ULIP: Best Unit Linked Insurance Plan Online in India 2024 | Edelweiss Tokio Life

How Does A Unit Linked Insurance Plan Work?

A Unit Linked Insurance Plan (ULIP) is a financial instrument, which combines the benefits of market-linked investment and life insurance. This means that along with providing you life cover, your investment is diversified in the market and returns are incidental to the market performance, helping you generate better returns in the long-term.

Investments in ULIP can be customized as per preferences. You can choose to invest in a bouquet of diverse funds, including equity, debt, and balanced funds, basis your risk appetite. Generally, investors seeking lower risk may opt for debt funds, while equity is preferred by investors willing to take higher risks. If you are someone looking for a combination of equity and debt funds where risk is moderate and returns are higher than debt funds, then balanced funds are the right choice for you! Please find here our list of funds.

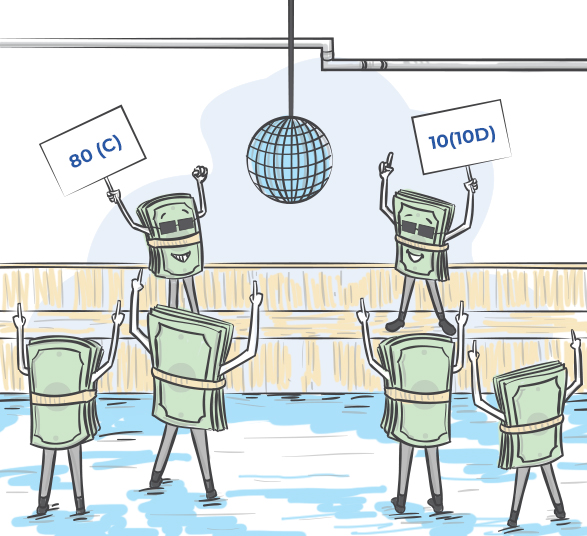

Moreover, premium amount paid toward ULIP is eligible for tax benefits up to ₹1,50,000 under Sections 80C and returns upon maturity are exempt under Section 10(10D) if conditions of Income Tax Act, 1961, are fulfilled#. You need to continue your ULIP for 5 years to continue tax exemptions.

What Are Death And Maturity Benefits In A ULIP ?

Death Benefits

This is the sum assured paid out in case of unfortunate demise of the policyholder during the policy period.

Maturity Benefits

Lumpsum returns are offered on maturity when the policyholder survives the policy term. Maturity benefits are equal to the amount of fund value calculated at the prevailing NAV on the maturity date.

ULIP for Wealth Creation

ULIPs are a great way to accumulate wealth for that big plan you have – marriage, new car, or your own house. ULIPs by Edelweiss Tokio Life gives you opportunity to invest for short-term starting from 5 years. So, if you have any short-term goals like a wedding/ buying a car/ family vacation 5 years down the line, ULIPs are a great choice for investment. By investing an amount of just ₹7,500 per month, considering 8% rate of returns, you will get around ₹5 Lakhs*1 at the time of maturity (after 5 years). Isn’t it a good option? Not just this, if you have a long-term goal like buying a house, ULIP can be your best partner. 10 years from now, you might need approximately ₹45 Lakhs*2 as down payment for your dream house. Big plans ask for big commitments. With 8% rate of return and booster additions, investing ₹27,000 per month in ULIP for next 10 years will help you achieve your dream easily.

ULIP as Child Insurance Plans

As a new parent, the most important piece of advice you get is to start saving for your child’s future! The cost of education is sky high and, with inflation playing a major role, these costs are increasing yearly. A Unit Linked Insurance Plan lets you build a corpus for your child. Edelweiss Tokio Life has ULIPs that have no minimum age limit, that is, you can buy a policy in your child’s name as soon as he/she is born. Your child would pass high school somewhere around the age of 18 years, that is when you need a major sum to pay for his/ her higher education. Suppose your little one is already 3 years of age and considering current education fees of ₹15 Lakhs and an inflation rate of 6%, the expected cost of education after 15 years will be approximately ₹36 Lakhs. If you do not have any other backup, you need to start investing at least ₹10,000/- per month to not give up on your child’s future. Moreover, a ULIP such as Edelweiss Tokio Life – Wealth Plus provides you with a ‘Rising Star Benefit’ to help you look out for your kid even in your absence. This option will give your child an additional lumpsum benefit and waive off any future premiums in your absence. This means the financial future of your child is secured even when you are not there to take care of them.

