1 Cr Term Insurance. Is it enough for you?

Blog Title

795 |

There are various insurance products present in the market, such as term life insurance, guaranteed income plans, ULIPs, etc. Term insurance is the simplest form of life insurance that covers you for a limited period, such as 40 or 50 years. In exchange for regular payments, also known as premiums, the insurer pays out money to your loved ones when you are not around. With term insurance in place, your family has a safety net to replace your income, pay debts, send kids through college, or take care of other important future expenses.

Term life insurance plans are one of the top choices for people who want to take care of financial obligations for their family.

What is a Term Insurance?

A Term Insurance Plan is a type of life insurance policy that may be purchased by an individual for his or her own life. Simply put, it's a contract between you (the policyholder) and the insurance company that assures that if you unfortunately die within the agreed policy time, your family members (beneficiaries) mentioned will receive a sum assured.

Having a term insurance plan helps in safeguarding you and your family needs by putting you on a road to financial security. Term life insurance provides instant protection and gives you access to features such as a child future option, better half option, limited pay option, and much more for the future if your life circumstances change. This benefit received will help your family deal with their financial loss in your absence.

Reasons to Choose a 1 Cr Term Insurance Plan?

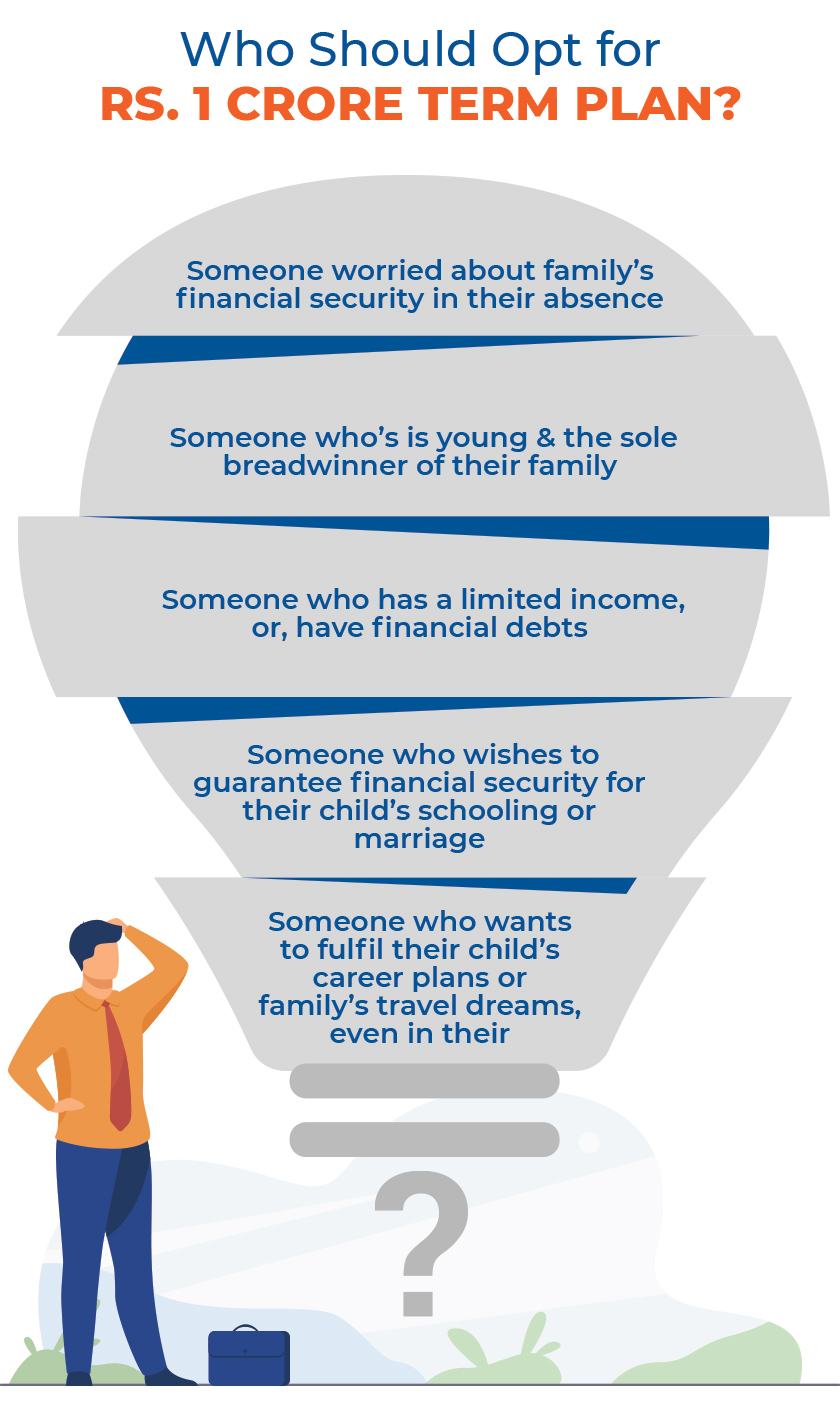

- If you are concerned about the financial security of your family in your absence, then having a term plan is an excellent option for you.

- If you are someone young and the sole breadwinner of your family, a term insurance policy of 1 crore can undoubtedly assist you in providing much-needed financial support to your loved ones, even if you are no longer around to do so.

- If you are someone with financial debts and you don’t want to put a burden on your family in the event of any unprecedented circumstance, a 1 crore life insurance premium can help your family pay off loans.

- If you are someone who wishes to guarantee financial security for your child’s schooling or marriage, or fulfil their career plans or travel dreams, even in your absence.

Now that you have realised your future financial security requires a term insurance plan above 1 Crore, let’s understand it better with an illustration.

In Illustration 1, as you can see that Mr Ashok needs a term life insurance of nearly 1 Crore.

On the other hand, in Illustration 2, Samay has no financial liabilities and has no dependents right now. By the time he reaches 35, he will have more financial liabilities and dependents.

Hence, it would be wise for Samay to choose a 1 Crore term insurance plan at this age since his premiums will be low considering his age and health risk factors involved.

