What is Face Amount/Face Value?

Blog Title

254 |

Face value is a term used to describe the amount of money promised to you upfront in any financial contract. In the field of life insurance, the face value or face amount of an insurance policy is the amount of money promised to you/your beneficiaries in the case of your untimely demise. Face value is also known as sum assured in the context of life insurance.

The main reason to buy a life insurance policy is to financially safeguard your loved ones in case of your unexpected death. The face value or sum assured ensures that your beneficiaries receive a specified lumpsum amount when they make a death claim. This sum is set at the very inception of your policy and its value depends on various factors such as your premium, your health condition, and your Human Life Value (HLV).

Understanding the Death Benefit

Death benefit is the final amount your beneficiaries get when they make a death claim on your insurance policy. A death benefit claim can only be made in case of your untimely passing. It is important to keep in mind that death benefit is not the same as face value. Face value is the minimum amount set for a death claim, and this amount is set before you finalise your policy purchase.

However, as time goes on, your policy will accumulate survival benefits (as per your policy terms and conditions). These survival benefits are either added as a bonus to the death claim, paid out immediately to the policyholder, or added to the maturity benefit at the end of the policy term. To put it simply, death benefit is equal to the face value plus any bonuses you have accumulated over the course of your policy term. If your policy has no bonuses or additional riders, then your death benefit will be equal to the face value.

Determining the Face Amount or Face Value

The main factors that determine your face value/sum assured include:

- Premium : Face value generally depends on the value of your annual premium payments. For example, when you read a policy brochure, you might notice a clause that says that the sum assured is 10x or 20x the annualized premium. A 10x sum assured basically means that the value of your sum assured will be equal to ten times the value of your annual premium payments.

- Human Life Value : Every person has a human life value (HLV) that is an approximate calculation of their total potential income, from now to the day of their retirement. Of course, this value is not a 100% accurate, as a person’s income can increase or decrease over time. But this value is useful for insurance providers to decide your face value.

- Your current health condition and lifestyle habits : Do you already have preexisting health issues? Are you a smoker or consume alcohol regularly? These questions are extremely important when it comes to deciding the value of your face amount. If you already have health problems, then an insurer is taking on higher risk by providing you insurance. Insurers may offer you a lower face value or may charge a higher premium for the same face value if you suffer from health problems.

What is the Ideal Face Value for a Life Insurance Policy?

Your face value/sum assured should be enough to keep your loved ones financially secure in your absence. The face value should be able to comfortably take care of your family’s lifestyle needs, education costs, medical costs etc. at least for the next few years. Ideally, your face value should, at minimum, be ten times the value of your current annual salary.

Face Value Vs Cash Value

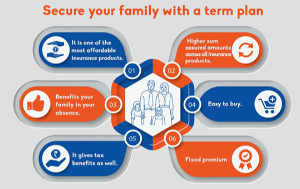

Face Value is often confused with Cash Value, though both are completely different aspects of life insurance. Face value is always provided in every life insurance policy. Whether it be a term plan, a ULIP, or a savings plan, face value is a prerequisite for any insurance policy. On the other hand, cash value is an additional benefit that is not provided in all life insurance policies. Cash benefit is generally offered for long-term savings plans or whole life insurance plans.

Moreover, face value only benefits your beneficiaries upon your/the insured person’s death. Cash value directly benefits you/the policyholder, as this value grows over time and is a part of your premium that is saved as investments. Some policies let you withdraw money from your cash value, while other policies allow you to borrow against the value as a temporary loan. This additional cash value can be of great help during financial emergencies where you need quick access to liquid assets.

Impact on Premiums

Your face value and premium are directly related. If you increase your face value, then you can also expect your premium payments to increase. Generally, depending on your policy terms & conditions, the sum assured/face value will be 10x to 20x your annualised premium. Annualised premium is the total premium you pay within a single financial year. Even if you pay premium monthly or quarterly, your face value will depend on the total annual premium and not the monthly/quarterly premium instalments.

Is the Face Value of Insurance Taxable?

No, according to Section 10(10D) of the Income Tax Act, the death benefit/face value of an insurance policy is not taxable. The only exception to this rule is Keyman insurance policies (taken by companies in case a key member passes away).

Can You Adjust Your Face Value Over Time?

Generally, the face value of an insurance policy is unchangeable, though some policies do have special provisions that let you increase your face value for special milestones like marriage or childbirth. In most cases, your sum assured will remain the same irrespective of your growth over time. Of course, your human life value might have increased over time due to promotions or increased income.

If you feel like your current insurance policy does not meet your needs, then you can always opt to purchase another policy. There is no maximum limit on the number of policies you can have. If you don’t want to pay for multiple policies, then you can also surrender your current policy and replace it with another one that has a satisfactory face value.

Conclusion

Face value is a core feature of any life insurance policy. Always ensure that an insurance policy’s face value is sufficient to provide for your family in case of any eventuality. You can opt for term plans like Edelweiss Tokio Life- Zindagi Protect if you want comprehensive life cover for an affordable price.

Swati Tumar - Travel & Finance Writer

Swati is a Writer in the day and an illustrator at night. Among her interests, she is quite fond of art and all things creative. She often indulges herself in creating doodles, illustrations, and other forms of content. She identifies herself as an avid traveler and shameless foodie.