ULIP for Retirement Planning

A ULIP can be a reliable plan for retirement. At the age of 35, you start planning for your retirement and decide on a retirement age of 55. You have 20 years in hand and considering your current liabilities, you are able to contribute ₹5000/-per month for your plan. Here, considering your plan term as 20 years, at 8% rate of return, you will receive approximately ₹30 Lakhs*3 at the end of the policy period, by which you will be 55. This is a good corpus that you can use for your retirement. You may save it for yearly expenses or use it to buy your dream retirement home.

Since, ULIPs are not guaranteed income products and are linked to market, there is a risk attached.

*1 Assumed at 4% rate of return, return would be ₹ 4,68,340 at the end of your policy term, after 5 years. (Male, Age: 26 Years, Investment Amount: 7,500, Policy Option: Base, Policy Term: 5 Years, Pay for: 5, Payment: Monthly, Fund Management: Self-Managed)

*2 Assumed at 4%, rate of return would be ₹ 37,48,996 (Male, Age: 26 Years, Investment Amount: 27,000, Policy Option: Base, Policy Term: 10 Years, Pay for: 10, Payment: Monthly, Fund Management: Self-Managed)

*3 Assumed at 4% rate of return, return would be ₹16,16,912 (Male, Age: 35 Years, Investment Amount: 5000, Policy Option: Base, Policy Term: 23 Years, Pay for: 20, Payment: Monthly, Fund Management: Self-Managed)

Some benefits are guaranteed, and some benefits are variable with returns based on the future performance of the your Insurer carrying on life Insurance business. If your policy offers guaranteed benefits, then these will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable benefits then the illustrations on this page will show two different rates of assumed future investment returns. These assumed rates of return are not guaranteed, and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance.

Myths About Investing In ULIPs

As ULIPs are complex products, there are numerous myths surrounding them. Some of the myths are:

- Myth: ULIPs are expensive because of numerous inherent charges.

Fact: There was observed a massive reduction in the charges that are associated with ULIPs. These reductions have made plans extremely suitable. The charges capping was done to ensure the plan is quite affordable.

- Myth: They are risky instruments.

Fact: ULIPs provide the ability to invest in equity, debt, or a mix of debt and equity-based on the policyholder’s suitability. You have the ability to opt for low-risk instruments if you’re risk-averse and vice versa. The risk will entirely depend on the policyholder’s risk profile and instrument chosen.

- Myth: Market Volatility lowers life cover.

Fact: The insurance coverage will remain unaffected by market volatility. In the event the policyholder meets their untimely demise during the policy’s term, ULIPs provide complete insurance cover or fund value, whichever is higher.

Why Are ULIPs The Best Investment Option?

ULIPs aim at creating long-term wealth by investing money in the market to maximize returns on the investment. Since the money is invested in market, ULIPs are great investment option as they can benefit from market movements and offer healthy returns. A ULIP is an integrated plan that offers investment opportunities as well as insurance protection. A ULIP plan offers the chance to earn market-linked profits, in contrast to a pure life insurance policy that just offers insurance cover. In such a plan, a portion of the premium is invested in market-linked funds.

We all know the importance of life cover to protect your family’s financial goals in case of your unfortunate demise or accident. This is where a ULIP stands out, as it provides protection along with market-linked returns in the same plan. Other investment options are purely investment based with no insurance coverage.

A little extra for your loyalty is something that you deserve. ULIPs offer loyalty and booster additions for those who stay invested longer in the plan. This feature makes ULIPs better than any other investment product in the market.

It all comes down to your needs and liabilities. If you want a long-term wealth accumulation system, and don’t mind a short lock-in period, then ULIP is the go-to for you. The reason for this is that you and your loved ones will also receive life insurance coverage at no additional cost.

