Know Your Rights & Responsibilities as a Life Insurance Nominee

Blog Title

340 |

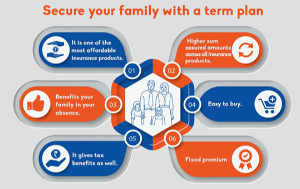

The nominees of an insurance policy are the ones who will receive the life cover amount in case of the insured person’s untimely death. In fact, the primary function of any life insurance policy is to provide the nominees with financial security in the absence of the policyholder. If you are a life insurance nominee, learning about your rights and duties can help you quickly settle any outstanding claims. A common worry among nominees is that their insurance claim will get rejected.

But the fact of the matter is that if you follow the right protocols, and provide all the documents the insurer needs, then your claim will be settled promptly. Below are a few of the important rights and responsibilities you need to be aware of as a nominee. Following these guidelines can help you avoid issues with Claim Settlement or other life insurance related benefits.

Rights of a Life Insurance Nominee

- Right to the Sum Assured: If you are directly related (parent, spouse, child) to the life insured and are a nominee, then you have first right to the sum assured. This means that your right to the sum assured/life cover precedes the right of any other legal heir who is not a nominee. If the policy has no beneficial nominees (closely related family), then the legal heirs of the insured person may also lay claim to the sum assured.

- Right to Other Policy Benefits: Life cover is not the only benefit provided by life insurance policies! Nowadays, most policies also offer riders and other benefits that provide additional financial protection during turbulent times. For example, the Family Income Benefit option in Edelweiss Tokio Life- Guaranteed Savings STAR ensures that you (the nominee) continue to enjoy the policy’s maturity benefits even after the death of the life insured. Depending on the terms & conditions of a plan, you might be eligible to various other payments that are not included in the life cover. It is important for all nominees to thoroughly understand the benefits offered by their life insurance policy.

- Know the Status of the Policy: Life insurance nominees have the right to know the status of their claim. You can question the insurance company about the claim settlement process at any time. Moreover, you also have the right to make an appeal if your insurance claim gets rejected.

What happens When Your Insurance Claim Gets Rejected?

Did your claim get rejected? Don’t panic! All insurance companies are required, by law, to give a reason for their claim rejection. If your insurer fails to give a valid reason for claim rejection, then you can file a complaint with The Insurance Regulatory and Development Authority of India (IRDAI). You can also dispute the claim rejection if you disagree with the insurance company’s reasoning.

Responsibilities of a Life Insurance Nominee

- Understanding the Policy Terms: At the end of the day, a life insurance policy is meant to protect you, the nominee, against financial loss. So, it is essential for you to understand all the terms & conditions mentioned in the policy document. You should also know about the policy term, the maturity value, riders that are available, and the premium amount paid by the policyholder.

- Safeguard the Policy Document: This is a shared responsibility between the policyholder and all the beneficial nominees. The original policy document has to be submitted while making a claim. Misplacing this document can cause serious problems for you and the other nominees later down the line. If you lose the original policy document, then please inform your insurance provider immediately and ask for a replacement.

- Make Sure Your Details are Correct: Even a small spelling mistake can cause you a lot of heartache during the claim settlement process. If you notice any errors in the policy document, then please get them changed as soon as you possibly can. Important details include your name, address, age etc. Ensure that details of other nominees are correct as well. Don’t forget to update the policy details if you change your name or address!

- Have the Contact Details of Your Insurance Agent: The policyholder may have purchased the policy, but in their absence, it is you who needs to know how to navigate the claim settlement process. If the policy has been purchased through an agent, then ensure that you have said agent’s contact number in case of emergencies. If the policy has been purchased online, then you can directly make an enquiry on the insurance provider’s website. Our website even allows you to directly report a claim online.

Understand the Claim Settlement Process

All nominees need to learn how to initiate the claim settlement process in case of an emergency. The very first step to claim settlement is to intimate the insurance company of the life insured’s death. This can be done by calling your agent or by directly reporting the claim online. Once the claim settlement process has been initiated, you will need to share important documents to prove your claim.

Some essential documents that you need to provide include:

- The original policy document

- The death certificate of the life insured

- Your identity proof

- A copy of the FIR in case of accidental death

- A fully filled copy of the claim form provided by the insurer

Please do be ready to share any other documents that the insurance company asks for. The insurer needs to make sure that the sum assured is going to the right people, and verifying the identity of the nominees is just due diligence on their part. Knowing your rights and duties will help you stay on top of the claim settlement process, and you will be able to get the sum assured as quickly as possible.

Swati Tumar - Travel & Finance Writer

Swati is a Writer in the day and an illustrator at night. Among her interests, she is quite fond of art and all things creative. She often indulges herself in creating doodles, illustrations, and other forms of content. She identifies herself as an avid traveler and shameless foodie.