What Is An Annuity? Exploring Annuities in Insurance

Blog Title

310 |

Annuity is a contract between the insurer and yourself, where you pay a certain sum of money, and in return, you get payments from the insurer at predetermined intervals. These payments either start immediately or after you have finished your premium payments.

Let’s Understand This With the Help of an Example

The prospect of retirement is both enticing and worrisome at the same time. Right? On one side, you get to finally relax after years of hard work and spend time with your family. However, the dark side of retirement is that you no longer have steady income and will have to dip into your savings in case of emergencies. But here’s the thing, if you are well prepared for retirement, you will continue to have regular income well after you stop working! This regular income can be achieved with an annuity plan.

Of course, the first step to getting post-retirement income is to buy an annuity plan that meets your needs. You should prioritise learning about the different types of annuity plans available in India, their pros and cons, and how they can help you achieve your goals after retirement. Also, remember that most annuity plans provide life cover or offer some kind of compensation to your nominees in case you pass away.

Are Annuity Plans an Asset?

Annuity plans are generally considered to be long-term assets, as the payments you receive will amount to more than you initially invested. The main selling point of annuity plans is to provide a form of pension to people who no longer work. This is why annuity plans are so popular with retirees and have become synonymous with retirement plans. But keep in mind that annuity payments are made over a long period of time. While your overall returns will be greater than the investment amount, you will have to be patient.

Types of Annuities Available in India

- Regular Pay Deferred Annuity

Most retirement plans start off as any other life insurance policy, where you pay regular premiums to safeguard your beneficiaries with a sum assured in case of your death. However, retirement plans differ when it comes to the maturity benefit. When a retirement plan reaches policy maturation, you start to get annuity payments at regular intervals, either for the rest of your post-retirement life or for a predetermined period of time. This type of annuity is called deferred annuity, where your premium paying term acts as an accumulation phase that leads to regular payouts in the future. - Single Pay Deferred Annuity

In single pay deferred annuity, you only need to pay a single lumpsum premium at the start of your policy. You will be provided with life cover during the waiting period. Once the waiting period is over, you will receive regular annuity payments from your insurer. - Immediate Annuity

On the other hand, immediate annuity plans require you to pay a lumpsum amount at the beginning of the policy to get regular payments from day one of the policy. Immediate annuity plans are better for those who are planning to retire soon, as you get income immediately, while deferred annuity is better if you still have a few years left for retirement.

Duration of Disbursement

Simply put, the duration of disbursement refers to the number of years during which you will receive regular annuity payments. This duration is determined at the start of your policy, and you can even choose to receive payments for the rest of your life! If you choose the life-time payment option, then your regular annuity payments will be smaller, but the plus side is that you will never face a situation where you lack regular income.

Key Features of Annuity Plans

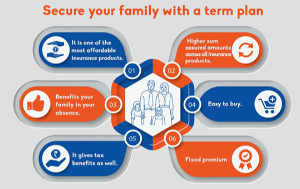

Annuity plans are best known for their retirement benefits, but these plans also offer a variety of other features that can help you and your family during a financial crisis. Below are some key features that may be included in an annuity plan. Note that not all plans offer the same features, and benefits will differ based on terms & conditions as well as the policy options chosen by you.

Guaranteed Income Through Fixed Annuity - The simplest type of annuity, where the amount payable to you is predetermined and unchangeable. The benefit of this type of annuity is that you know exactly how much money you are going to get at regular intervals.

Investment Options Linked with Annuity - Depending on your risk tolerance, you can opt to get a plan with variable annuity option. This type of annuity is linked with mutual fund returns. Depending on the performance of your mutual funds, your annuity can grow exponentially. However, like with all investments, mutual funds are subject to risk, and hence the value of your annuity payments will also be irregular.

Indexed Annuity - In indexed annuity, a part of your returns is guaranteed, so you will always have a certain assured amount paid to your regularly. However, the remainer of your returns will be market linked, and hence their value will completely depend on the performance of your investments. Indexed annuity can be considered the middle ground between fixed and variable annuity options.

Tax Benefits on Annuity Plans - You can claim tax benefits for the premium paid for an annuity plan. According to Section 80C of the Income Tax Act, you can get tax deductions of up to ₹1.5 lakhs for insurance premiums. However, the regular payments you receive from an annuity plan are considered as taxable income and will be taxed according to the latest tax laws of India.

Annuity Payout Options

Annuity plans also come with various payout options that you can choose from based on your personal preferences. Below are the common annuity payout models that are available in Indian annuity plans.

- Monthly- Payouts are received in modest monthly instalments.

- Quarterly- Receive your annuity payouts every four months. This means that you will get three payouts in one year.

- Half-Yearly- Lumpsum annuity payouts given every six months, so you will get two payments each year.

- Yearly- One single lumpsum payout every year. This option is best for those who prefer to get large payouts rather than earn a modest income over the course of a year.

How to Choose the Right Annuity Plan for You?

Annuity Plans are diverse in the features they provide, and a plan that is right for someone else might not be ideal for you. There are some basic questions that you need to ask yourself before buying an annuity plan.

The first thing to ask yourself is, when do you plan to retire? This question will help you decide if you want a plan that offers immediate payment or deferred income. If you plan to retire within just a few months or a year, then an immediate income plan should be your priority. However, if you are still a few years away from retirement, then you can comfortably wait for your annuity plan to mature without having to worry about income.

You also need to ask yourself if you need any other benefits to safeguard your loved ones. Some annuity plans are simple and provide nothing more than life cover and annuity payments. However, other plans have various other benefits, such as critical illness protection or accidental disability/death cover, that can help you secure your family’s financial condition in the case of your untimely passing.

Finally, you need to decide what your retirement lifestyle is going to be like. Do a through cost benefit analysis to determine how much annuity payout you need to live comfortably. Keep in mind that you will no longer have steady/salaried income after retirement, but your expenses will still need to be paid for. A good annuity plans can help you keep your currently lifestyle without having to dip into your savings.

Neha Panchal - Financial Content Writer

Neha used to be an Engineer by Profession and Writer by passion, which is until she started pursuing full-time writing. She's presently working as a Financial Content Writer, with a keen interest in all things related to the Insurance Sector.