Tax Incentives3 play a major role in deciding where you invest your money. ULIPs provide double benefits as premiums you pay under a ULIP are eligible for tax deductions u/s 80C and maturity benefit under are exempt if conditions of Section 10(10D), up to Rs 1,50,000 are satisfied# under Income Tax Act, 1961.

A Fund for every investor

Filter Funds as per your risk appetite

How To Manage ULIPs Funds?

Now that you know about different types of funds for investing in a market-linked policy, it becomes vital to understand how to manage your investment for better returns. Below are some of the key aspects to keep in mind when it comes to managing your investment:

- Be prepared to make a long-term investment since ULIPs have a five-year lock-in period.

- Many ULIPs allow you to switch money from debt-to-equity funds in a systematic manner. If you pay a yearly premium, you can start with a debt fund and then switch to an equity fund in a methodical manner. You should definitely think about adopting it to reduce your investment risk.

- If you are using ULIP for your retirement planning, you must go for a lifecycle-based strategy as it ensures that your money is automatically split between equity and debt basis your age.

- You must periodically review your ULIP investment portfolio as a good practise.

- ULIP funds that have underperformed or whose asset class has become expensive should be avoided. To get the same result, you'll need to swap from an equity ULIP fund to a debt ULIP fund. There will be no taxes to pay. There may be some fees, but keep in mind that Edelweiss Tokio Life ULIP offer investors unlimited fund switching.

- You can move money between the funds depending on your financial priorities and investment outlook. This facility is called switching and is available free of cost. Minimum amount per switch is Rs.1,000.

- If you have chosen the Life Stage & Duration based Strategy, you have an option to opt-in or opt-out of it at any point of time during the Policy Term. You may choose the Self-Managed Strategy by opting out of the Life Stage & Duration based Strategy at any point of time during the Policy Term.

Steps To Buy ULIP Online

Step 1

Choose your plan & Enter your name, mobile number, gender, date of birth and email ID.

Step 2

Select Your Investment Objective – Growing Money, Retirement Planning, Child Education or Tax Planning

Step 3

Enter details like investment amount, policy term, payment frequency, fund management strategy (self-managed, life stage and duration), etc.

Step 4

You will be prompted with a plan summary, with all the necessary details of the plan selected

Step 5

You can opt from monthly, half-yearly or yearly mode of payment and choose from a list of payment options such as Credit Card, Debit Card, Net Banking, Online Wallets

How Can You Save Tax³ By Investing In A ULIP?

As with all life insurance plans, the amount invested in a ULIP is available for tax benefits³. This follows from the income tax provision that 'any sum paid to keep in force' a life insurance policy can be claimed as a deduction³. Hence, you can even include the extra components like service tax, etc., that have been paid to the insurer.

- Tax Benefits³ under Section 80C :

The amount invested in a ULIP is eligible for tax benefits³ under Section 80C. You can save up to Rs. 64,116^^ taxes each policy year by paying regular premiums. - Tax Benefits³ under Section 10(10D) :

The maturity amount in a Unit Linked Insurance Plan (ULIP) is fully excluded from Income Tax under Section 10(10D). When the premium paid is more than 10% of the sum assured for policy issued after 1st April 2012 or more than 20% for policies issued prior to 1 April 2012, the maturity amount received from ULIP policy is fully taxable.

Why Should You Buy A Unit Linked Insurance Plan (ULIP)?

Saving for Future Goals

When it comes to fulfilling future goals, such as buying a new home, funding a child’s education, retirement planning etc., savings are a must. Without long-term savings plans, it is difficult to balance short-term needs and future goals. ULIPs, help you save systematically and help you plan for these future goals with regular systematic savings as low as ₹1,000 per month

Family’s Protection

A ULIP is a life insurance plus investment plan that offers you with a life cover. In case of an unfortunate death, your dependant family will still be financially secured.

Provides Tax Benefit³

All premiums are eligible for tax benefits³ under section 80C. The maturity amount received is also exempt, subject to conditions under Section 10(10D) of the Income Tax Act, 1961.

Savings & Investments

ULIPs give you the advantage of switching between funds depending upon their performance. This helps you to get a better maturity benefit on your invested amount by monitoring the growth.

Why Should You Buy A Unit Linked Insurance Plan (ULIP)?

