Ways to Reduce Your Insurance Premium

Blog Title

399 |

After a gap of about 3 years, Rohan rang his close friend Raj. Both of them were very happy after chatting for a long time. They shared their personal lives with their family and children.

Rohan asked Raj, “where are you currently working? Raj replied that he is working in an insurance company as a marketing manager. Rohan got happy after hearing this as he is struggling a lot with the premiums of his life insurance policy as he wants to reduce the Premiums. Being in an insurance company Raj was glad to help his friend.

Raj explained Rohan that Insurance makes life easy by taking the stress out that stems from the unpredictability of life. But when it actually comes to taking a policy, most investors tend to get confused with an overload of information and overwhelmed with the premium amount. If the costs associated with insurance premiums have deterred you from purchasing a much-needed policy you have to follow some simple tips that can bring down such costs considerably. These pointers will get you insight into how premiums work. Once you have that knowledge you can definitely lower your premium amount, nothing should stop you to go ahead and secure your life.

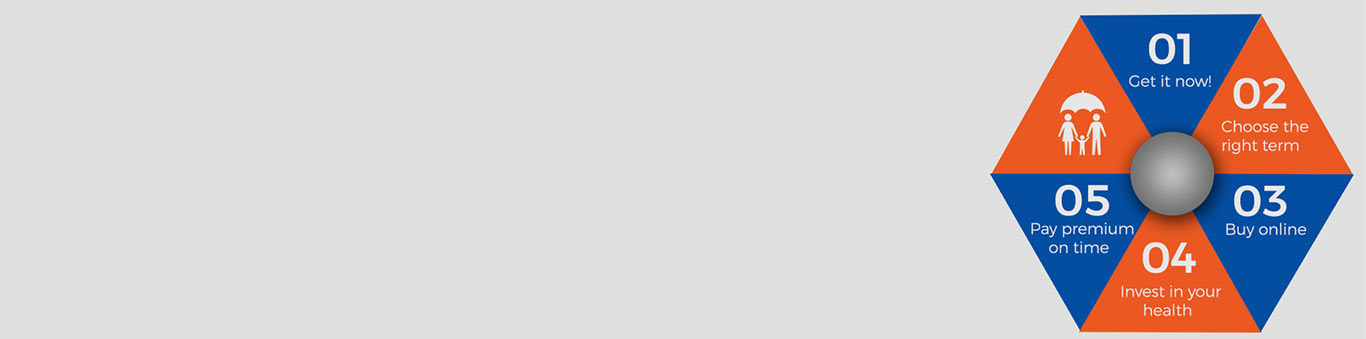

1. Get a life cover now!

It is highly recommended that a person starts investing in an insurance policy as soon as he is earning enough to meet the premium amount. Younger age commands lower premiums because of a longer productive life, good health and the lesser risk associated with a young policyholder.

That is why the best way to lower your term plan premium is to not delay the purchase of a term insurance plan. The older you get, the costlier the premium. An average delay of 5 years in buying a term plan could cost you Rs. 1,47,495 more than what you would pay to get insured today.

2. Determine the Right Duration

The tenure of an insurance plan can also make a difference to the premium amount. Some people apply for the cover for the longest duration possible, even if it is not required. Rather, an insurance policy should cover you till the time you intend to earn. As long as you are protected during your earning years, you can apply cover for a shorter duration. This will ensure that you don’t shell out too much money towards premium unnecessarily especially after you retire and you no longer have a steady source of income.

3. Buy Online

It is a well-established fact that buying online insurance is far cheaper than offline policies. The online term policies, in particular, are about 30-40% Since the cost of sale for an online insurance is an inexpensive affair for the insurance company owing to the elimination of advisor commission and various other administrative costs, the benefit gets transferred to the policyholder in the form of lower premium.

4. Invest in Your Health

And we do not mean hospital bills here, but your insurance premium. A fitter and a healthier person get affordable premiums to pay. Lifestyle diseases such as diabetes, hypertension and blood pressure increase the premium amount quite significantly. Same is the case with habits like smoking and drinking that would demand more premiums since they are high-risk factors.

5. Pay on time

It is important that a policyholder makes timely payment of premium. In case a policyholder does not make his/her payments on time, late payment fees can be added which increases the cost of the policy. A few companies may even request you to undergo a medical test. Just in case, the medical test reveals an adverse health condition, you may end up paying more than the regular premium. Another reason you should pay timely premiums is to avoid a defaulter tag which can ruin your financial standing when taking a policy in the future.

If given some time and thought, a life insurance policy need not burn a hole in your pocket. The right information and research can save you thousands on premiums.

After hearing this Rohan decided to follow the tips so that he can reduce the premiums of his insurance without any delay.

Siddhant Dubey - Writer & Photographer

Siddhant works as a freelance content writer who is interested in a wide range of spheres from photography and personal finance to cooking. He is also an aspiring photographer striving to showcase life around him through his vision.