As he gets older and has more responsibilities, he can increase his life cover and expand the term insurance policy to include his wife and children.

Why Should You Opt for a 1 Crore Term Plan?

- Early Bird Savings on Premiums! The more candles you blow on your birthday cake, the greater the amount of premium you pay. That is, when you are young, your premiums are lower. You buy early, you pay the same amount throughout your policy term, and you save big.

- Light on Your Pocket: With term insurance, there is no return on investment or wealth growth that you may expect with the insurance. Hence, the premium for a term plan is significantly cheaper than that of all other life insurance plans.

- Avoid Last Minute Financial Burden: You may be planning to get term insurance, considering your household needs and children’s education. Do not forget about those loans, debts, or any other financial liabilities that come into consideration while choosing your term insurance plan. In your absence, the burden of repayment can fall on your family members. Hence, to repay the loans and liabilities, a 1 Cr term insurance plan will come in handy.

- Beat that inflation!: The retail inflation rate rose to 6.62% in 2021 as compared to 2.9% in 2020. You may think that a 1 Cr term plan is a big amount right now, but after you factor in the rate of inflation, it will look like the right thing to go for!

- Riders: Riders are optional benefits that come at a low cost with your term insurance policy.Riders such as the Critical Illness Rider, Accidental Death Benefit Rider, Accidental Total & Permanent Disability Rider, Hospital Cash Benefit Rider, and Waiver of Premium on Critical Illness Rider are available in plans.

Benefits of Opting for 1 Crore of Term Life Insurance

- In the event of the policyholder's untimely death, the nominee will receive the total pay-out as a lump sum, a lump sum and a monthly pay-out, or only a monthly amount.

- The lumpsum, monthly or combination amount received will help your family live a financially secure life in case of your absence.

- The premiums paid for purchasing 1 Cr term life insurance have tax benefits3 under section 80C. Furthermore, the maturity amount has tax-benefits3 under section 10(10D).

- One of the best things about term insurance plans is that they are super-beginner friendly. Since there is no investment element involved, all you need to do is pay your premiums, and you are insured for the selected duration.

- Another interesting feature of a term insurance plan is choosing an option for return of premiums. Meaning, if you survive your policy period you will get total returns of your premium.

As per provisions of Income Tax Act, 1961. Tax benefits are subject to changes in tax laws.

Siddhant Dubey - Writer & Photographer

Siddhant works as a freelance content writer who is interested in a wide range of spheres from photography and personal finance to cooking. He is also an aspiring photographer striving to showcase life around him through his vision.