Saving for Future Goals

When it comes to fulfilling future goals, such as buying a new home, funding a child’s education, retirement planning etc., savings are a must. Without long-term savings plans, it is difficult to balance short-term needs and future goals. ULIPs, help you save systematically and help you plan for these future goals with regular systematic savings as low as ₹1,000 per month

Family’s Protection

A ULIP is a life insurance plus investment plan that offers you with a life cover. In case of an unfortunate death, your dependant family will still be financially secured.

Provides Tax Benefit³

All premiums are eligible for tax benefits³ under section 80C. The maturity amount received is also exempt, subject to conditions under Section 10(10D) of the Income Tax Act, 1961.

Savings & Investments

ULIPs give you the advantage of switching between funds depending upon their performance. This helps you to get a better maturity benefit on your invested amount by monitoring the growth.

Reasons Why You’re Bound To Love Us Back

Zindagi Unlimited

We’ve got experience in helping people make their Zindagi unlimited

Grow Your Wealth

We've got the expertise to help you grow your wealth

Our Offerings

We constantly innovate our offerings to get better results for you

Fire Away Queries

How Does A ULIP Plan Work?

Unit Linked Insurance Plans are insurance plans which combine the benefits of diversification of equity investments with the benefit of life insurance in one plan. These plans provide market-linked returns along with life insurance coverage. They are very flexible and considerably stable. You can check the fund performance of any fund and you can change the fund(s) you want to invest in, as per your wish and risk appetite.

Was this helpful?

What Is Minimum Lock In Period For ULIP?

The ULIP plan comes with a lock-in period of five years. A lock-in period is the timeframe (i.e., five years) when the policy holder cannot withdraw or liquidate the value of the fund that has been accumulated. After the ULIP lock-in period, partial or full withdrawals can be made depending upon the specific ULIP.

Was this helpful?

How To Choose The Best ULIP Plan?

A ULIP or Unit Linked Insurance Plan serves the purpose of both investment and life insurance under a single plan. And the net premium paid by you is further invested in any of the chosen funds – equity, balanced, debt, etc. Upon ULIP maturity, the fund value of the insurance will be as per the value of the market. In any unforeseen situation such as death, the insurance claim value will be the higher of available fund value or sum assured.

Here is the quick guide to choose best ULIP plan to meet your financial goals:

1. Select best ULIP Fund Options as Per Your Goals

2. Opt. for Required Amount of Life Insurance Cover

3. Know the ULIP Charges

4. Check-out the Tax Benefits³

5. Check-out the Features of ULIPs

6. Stay Invested for a Long Term with ULIPs for the best returns

A best ULIP plan will be a perfect solution to secure your future financial goals.

Was this helpful?

Can I Surrender My ULIP Plan?

At any time during the Policy Term, you can submit a written request to surrender the Policy. If the surrender request is received before the completion of first 5 policy years, the fund value net of discontinuance charge shall be credited to the discontinued policy fund. Thereafter the treatment will be as mentioned under ‘Discontinuance of Premiums’ and ‘Policy Revival’ section. If the surrender request is received after the completion of first 5 policy years, you shall be entitled to the fund value as on date of surrender and the policy will terminate.

Was this helpful?

What Is Fund Switching In ULIP?

Following are the charges one must know about:

- Premium Allocation Charge: Percentage of the premium assumed towards charges before allocating the units under the policy.

- Policy Administration Charge: Administrative expenses incurred by the company towards the maintenance of the policy.

- Fund Management Charge: For managing the fund and is levied as a percentage of the value of assets. This fee is deducted before arriving at the net asset value, or NAV.

- Discontinuance Charge: Deducted for premature encashment of units, either partial or full. This charge is usually calculated as a percentage of the fund or of the annualised premiums.

Was this helpful?

Does ULIP Provide Death Benefit?

Like all life insurance plans, ULIP provides death benefit. The unit-linked insurance plans (ULIPs) provide both death and maturity benefits to the policyholder. As a part of death benefit, in-case of unforeseen situation, the insurance claim value will be the higher of available fund value or sum assured.

Was this helpful?

How Do I Make The Most Out Of The Funds In A ULIP?

