What is Fund Switching in Insurance?

Blog Title

517 |

Fund switching refers to the act of moving your funds from one investment to another. When talking in the context of insurance policies, fund switching is an option provided in Unit Linked Insurance Plans (ULIPs). ULIPs are insurance policies that also allow you to invest a part of your money into various market linked investments. You get to choose your own investments in a ULIP, and the returns you get from such a plan depend completely on the growth of your market linked funds.

Of course, the market is not static, and an investment that seems good at one point may not be as profitable in the future. This is why most ULIPs allow you to switch your funds whenever you need. If your current ULIP investments aren’t doing well, then don’t panic! Learn to always stay on top and switch your funds to get the most out of your ULIP.

Fund Switching in ULIPs

Keep in mind that fund switching in ULIPs is not the same as freely switching your funds in the share market. Your ULIP funds can only be switched to another investment option provided in the same policy. This means that, ultimately, your funds will still be linked to the ULIP, and the market investments offered by the plan.

Planning and information gathering are key tools for any investment venture, and the same also applies to ULIPs. Always be certain that all the funds provided by a ULIP meet your quality requirements before finalising your purchase. Ultimately, it is okay if one fund performs poorly, but if all the funds are not up to par, then you will be the one to lose out.

How Many Times Can You Switch Funds in a ULIP?

Some ULIPs allow you to switch funds from one investment to another unlimited number of times. However, most policies may ask you to pay additional charges to switch funds if you have already made a specific number of switches. The free switch limit of a ULIP is always specified in the policy brochure, so always go through the terms and conditions of a plan before finalising your purchase. You can only switch funds if your policy premium payments are up to date.

When Should You Switch Funds in a ULIP?

You should regularly review your investments to ensure that they are performing according to your standards. If an investment is underperforming or is not performing to your liking, then the best course of action may be to switch your funds into another market linked investment. Below are some of the primary factors to take into consideration while choosing your market linked funds.

Your risk tolerance- Each person’s risk appetite differs. Some people prefer exponential growth and are willing to invest in riskier funds, while others would rather invest in a stable fund with modest returns. Choose and switch your funds according to your risk tolerance. Consult a financial specialist to further understand your risk tolerance and the pros/cons of various fund types.

What are your goals- Equity funds are better if you want to grow your investments over a long period of time, but such funds suffer in the short-term due to the volatility of the market. On the other hand, a debt fund might be better if you want stable short-term growth. But the downside of debt funds is that they do not offer the same long-term growth as an equity fund. So, choose your funds according to your financial ambitions.

How to Determine Your Risk Appetite?

This is a question that only you can answer for yourself. Some people have absolutely no issue with the possibility of risk, but for others, even a slight possibility of risk can be a major source of financial anxiety. One important factor to remember is that risk is less of an issue for long-term investments. If you plan to keep investing for a decade or more, then you can safely assume that you will at least see some growth.

Moreover, keep in mind that you are not the only one who benefits from the success of your ULIP, even the insurer will want to see your funds succeed and grow in value. If you are uncertain about your risk tolerance, then it would be wise to contact a reputed financial professional who can guide you through the basics of investing and ULIPs.

Are ULIP Funds Taxable?

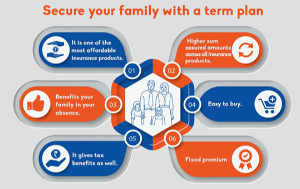

In India, tax exemptions for ULIPs are listed under Section 10(10D) of the Income Tax Act. According to current tax laws, total premium paid should be less than ₹2.5 lakhs to gain tax exemptions on ULIP maturity benefits. Meaning that any policy that is worth more than ₹2.5 lakhs (in premiums) will not be tax exempt, and the returns will be treated as capital gains.

Premiums paid on ULIPs are also tax deductible. According to Section 80C, you can get deductions of up to ₹1,50,000 on premiums (not just for ULIPs but for all life insurance plans)! Keep in mind that tax laws are subject to change depending on current government policy.

Let Your ULIP Grow Your Wealth for You!

Now that you understand how fund switching works, you can plan your ULIP funds with a bit more confidence. Remember that most ULIPs provide a few free fund switches! So, use those free switches to your advantage and don’t be afraid to make a mistake. Just because you picked a wrong fund now doesn't mean that you have to stick with that choice forever! Be aware of your risk appetite and choose the funds that give you the best growth potential.

Chirag Iyer - BFSI Enthusiast

Chirag is a writer and an avid reader who loves to drink coffee! His other interests include boxing, karate, and singing.