What is Maturity Benefit in Insurance?

Blog Title

218 |

A maturity benefit is the lumpsum amount you get if you survive until the very end of your policy term. There is a common misconception that life insurance only provides benefits in case something unfortunate happens to you. But the reality is that life insurance has greatly evolved over the years, and now, insurance policies not only provide life cover but also help you grow your wealth over time!

What Insurance Plans Provide Maturity Benefits?

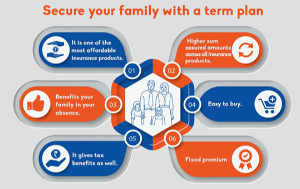

Not all insurance plans come with maturity benefits. Term plans, for example, generally have no returns. However, if you buy a term plan with return of premiums option, then you will at least get back the total amount of premium you paid over the course of your policy term.

Savings insurance plans and Unit-Linked Insurance Plans (ULIPs) are the two main types of insurance plans that offer maturity benefits at the end of the term. Savings plans are a great choice if you prefer guaranteed returns. On the other hand, ULIPs are preferable if you have an appetite for risk. ULIPs invest your money into market linked Funds, meaning that your returns are not be guaranteed and will depend on how well the market is performing. Keep in mind that maturity benefits are only granted if you survive until term end and your policy is still in-force. Maturity benefits are not granted if you pass away or lapse your policy.

Maturity Benefits in Savings Plans

If you are new to investing or don’t have the risk appetite for market linked products, then savings plans or ‘money-back’ plans are the perfect fit for you. Each savings plan comes with a ‘rate of returns’ that is revealed in the policy brochure itself. In a savings plan, your premiums are not just payment for the life cover. The premium you pay also acts as an investment which grows over time thanks to the rate of returns.

Once your policy matures (reaches the term end), you will receive a lumpsum amount that can help you prepare for your future dreams! This lumpsum will be equal to your total premium paid plus the returns. And if your plan offers guaranteed returns, then you will know exactly how much money you will get back at the very end. This gives you the freedom to plan for your financial ambitions, years in advance.

Maturity Benefits in ULIPs

ULIPs differ from savings plan in their risk factor. ULIPs directly invest your money into market linked funds, and hence your growth rate is completely dependent on the market performance. If the market is performing exceptionally well, then your returns will be significantly greater than the money you invested. However, if the market performs poorly, then your returns will reflect that downturn. ULIPs are ideal for those who are willing to take on financial risk for greater growth. If you are young and have few responsibilities or are willing to deal with the ups and downs of the market, then consider buying an ULIP.

Can You Get Maturity Benefits Before the Term End?

No, maturity benefits are only granted at the very end of your policy. However, some plans offer payouts in-between the policy term at predetermined intervals. These payouts can either be in the form of a lumpsum payment or regular income. Such payments are called ‘survival benefits’. Remember that survival benefits and maturity benefits are not the same thing! So, don’t get confused between the two terms while buying an insurance policy.

Moreover, maturity benefits are not paid out if your policy lapses. Generally, you can surrender your policy after three years to get back a portion of the money you invested. However, this ‘surrender value’ is not equivalent to the maturity benefit and you will not be able to recover the whole amount you invested in premiums.

How to Claim Your Maturity Benefits

Claiming maturity benefits is quite simple. Just follow the steps below to ensure that you get your returns as quickly as possible:

- Fill the ‘policy discharge form’. This form should be provided by your insurance company at least a month before maturity date. If you haven’t received your policy discharge form, then contact your insurer as soon as possible and ask them to send you one.

- Submit both the policy discharge form as well as the original policy document.

- You will also need to share your ID/address proof. This can be your PAN Card, passport, driving license etc.

- Share your bank account details via a copy/image of your passbook or by sending a cancelled cheque.

- Share any other documents requested by your insurer.

Once these steps have been completed and the insurer has verified your identity, the maturity benefits should be directly credited to your account.

Get More Than Just the Life Cover!

Securing your family in your absence is important, but your life insurance policy can be more than just life cover! With a savings plan or ULIP, your insurance plan will not just safeguard your loved ones but will also help you grow your wealth. Use life insurance as both a safety net and an investment. Choose a plan like Edelweiss Tokio Life- Premier Guaranteed STAR if you want comprehensive life cover along with survival and maturity benefits.

Aastha Mestry - Portfolio Manager

An Author and a Full-Time Portfolio Manager, Aastha has 6 years of experience working in the Insurance Industry with businesses globally. With a profound interest in traveling, Aastha also loves to blog in her free time.