Again, that is your choice and depends on your risk-taking capacity. Always check the fund performance, see how the growth rate has been since the past few years and see all the available funds in the savings plan while you make the decision. Moreover, you do not have to worry about your decision because you can change funds unlimited number of times. There is no charge for switching funds.

Was this helpful?

What Are Tax Benefits³ Provided By Unit Linked Insurance Plan (ULIP)?

Unit Linked Insurance Plan (ULIPs) also provide tax saving benefits³ as per the Income Tax Act, 1961. You get dual tax benefits³ with ULIP plan. For example, with Edelweiss Tokio Life ULIP you can avail tax benefit³ on the premium you pay u/s 80C and even the maturity benefits are eligible for tax exemption³ u/s 10(10D). Below are the tax benefits³ that you can avail with a ULIP plan:

• Entry Benefit: You get tax benefit³ on the payment of your premium u/s 80C

• Earning Benefit: The money growth that you get is not taxable

• Switching Benefit: You can make the switches between the funds without paying any additional charges

• Exit Benefit: You also get tax exemption³ on the maturity amount

Was this helpful?

What Is The Difference Between A ULIP And An Endowment Plan?

A ULIP is a market-linked investment cum insurance plan whereas an endowment plan is a life insurance policy which, apart from covering the life of the insured, helps the policyholder save regularly over a specific period of time so that he/she is able to get a lump sum amount on the policy maturity in case he/she survives the policy term. Endowment policies does not provide transparency, as there is no investment portfolio. However, ULIP plan is extremely transparent as you can track your investment portfolio.

Was this helpful?

What Is The Difference Between A Term Plan And A ULIP?

A term plan gives your nominee the life cover amount in case of the policyholder’s demise. But if the policyholder outlives the policy term, he will not receive any benefits. In a ULIP, which is an investment plan, you get a certain amount of maturity benefits based on the funds you have invested in, after the investment period. But if you expire before your policy term, your nominee will get the fund value up to that point.

Was this helpful?

Are ULIPs A Good Investment?

If you're looking for a safe investment that will help you build wealth in the long run, ULIPs are the way to go. This single plan provides you with savings as well as protection. ULIP, or Unit Linked Insurance Plan, is a type of insurance that also serves as an investment. It provides life cover with good returns while also assisting in tax benefits on premiums paid and maturity amount received. Due to these reasons, in today's economy, ULIPs have emerged as one of the greatest investment possibilities.

Was this helpful?

What Is The Right Time To Invest In ULIP?

Anytime is a good time to invest in a ULIP. ULIPs are designed to help you withstand market volatility, so you can invest in them when the markets are down or up. The earlier you begin, the better, since you will be able to take advantage of compounding's power. Compounding is the process of continually reinvesting your earnings in order to expand your wealth. You will be in a better position to realise the benefits if you invest over a longer period of time

Was this helpful?

Can We Increase The Premiums Of ULIP?

You have an option to change (increase or decrease) the PPT subject to:

• The PPTs allowed under the plan

• All other conditions in the plan being met

• Provided all the due premiums till the date of such request have been paid.

In case of decrease of PPT, the revised PPT shall not be less than 10 years. This option can be exercised while the policy is in-force and before the expiry of the existing PPT.

Was this helpful?

Can ULIPs Give Higher Returns?

In a single plan, unit-linked insurance plans combine the benefits of funds diversification with the benefits of life insurance. Both market-linked awards and life insurance are included in a ULIP. They are extremely adaptable and reliable and can help you get better returns with the power of compounding. You can review each fund's performance and alter the fund(s) you want to invest in based on your preferences and risk tolerance.

Was this helpful?

What Is The NAV In ULIP?

NAV stands for Net Asset Value. The net asset value (NAV) of an investment fund is the asset value per unit minus the liability value. This figure aids in the monitoring of your fund's performance. Understanding NAV necessitates a fundamental understanding of how ULIPs operate.

Was this helpful?

We are always there for you !

