Save Your Family Against Disasters

Blog Title

300 |

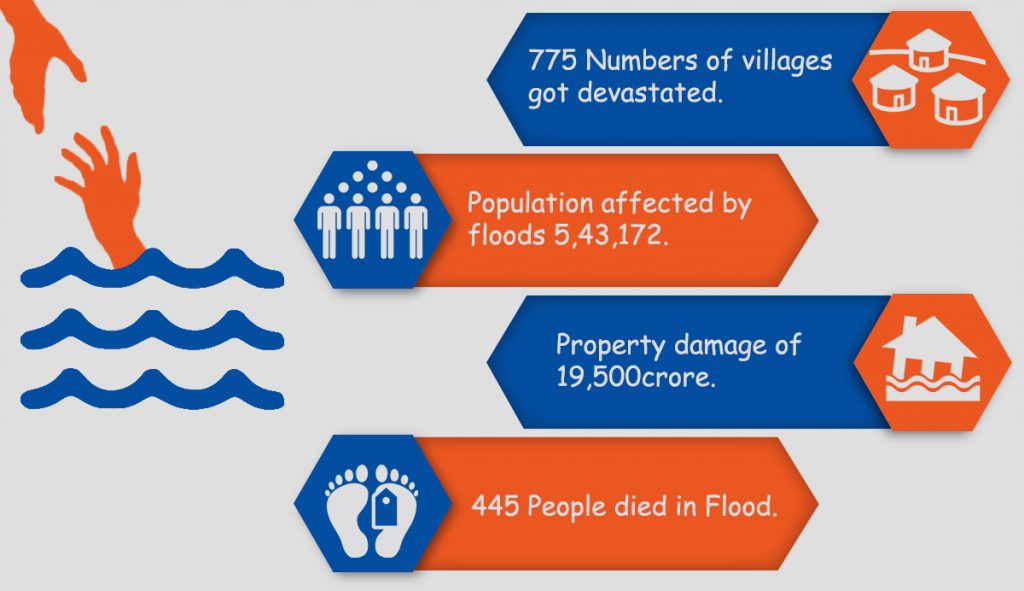

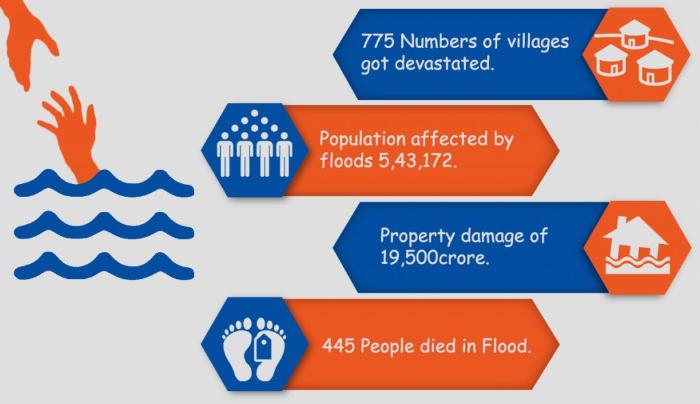

Riya was excited about her sister-in-law’s marriage next month. Her husband had to visit Kerala for some business trip so she and her sister-in-law Tina are making arrangements for the big day. But the news she got shattered Riya’s hopes and dreams. She lost her husband in the life-taking flood which arrived on August 2018.

It was only one year of their happily married life and their son was just 6 months old. Riya never expected such a shocking incident to take place in her life. But life is uncertain and full of surprises and natural disasters are one of them.

What happened in Kerala can happen anywhere and anytime! Lack of preparation and awareness can have a disastrous impact on many lives. Whether it is an earthquake, bushfire, tornado, flood, hurricane or tsunami, preparing yourself can save you time and money.

Riya’s husband had never thought of this calamity and not even of a term insurance plan. His wife and son are left unarmed with few savings and nothing else. If he would have opted for a term plan, they wouldn’t have to face financial challenges and their lifestyle would be taken care of.

There are risks that we can prepare ourselves for and there are risks that are unforeseen. Either way, preparing yourself can help your dependents to get back on their feet and continue their life.

Natural disasters are unavoidable and uncontrollable, but by getting a sufficient life cover you are securing your loved ones from drastic financial instabilities.

Despite an increase in natural calamities, people still ignore buying a term insurance to protect the future of their loved ones. Disasters often create an interest in people’s mind but only for a few weeks.

So, if Mother Nature continues on her current path of destruction, the least you can do is provide sufficient coverage to your family.

Optimistically this story has shown you just how important life insurance is and certainly, it is not at all a choice but a compulsion. A term life insurance policy is a reasonably priced way to give you and your family complete peace of mind, knowing that they will be sheltered if something unfortunate were to happen to you.

You should opt for a term plan which can give benefit to your better half so that she can perform all the duties on your behalf.

Edelweiss Tokio Life – Zindagi Plus is a term insurance policy which provides considerable life coverage at a nominal cost. Knowing the features of this term plan will certainly enable you to buy this product as it can suit all your necessities, budget, and financial objectives. Let us enumerate the most important features of Edelweiss Tokio Life Zindagi Plus which makes it a must buy life insurance policy for you and your family.

The USP of Edelweiss Tokio Life – Zindagi Plus is the ‘Better Half Benefit’. Under this, after the demise of the policyholder, a life cover will start in his/her spouse’s name. This will be 50% of the life cover of the policyholder, up to an amount of Rs. 1cr. The spouse won’t have to pay any premium and the nominee will also get the sum assured.

Secondly, the Top-up Benefit increases your life cover systematically as per your chosen rate. It shields you from future price rise and uncertainties and so you don’t have to buy a new policy all over again.

The Critical Illness Cover rider covers you against 17 Critical Illnesses.

An Accidental Total and Permanent Disability will provide an amount you have selected in case an accident causes permanent disability. This takes care of all your expenses and the policy continues as usual.

Knowing the basic features of a term plan will certainly enable you to buy a product as per your requirement, budget, and financial objectives.

Acts of God never come with a warning, they just strike you!

Awareness remains the key to preparedness.

Siddhant Dubey - Writer & Photographer

Siddhant works as a freelance content writer who is interested in a wide range of spheres from photography and personal finance to cooking. He is also an aspiring photographer striving to showcase life around him through his vision.