‘Participating’ vs ‘Non-Participating’ Plan in Life Insurance

Blog Title

292 |

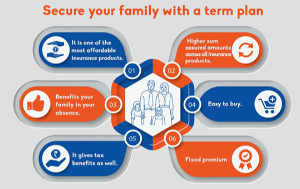

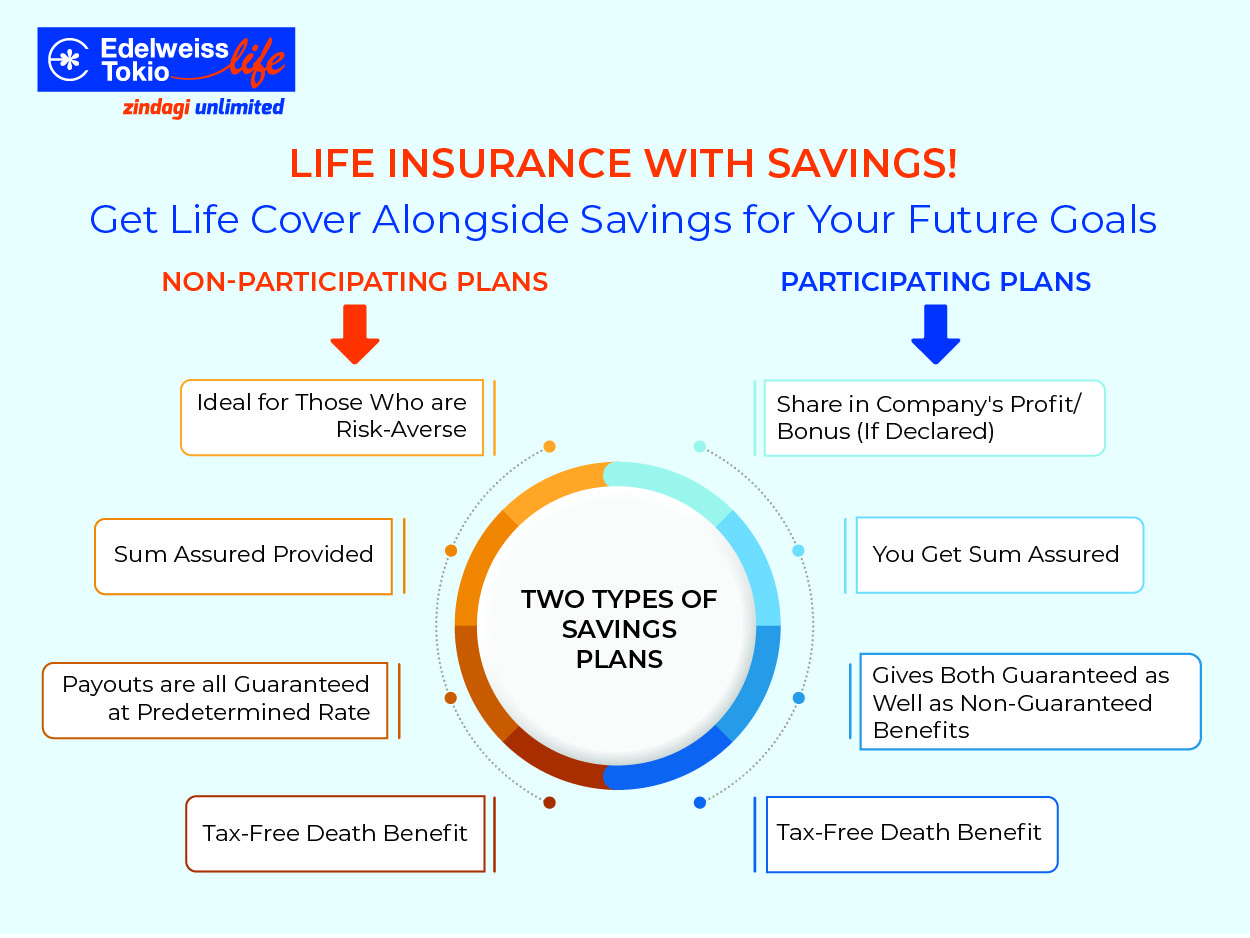

Life insurance plans that also offer a savings element generally come under two categories, ‘Participating’ and ‘Non-Participating’ or ‘Par’ and ‘Non-Par’. You might be interested in buying a savings insurance plan and may have come across these terms while comparing various plans.