For queries, write to onlinesupport@edelweisstokio.in

# The money received from insurance company is tax free for all ULIP policies issued prior to 1st February 2021 provided the premium paid did not exceed 10%/15% of the sum assured for any of the premium paying term. However, the ULIP policies issued after 1st February 2021 will not enjoy this exemption if the premium paid for such polices for any of the year exceeded 2.50 lakhs during the year.

~ Claim statistics are for Financial Year 2022-23 and is computed basis individual claims settled over total individual claims for the financial year. For details, refer to Public Disclosures in our Website.

^^ Applicable where the taxable income exceeds Rs. 5 crores. Tax benefit of ₹ 64,116 is calculated at highest tax slab rate of 30% (in addition to income tax, a surcharge of 37% is applicable where the Taxable Income exceeds 5 Crores) on life insurance premium u/s 80C of ₹ 1,50,000. As per provisions of Income Tax Act, 1961. Tax benefits are subject to changes in tax laws.

* Tax benefit of ₹ 46,800 is calculated at highest tax slab rate of 30% (in addition to income tax, cess of 4% is also applicable) on life insurance premium u/s 80C of ₹ 1,50,000. As per provisions of Income Tax Act, 1961. Tax benefits are subject to changes in tax laws.

** Illustration for Life Insured - Age: 25-year-old (male) | Annualized Premium: Rs. 60,000 (excluding taxes) | Policy Term: 20 years | Premium Paying Term: 10 years | Premium Paying Frequency: Monthly | Plan Option : Base| Investing For: Himself | Fund Management: Self Managed | Systematic Withdrawal Plan: No | Distribution Channel: Online | Maturity Benefit Received by Policyholder: Rs. 16,15,525 at 8% and Rs. 9,08,729 at 4%

0 - Provided the premium paying term is more than or equal to 10 years.

3 - As per provisions of Income Tax Act, 1961. Tax benefits are subject to changes in tax laws.

9- Riders are Optional and available at extra cost. Please refer rider brochure for more details.

Edelweiss Tokio Life - Accidental Total and Permanent Disability Rider is only an Individual, Non-Linked, Non-Participating, Pure Risk Premium, Health Insurance rider. UIN 147B001V04

Edelweiss Tokio Life - Accidental Death Benefit Rider is only the name of an Individual, Non-Linked, Non-Participating, Pure Risk Premium, Health Insurance Rider. UIN 147B002V04

Edelweiss Tokio Life - Critical Illness Rider is only the name of the Individual, Non-Linked, Non-Participating, Pure Risk Premium, Health Insurance rider. UIN 147B005V04

Edelweiss Tokio Life – Payor Waiver Benefit Rider is only the name of the Individual, Non-Linked, Non-Participating, Pure Risk Premium, Life Insurance Rider. UIN 147B014V05

Edelweiss Tokio Life - Waiver of Premium Rider is only the name of the Individual, Non-Linked, Non-Participating, Pure Risk Premium, Health Insurance rider. UIN 147B003V05

Edelweiss Tokio Life - Hospital Cash Benefit Rider is only the name of an Individual, Non-Linked, Non-Participating, Pure Risk Premium, Health Insurance Rider. UIN 147B006V03

The Linked Insurance Products do not offer any liquidity during the first five years of the contract. The policyholder will not be able to surrender/withdraw the monies invested in Linked Insurance Products completely or partially till the end of the fifth year.

Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. Please know the associated risks and the applicable charges from your Personal Financial Advisor or the Intermediary or policy document of the Insurer. The premium paid in unit linked life insurance policies are subject to investment risk associated with capital markets and the unit price of the units may go up or down based on the performance of investment fund and factors influencing the capital market and the policyholder is responsible for his/her decisions.

Edelweiss Tokio Life – Wealth Secure+ is the name of the Unit Linked, Non-Participating, Individual, Life Insurance Plan. UIN: 147L062V02

Edelweiss Tokio Life – Wealth Plus is the name of a Unit Linked, Non-Participating, Individual, Life Insurance Plan. UIN: 147L055V04

Edelweiss Tokio Life – Wealth Gain+ is the name of a Unit Linked, Non-Participating, Individual, Life Insurance Plan. UIN: 147L061V03

For more details on risk factors, term and conditions please read sales brochure carefully before concluding a sale.

ARN No : CP/3480/Oct/2023