What is a Death Benefit in Life Insurance?

Blog Title

547 |

Death benefit is the amount of money your family will receive if you (the insured person) pass away. It is perhaps the most important aspect of any life insurance policy. In fact, the very concept of life insurance revolves around financially securing your family with the death benefit in case something unforeseen happens to you. The death benefit is also known as ‘life cover’. If you plan on buying a life insurance policy, then it is essential to know how your death benefit is calculated and how your family can claim said benefit if anything happens to you.

Which Insurance Policies Provide Death Benefit?

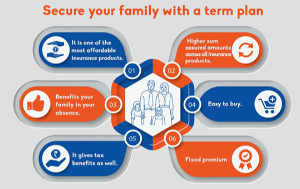

Any plan that is deemed a ‘life insurance’ policy will have death benefit as one of its main offering. Whether it be a term plan, savings insurance plan, or ULIP, if it has the term ‘life insurance’ in its name then it will provide life cover. Of course, the amount of money you receive through the death benefit will differ depending on various factors, including what type of insurance policy you purchase and when.

Is Sum Assured and Death Benefit the Same?

Another term that you will commonly come across while researching life insurance is ‘sum assured’. The sum assured is the minimum amount your nominees receive upon your death. This amount is determined before you finalise your policy purchase.

Sum assured and death benefit are intrinsically linked, but they are technically not the same thing. Some policies have bonuses or funds that are slowed added to the death benefit over time. This means that your death benefit is equal to the sum assured plus other bonuses. If your policy has no returns or bonuses that are incurred over time, then your death benefit will be the same as your sum assured.

How is Death Benefit Calculated?

The amount of money you receive as life cover depends on numerous factors. All insurance companies make their customers undergo a review process before finalising the terms of an insurance policy. This review process helps the insurance company determine the appropriate sum assured for a customer based on their needs, lifestyle, and financial standing. Below are some of the key factors that may affect your death benefit.

- Human Life Value (HLV): This is the approximate income you will make over the course of your working life. Of course, this value is not perfect, as it mainly considers your current income. If your income increases or decreases, then your HLV will change accordingly.

- Your Health Condition: A company selling you life insurance is taking on the risk of your death. Someone who is healthy is less likely to fall victim to a serious illness. This is why people with a clear medical history tend to have better premium and sum assured rates than those who have preexisting health conditions.

- Age: Those who are young tend to be healthier and will hence have a better premium to sum assured ratio. However, young people also tend to earn less than someone who is older and established in their field.

- Lifestyle/habits: Those who smoke may have higher premium rates/lower sum assured than those who do not smoke. This is because smoking causes numerous health issues as you grow older. Similarly, other harmful habits or lifestyle choices may also affect your sum assured/premium rate.

- Liabilities: Your liabilities also play a key role in determining your sum assured.

- Other Policies: If you have other active life insurance policies, then the sum assured for any new policy you purchase may be lowered.

What is the Ideal Death Benefit Value?

Your death benefit value should be more than enough to provide for your family in your absence. This means that your death benefit needs to cover for your family’s lifestyle requirements, education, basic necessities, and debts. At the very least, as per experts, the death benefit should be ten times your annual income.

Is it Possible to Get Death Benefit of Rs 1 Crore?

Yes, your death benefit is an extrapolation of your annual income. So, if you have an annual salary of over Rs 10 lakhs, then you can definitely try to get a policy with a death benefit of Rs 1 crore (10x your annual income). However, if your annual income is lower than Rs 10 lakhs, then it will be difficult to get a sum assured/death benefit of over Rs 1 crore.

How to Claim Death Benefit on a Life Insurance Policy

- The first step to claiming the death benefit is to notify the insurance company of the insured person’s death. This can either be done by contacting your agent, calling the company’s customer service, or by reporting a claim on the company’s website. You can report a claim online on our website.

- Fill up the claim form and share a copy of the insured person’s death certificate.

- Share the original policy document.

- You will also have to share documents that prove that you are the nominee.

- Share any other document the insurer asks for to make the process as seamless as possible!

- Once you have shared all the relevant documents, all you need to do is wait for the death benefit to be credited to your (nominee’s) account.

Always ensure that your death benefit is high enough to cover for your family’s needs! If you are just looking for a high death benefit at an affordable premium, then consider buying a term plan. Edelweiss Tokio Life- Zindagi Protect is a comprehensive term plan that even offers return of premium option.

Neha Panchal - Financial Content Writer

Neha used to be an Engineer by Profession and Writer by passion, which is until she started pursuing full-time writing. She's presently working as a Financial Content Writer, with a keen interest in all things related to the Insurance Sector.