Return of Premium: A Term Insurance Plan That Pays You Back

Blog Title

261 |

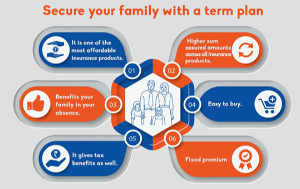

Term insurance is considered as the simplest form of life insurance. All you need to do is pay premium in exchange for life cover which will be paid to your family in case of your untimely death. However, term insurance plans generally do not offer any returns at the end of the policy term. Your family only receives a payout when you are no longer around, and if you survive, then all the premiums you paid over the years are lost.

This is why insurers are now offering term plans that provide a ‘return of premium’ at the end of the term. Return of premium plans give back the premiums you have paid for your term plan as a lumpsum upon policy maturation. If you are interested in a term plan that also includes savings, you should consider buying a term plan with return of premium option.

Do All Term Plans Have a Return of Premium Options?

No, most term plans have no return of premium option. The premiums you pay are completely dedicated to providing life cover for your loved ones. If you want to get back your premiums, you need to look for a term insurance plan that specifically mentions a return of premium option. Return of premium is generally an optional benefit that is added on to your term plan.

When you opt for return of premium, your premiums payments are saved and then paid back as a lumpsum at the end of your policy. This will help you pad your wallet and pay for your future financial goals! Edelweiss Tokio Life- Zindagi Protect is a comprehensive term plan that provides you with the option of adding Return of Premium Benefit to your policy.

What is Are the Benefits of Return of Premium Plans Over Savings Plans?

Savings insurance plans not only provide life cover but also provide a return on your investment that exceeds the premiums you paid over the course of your term. So why choose a return of premium term plan instead of a savings insurance plan?

The main benefit of a term plan is its affordability. Most term plans have affordable premium rates when compared to savings plans or ULIPs. Moreover, term plans also offer a higher sum assured for a lower premium rate, making them ideal for those who are already on a tight budget. This affordability combined with a high sum assured is the main reason why term plans are still so popular. While term plans will not grow your money, with a return of premium plan, you will at least get back all the premiums paid as a lumpsum, providing you with a financial boost post your policy’s maturation.

If your primary concern is providing life cover to your family, but you don’t want to lose money in a term plan, then a return of premium plan is ideal for you. While return of premium plans have higher premium rates than a normal term plan, the premiums are still considerably more affordable than other life insurance plans. Plus, the maturity returns you get will reduce your overall insurance cost to net zero (deducting tax and GST).

Main Features of Return of Premium Plans

- Survival Benefits- Most term plans do not have any survival benefits. With return of premium option, your turn plan will benefit you no matter what.

- Affordable- Term plans are far more affordable than other types of life insurance. This continues to be true even if you add on a return of premium benefit for an additional cost.

- Higher Death Benefit- In some cases, the return of premium option is also added on to your death benefit. This means that if you pass away, your loved ones will not only get the sum assured but will also receive a lumpsum payout that equals the premiums you have paid towards your policy. Keep in mind that this additional benefit is not offered in every return of premium plan.

- Higher Payout with Waiver of Premium- Waiver of premium is a rider offered in many term insurance plans. This rider waives off all future premium payments if you get diagnosed with a critical illness or face any disability due to an accident. Your policy continues to be in force without any premium payments until it reaches term end. Upon reach term end, your return of premium benefit will trigger, and you will not only get back the premiums you have paid but will also receive an additional amount that is equal to the premiums you would have paid if your policy hadn’t been waivered.

Are Return of Premium Plan Taxable?

Return of premium plans are subject to tax deductions under Section 80C just like any other term insurance plan. Under Section 80C, you can claim deductions of up to ₹1.5 lakhs on premiums paid in a financial year. The maturity benefit you get at term end (the return of premium) may also be tax exempt in accordance with Section 10(10D) of the Income Tax Act, provided that your policy meets the required terms and conditions mentioned in Section.

Conclusion

Overall, the benefit of a return of premium plan is that you get back all the premiums you have paid over the years. This benefit turns your term plan into a savings venue that can help you fulfil your future financial goals! If you are interested in growing your money while also getting life cover, then consider getting a savings plan like Edelweiss Tokio Life- Guaranteed Growth Plan or a Unit Linked Insurance Plan (ULIP) like Edelweiss Tokio Life- Wealth Rise+

Aastha Mestry - Portfolio Manager

An Author and a Full-Time Portfolio Manager, Aastha has 6 years of experience working in the Insurance Industry with businesses globally. With a profound interest in traveling, Aastha also loves to blog in her free time.