To put it simply, a ‘participating’ plan is one where a part of your premium is invested into the insurance company itself. On the other hand, a ‘non-participating' plan lacks this investment element and generally offers completely guaranteed returns.

Read on to learn more about the nuances of a participating insurance plan and how it can help you grow your wealth.

First Understand the Difference between Guaranteed and Non-Guaranteed Returns

Most savings insurance plans are ‘guaranteed returns’ plans, meaning that you know exactly how much money you will get back as a return on your investment. These plans are ideal for those who are risk averse and want an investment with assured growth. A plan that purely offers guaranteed returns will always be a non-participating plan.

If an insurance plan is tagged as ‘participating’, then there will also be a non-guaranteed element to it. ‘Non-guaranteed’ returns basically means that you do not know the exact growth rate for your investments and cannot accurately predict how much money you will get back. Participating plans generally include a certain element of risk, as the non-guaranteed returns will depend on the performance of the insurance company. The better the company performs; the better will be your returns. Generally, non-guaranteed returns of a participating plan are provided in the form of a ‘cash bonus’.

How Exactly do Participating Plans Work?

When you purchase a participating or ‘par’ plan, you invest a part of your premiums into the insurance company. This makes you eligible for profit-sharing benefits. Every financial year, when an insurance company discloses their profits, you will receive a segment of those profits in the form of a cash bonus. This cash bonus can either be received as income, or it can be added onto the sum assured received on death, or it can be paid out at the very end of your policy term as a maturity benefit.

Other Benefits of a Participating Plan

- The cash bonus received from a participating plan can be a great source of secondary income.

- Bonuses received via participating plans can often exceed the guaranteed returns if the insurance company is performing well.

- You can choose to reinvest the cash bonus with the insurer to further enhance your returns.

- Some policies allow you to pay off your year’s premium using the cash bonus itself, meaning that your policy can pay for itself once it starts accruing profits.

Participating vs Non-Participating Plan: Which is Better?

|

Participating Plan |

Non-Participating Plan |

Profit-Sharing |

Has profit-sharing element as returns are directly linked to insurance company’s performance. |

No profit-sharing element. All returns are guaranteed at the start of the policy. |

Risk |

Slight risk due to returns being linked to company’s profits. If the insurer performs poorly, then returns will also be lower. |

Low risk. As returns are guaranteed, you can expect the same returns irrespective of company performance. |

Rate of Returns |

Potential for higher returns if the insurance company’s profits are high. |

Rate of returns are set at the start of the policy and never change; hence, the growth rate is generally modest. |

Ideal For |

Customers who are risk savvy and looking for higher returns. |

Customers who are risk averse and want returns that are completely guaranteed. |

Are ULIPs Classified as Participating Plans?

Unit Linked Insurance Plans (ULIPs) are a unique type of insurance where a part of your premium is invested into market linked funds. This means that your returns are not based on the company’s performance, but rather the performance of the market funds that you’re invested into. Of course, a ULIP can also be a participating plan if the insurer offers profit-sharing benefits as part of the policy terms.

But in general, ULIPs and participating plans are considered to be different insurance products based on the nature of investment. However, both types of insurance are non-guaranteed.

A Chance of Better Returns!

The main advantage of buying a participating plan is the chance of getting a higher return on investment compared to a guaranteed plan. If you are willing to take on a bit of risk and trust the insurer you are investing in, then participating plans are the way to go.

Aastha Mestry - Portfolio Manager

An Author and a Full-Time Portfolio Manager, Aastha has 6 years of experience working in the Insurance Industry with businesses globally. With a profound interest in traveling, Aastha also loves to blog in her free time.