What Does ‘Waiver of Premium’ Mean in Life Insurance?

Blog Title

232 |

You might have come across the term ‘Waiver of Premium’ while browsing through life insurance plans online. But you might be unsure of what this means. ‘Waiver of Premium’ is usually a rider (paid addition to your insurance plan) or a plan benefit that ensures that your family is still protected by your life cover without having to pay any more premiums. Want to know more details about waiver of premium? Below is a breakdown of why this benefit can be a lifesaver during emergency situations.

The Benefits of Waiver of Premium

Safeguard Your Family Without Any Financial Burden: Most life insurance policies lapse if you fail to pay your premiums on time. However, when you meet with an accident or fall seriously ill, you might be unable to pay your premiums due to loss of income. Waiver of premium benefit takes these unfortunate circumstances into account.

If you meet any of the conditions listed in your policy’s waiver clause, you will be liable to receive all the policy benefits without needing to pay any premiums. This means that your family will continue to be safeguarded and the financial burden of paying premiums will no longer be an issue.

Receive Maturity Benefits Irrespective of Premiums Paid: When the waiver of premium benefit is triggered, your policy continues to be in-force without needing any more premium payments. If your insurance plan provides any maturity or survival benefits, you can claim the same even if you haven’t finished your premium payments.

Moreover, the value of your maturity/survival benefits will be calculated based on the premium you would have paid rather than the premium you have actually paid. This clause can be a financial lifesaver during situations where you are suffering from loss of income due to disease or disability.

Protection During Loss of Income: The main reason this clause exists is to protect the policyholder even when they no longer have income. Working traditional jobs when you are critically ill or disabled can be extremely difficult or even impossible, and insurers understand this fact. This benefit allows policyholders to prepare for such scenarios. With this clause in-force, your insurance policy will no longer act as a financial burden and will instead be a free-of-charge safety net that your family can rely on while you incapacitated.

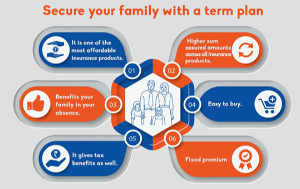

What Plans Offer Waiver of Premium?

Waiver of premium is generally offered as a rider or benefit for term insurance plans or whole life insurance plans. Some long-term savings plans also offer this benefit. Go through an insurance policy’s brochure and look for the ‘waiver of premium’ section. The section will either be included in the general policy benefits or in the list of riders. If waiver of premium is not mentioned at all, then the policy most likely does not offer this benefit as an option.

Keep in mind that riders are optional add-ons that need to be purchased. So, if the waiver of premium clause is offered as a rider, then you will have to pay additional premium to activate it.

How to Avail of the ‘Waiver of Premium’ Benefit?

If your policy includes ‘waiver of premium’ as a benefit or rider, then you can avail of this benefit if you meet any of its terms and conditions. Most waiver of premium plans contain a list of situations where you can activate this benefit. Critical illnesses and accidental disability are generally included as triggers for this clause. You can check the list of conditions covered by this clause in a policy’s terms and conditions, or if you already have an insurance plan, contact your agent for more details on how waiver of premium is triggered.

Documents You Might Need to Claim Waiver of Premium

Some of the documents you will need to claim waiver of premium are listed below:

- ID Proof

- Policy Document

- Filled Claim Form

- Address Proof

- Bank Proof (Passbook or Cancelled Cheque)

- Proof of Medical Condition (Doctor’s Prescription, Medical Certificate etc.)

- Certificate of Disability in Case of Accidental Disability

Additionally, provide any other documents the insurer asks for to ensure that waiver of premium is triggered as soon as possible.

When Can You Not Claim Waiver of Premium?

Those who already have preexisting disabilities that prevent them from working cannot get a policy with waiver of premium. Moreover, waiver of premium is generally not claimable if you are incapacitated due to willingly participating in adventure sports, combat sports, or other hazardous activities.

Conclusion

Waiver of premium can be an indispensable asset in the off chance that you are incapacitated due to illness or accidents. We can never predict what will happen in the future, and it is always wiser to be safe rather than sorry. Waiver of premium can help you ensure your family security during turbulent times. So, if safeguarding your loved ones is your primary concern, adding waiver of premium to your life insurance policy is a no-brainer.

Swati Tumar - Travel & Finance Writer

Swati is a Writer in the day and an illustrator at night. Among her interests, she is quite fond of art and all things creative. She often indulges herself in creating doodles, illustrations, and other forms of content. She identifies herself as an avid traveler and shameless foodie.