How to Set and Achieve Money Goals in Your Family?

Blog Title

190 |

Setting up financial goals for your family is necessary to achieve your future aspirations. Money goals can be as small as savings to buy a new refrigerator to as large as taking a loan for a new house. Each goal requires intricate planning, and you need to have backup funds saved in case of emergencies. Moreover, setting up money goals will also help your children learn the importance budgeting and savings money. Below are some of the important steps to keep in mind while setting up money goals for you and your family.

Financial Planning

Growth over time can only be achieved with proper financial planning. And the first step to formulating any plan is to decide your end goal. When you have a family that also depends on your income, it becomes essential to plan your finances according to your entire family’s future needs. From paying for your children’s education to buying your dream home, each financial goal requires a plan that lets you achieve said goal seamlessly. Achieving your goals becomes far more stressful and difficult if you don’t have the required funds at the right time. Ensure that your family’s future is secure and stress-free by planning for each stage well ahead of time.

Setting Financial Goals

Planning for a financial goal is a step-by-step process. The easiest way to plan out a financial goal is to follow the SMART goal framework.

- Specific : Make sure that your goal is well defined. For example, if you want to buy a new refrigerator for your family, decide on the model and size of the fridge before you start planning. Having a set goal allows you to plan your budget accordingly, while a vague goal leaves a lot of room for errors.

- Measurable : The monetary costs required to reach your goal should be clearly laid out before you start planning. Your calculations do not need to be completely accurate, but you should have a decent idea of how much money you need to save to achieve your end goals.

- Attainable : Not all goals are achievable in a given time frame. You need to save money according to goals that you can fulfil realistically based on your income and expenses. If a goal requires too much money for a given time frame, then just put on a pin on it and move on to another goal that is more achievable for your current financial budget. Prioritise your money goals according to your short-term and long-term needs.

- Relevant : Your goals should be beneficial to your entire family. This is why it is also important to take your family’s ideas and personal goals into consideration while creating a family goal. Each family member might have their own aspirations for the future, and it is important to take in everyone’s input while setting up a long-term financial goal.

- Time-bound : All your goals should have an end date. Plan your budget in such a way that your savings are adequate to comfortably achieve your goals at the right time.

Choosing Your Investments

One of the best ways to grow your savings is to invest your money into various market linked funds. Investments have the chance to exponentially grow your wealth over a long period of time. Of course, the downside of any investment is the risk associated with the market. Equity investments are ideal for long-term goals, as this type of investment grows over time but is volatile in the short-term. Debt funds, on the other hand, are safer for short-term goals as they are less volatile. However, debt funds are less beneficial in the long-term as the growth is not as impressive. Choose your investments according to your risk tolerance and financial needs.

Have Emergency Funds

Setting aside money to fulfil your future goals is an ideal scenario, but you should also have some funds saved in case of an unexpected crisis. Health issues, accidents, and other sudden expenses can ruin your budget if you haven’t set aside some emergency funds.

Understanding Insurance

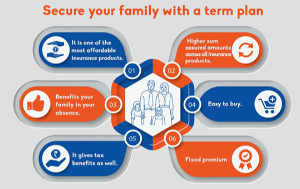

As your family grows larger, you should consider getting a term insurance plan to safeguard the aspirations of your loved ones in your absence. Term insurance plans are known for their affordable premium, and the coverage they provide can help your family live comfortably no matter what happens to you.

If you are not satisfied with a simple term plan, you can opt for ULIPs or Guaranteed Returns Plans. These life insurance plans also offer an element of savings, meaning that the premium you pay will be returned to you, with benefits, once your policy reaches maturity. Savings Plans will keep your family secure in your absence while also providing you with financial benefits if you survive until the end of the term.

Guaranteed Returns Plans are perfect if you are risk averse and want insurance along with an assurance of modest returns at maturity. ULIPs, on the other hand, are more suitable for those who want exponential returns by linking their savings to various market funds.

Budgeting

After you have decided on a shared goal for the entire family, you need to evaluate your current financial status. What is your current total income? Will your income increase or decrease over time? What are the basic monthly expenses that you pay for food, electricity, groceries, schoolbooks etc.? Identify your expenses and your income and try to save money wherever possible to reach your money goal as quickly as possible. Make sure that your budget covers all your money goals as well as your daily expenses, while still leaving enough money for long-term savings.

Monitoring and Adjusting

Financial plans can change due to various factors, which is why it is important to review the status of your money goals regularly. If a plan is not panning out like you hoped it would, then consider shifting funds to a different goal that is more achievable. Flexibility is essential when it comes to planning long-term goals, as no one can predict the future.

Family Involvement

Don’t just plan for the future by yourself, involve everyone in your family in the conversation. Your spouse should definitely know everything about your financial plan, and if you live with your parents, then it would be wise to include them in the conversation as well. You should also consider involving your kids in the discussion, provided that they are old enough to understand the importance of budgeting.

Moreover, if you do manage to fulfil a goal, then don’t forget to celebrate the occasion with your entire family! Celebrating a milestone is great for your family’s morale, and you kids will also learn how gratifying it is to fulfil a well-planned financial goal.

Chirag Iyer - BFSI Enthusiast

Chirag is a writer and an avid reader who loves to drink coffee! His other interests include boxing, karate, and singing.