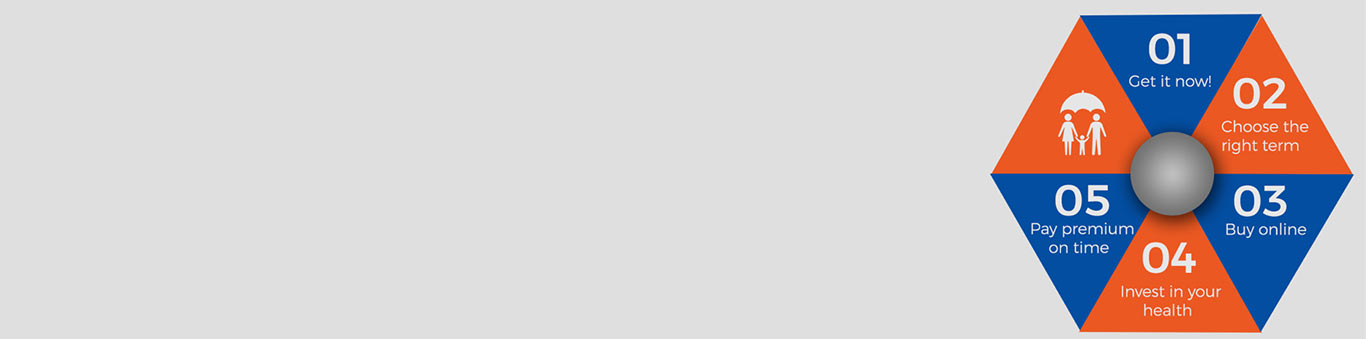

Reduce your insurance premium by simply following these steps

Blog Title

816 |

After a gap of about 3 years, Rohit rang his close friend Raj. They had a chat for a while, speaking all about their personal and professional life as well.

Rohit asked Raj, “Where are you currently working? Raj replied that he is working in an insurance company as a marketing manager. Rohit then said, “Oh! This must be a tough job as most people don’t opt for life insurance as the premiums seem very expensive.”

Raj then replied, “Even I had the same assumption before joining the company. However, let me explain to you that insurance makes life easy as it covers the risk that can occur due to uncertainties in life. But when it comes to purchasing a policy, most people tend to get confused as they are overloaded with information and weighed down with the premium amount. If the costs associated with insurance premiums have deterred you from purchasing a much-needed policy you have to follow some simple tips that can help you in reducing your premium amount considerably. These pointers will get you insight into how insurance premiums work. Once you have that knowledge you can definitely lower your premium amount, nothing should stop you to go ahead and secure yourself and your family.

1. Get a life cover now

It is highly recommended that a person starts investing in an insurance policy as soon as he is earning. Life insurance premium and age of the policyholder are directly proportionate. This is because the younger you are, lesser the risk involved as the chances of you being in good health and having a longer productive life is higher.

And so the best way to lower your term plan premium is to avoid delaying the purchase of a term insurance plan. The older you get, the higher the premium amount. An average delay of 5 years in buying a term plan could cost you more than Rs 1 lakh cumulatively than what you would pay to get insured today.

2. Buy Online

It is a well-established fact that buying online insurance is far cheaper than offline policies. Online term policies, are about 30-40% cheaper. This is because there is elimination of an advisor commission and various other administrative costs, the benefit gets transferred to the policyholder in the form of lower premium.

3. Invest in Your Health

A healthier person gets the privilege of affordable premium rates as compared to an unhealthy person. Lifestyle diseases such as diabetes, hypertension and blood pressure can increase the premium amount quite significantly. Same is the case with lifestyle habits like smoking and drinking. The premium amount would be higher since they are high-risk factors.

4. Pay on time

It is important that a policyholder pays his premiums on time. In case a policyholder does not pay on time, late fees can be added which increases the premium amount. A few insurance companies may even request you to undergo a medical test. Just in case, the medical test reveals an adverse health condition, you may end up paying more than the regular premium. Another reason you should pay timely premiums is to avoid a defaulter tag which can ruin your financial standing when taking a policy in the future.

If given some time and thought, a life insurance policy will not burn a hole in your pocket. The right information and research can save you thousands on premiums.

After hearing this Rohit decided to follow these simple tips so that he can purchase a life insurance plan at lower premium rates without any delay!