How to Minimize the Chances of Life Insurance Claim Rejection?

Blog Title

208 |

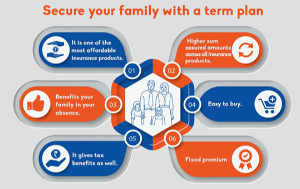

Life insurance policies exist to safeguard your loved ones in your absence… If anything were to happen to you, your family can file a life insurance claim against your policy and receive a significant amount of death benefit to support their life goals. But what happens if your family’s claim gets rejected due to some circumstances?

This is a worry that most life insurance policyholders and nominees may have felt at one time or another. It can be truly disheartening when your claim gets rejected, and more importantly, it can be financially catastrophic if the insured person was your family’s breadwinner. Keep in mind that insurers cannot just reject your claim on a whim. They need a valid reason for rejecting a claim.

More often than not, an insurance company has a good reason to reject a claim. There are certain red flags that insurers look for while investigating any life insurance claim. If you avoid these red flags and share all the required documents with your insurer, then the chances of your claim getting rejected are significantly reduced.

Why do Life Insurance Policy Claims Get Rejected?

Claims can get rejected for multiple reasons. Some of the most common reasons for rejection include:

- Making a claim after a policy has already lapsed (due premiums were not paid)

- Concealing details about pre-existing health issues/diseases, age, income or even weight

- Obscuring details about lifestyle habits like smoking, drinking etc

- Not disclosing all the details about your other insurance policies

- Incorrect or failure to update the nominee details

- Failure to provide relevant documentation

- Death of insured person due to any of the causes mentioned in the ‘exclusions’ clause

How to Ensure That Your Insurance Claim Is Not Rejected?

- Pay Policy Premiums on Time:

Sometimes people just forget to pay their premiums. Don’t worry if you miss the premium due date, as all life insurance policies come with a grace period. Edelweiss Tokio Life Insurance offers a grace period of 15 days for monthly premium policies, and 30 days in all other cases. Your policy will remain active even during this grace period. However, if you do not pay your premiums within the grace period, then your policy will lapse, and you will no longer be covered. Any claim made on a lapsed policy is invalid, which is why it is important to keep track of your life insurance premiums. - Share Medical Details & Undergo Medical Tests:

Being dishonest about health issues is another major reason for claim rejections. An insured person needs to be completely honest about their past health issues, medical history, and family predisposition to diseases. Lying or obscuring any of these facts will end up causing problems for the nominees when they try to make a claim. - Be Honest About Your Lifestyle:

Similar to your medical history, your lifestyle habits also pay an important role during the insurance risk assessment process. People who smoke and drink frequently are more prone to certain diseases and health conditions, which inadvertently increases the risk for insurers. The policyholder should be completely honest about their lifestyle to avoid trouble for their nominees during claim settlement. - Share Details About All Your Insurance Policies:

In India, there is no limit to the number of life insurance policies one can buy. However, the sum assured/life cover provided by each subsequent life insurance policy will be reduced. If your first policy provides you with adequate life cover, then your second policy will have a lower sum assured. You cannot get life cover that drastically exceeds your Human Life Value (HLV), aka the approximate value of your total lifetime income. If you hide details about your previous insurance policies, the insurers cannot accurately conduct their risk assessment process. This, in turn, leads to claim rejection later down the line. - Update Nominee Details Whenever Relevant:

Always ensure that your nominee details are up to date. If anyone changes their name or address, your priority should be to notify the insurer immediately so that they can update their database. Moreover, if a nominee passes away before you (the insured person), you can always add a new nominee to the policy. If the insurer cannot verify the identity of the nominees, then they are more likely to reject a claim. - Make Claims ASAP with Proper Documentation:

If you are a nominee, you need to intimate the insurer of you claim as soon as possible. Make sure that you have the death certificate in hand along with the original policy document. The faster you intimate the insurer the faster your claim will be settled. Cooperate with the insurer when they ask for more documents to ensure that the claim settlement process is as smooth as possible. - Read Policy T&C Thoroughly:

Both the nominees and the policyholder need to thoroughly go through the policy document. Understand the benefits provided to you as well as the exclusions listed in the terms. Knowing every detail of your policy can help you avoid situations that can lead to claim rejection.

What Can You do if Your Claim is Still Rejected?

What if you take every single precaution mentioned above, but your claim is still rejected? The first course of action is to find out why your claim was rejected. According to The Insurance Regulatory and Development Authority of India (IRDAI), an insurer must provide a valid reason for claim rejection. If your insurer has not shared a reason with you, then demand one immediately.

If you are not satisfied with the reasoning behind claim rejection, then you can contact the insurer’s grievance redressal cell. Every insurance company has a grievance redressal office that deals with claim rejection complaints. If you are still unable to reach a settlement, then consider contacting a higher authority in the IRDAI. A Grievance Redressal Officer (GRO) will register your complaint and try to resolve the issue. You can directly file a complaint with the IRDAI on bimabharosa.irdai.gov.in.

Neha Panchal - Financial Content Writer

Neha used to be an Engineer by Profession and Writer by passion, which is until she started pursuing full-time writing. She's presently working as a Financial Content Writer, with a keen interest in all things related to the Insurance Sector.