Which Guaranteed Income Payout Option is Right for You?

Blog Title

179 |

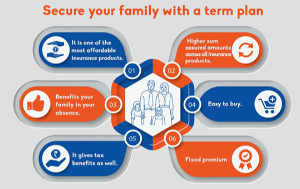

Life insurance cushions your family’s finances against large and unexpected expenses. It would be even more helpful to have insurance that offers a fixed income, paid out at regular intervals. This is exactly what a guaranteed income plan from a reliable insurance company does. There are generally 4 payment options – lumpsum, short-term, long-term and retirement income payouts. These payouts can be used to finance a wedding, higher education, or international travel. In short, it helps anyone like you, looking for a second source of income, plan your future finances in a more stable and organised manner.

India’s awareness of life insurance has grown remarkably exponentially in recent years. This can be seen in the growth of the life insurance market by 18% in FY 2023, from the 2022 level. This growth has been attributed largely to a significant rise in the investment literacy rate. The other growth drivers are rising digitisation, improved customer services and favourable regulatory policies.

While the growth is remarkable, it is important to know how to pick the right guaranteed income plan payout option to maximize its benefits.

1.Lumpsum

A lumpsum benefit in a guaranteed income plan refers to a payment method where the entire benefit is paid in one go instead of at periodic intervals. A lumpsum would be helpful for those who want to clear a debt, start a business, buy a car, or pay hefty medical bills. In short, you can tide over significant expenses that might not be possible with monthly payments. The premium paying options available are for 5, 8, 10 and 12 years, with guaranteed maturity benefits. The policy term options go up to a whopping 20 years.

2.Short Term Income

Short-term income refers to a regular stream of payment for a short period of time. The income benefit payouts begin after a specific period once your premium paying term is over. You can pay the premium for 8, 10 or 12 years and enjoy a steady income for up to 26 years. Policyholders can add critical illness benefit and family income benefit with this option. Short-term income suits anyone looking for a stable and predictable income source for a specific period.

3.Long-Term Income

Long-term income is a regular stream of payment for a longer timeframe, usually up to 42 years. The income benefit payouts begin after a specific period once the premium paying term is over. You can pay the premium for 5, 8, 10 or 13 years. After that, you can enjoy a steady income for up to 42 years. Policyholders can add critical illness and family income benefits with this guaranteed income insurance plan. A long-term income plan is ideal for funding your child’s education, long-term regular treatments like chemotherapy, or early retirement.

4.Retirement Income

This is ideal for anyone looking to create a regular income once they are no longer gainfully employed. A maturity benefit is offered on survival after the policy term. Further, policyholders can receive a regular income stream after completing the premium payment term and a specific waiting period. Pay the premium for 5, 8, 19 or 12 years and receive a steady income for 20 years. Critical illness and family income benefits are available with this plan.

One size does not fit all. Therefore, make sure to read and understand each plan before picking a suitable one for yourself. You can talk to a financial advisor to make an informed decisions based on plan features and tax benefits.

How to Get a Guaranteed Income Plan in India?

A guaranteed income plan is the best choice for anyone looking for assured returns. Here’s how you can get it online from the comfort of your home.

Step 1: Select a plan option from the ones mentioned above. Assess your financial requirements and choose an investment amount.

Step 2: Choose a favourable policy term, premium payment term, and payout frequency.

Step 3: Explore the different benefits available, like family income benefits on either critical illness or critical illness and death.

Step 4: Choose from riders like premium waiver benefit, hospital cash benefit, accidental total and permanent disability, and critical illness rider. These are extra layers of protection.

Step 5: Now, submit the required documents for verification. Sit back and relax.

A guaranteed income plan is your constant income source, regardless of your circumstances. So, whether you want to enjoy a happy retirement or wish to tick off big life goals, this insurance product is helpful every step of the way. Even in your absence, the beneficiaries can live without financial woes. This is because life cover is available throughout the policy term once the premiums are paid off, and the policy is in force. Look for an insurance provider with a 99% claim settlement ratio. They will also ensure excellent customer service for a satisfying experience.

Aastha Mestry - Portfolio Manager

An Author and a Full-Time Portfolio Manager, Aastha has 6 years of experience working in the Insurance Industry with businesses globally. With a profound interest in traveling, Aastha also loves to blog in her free time.