How Do I Calculate My Term Insurance Premium

Blog Title

1403 |

Term Insurance or a Term Insurance Plan offers high financial coverage to the policyholder’s family at lower premium rates for a fixed period of time called as ‘policy term’.

Money plays an important role in the purchase of a term insurance policy. Considering this, insurance companies like Edelweiss Tokio Life Insurance developed a Term Plan Premium Calculator to calculate the total premium payable against the chosen sum assured. As a term plan helps you secure the future of your family, adequate cover must be chosen with careful analysis.

What is a Term Insurance Premium Calculator?

A term insurance premium calculator is an easy, free and effective online tool provided by an insurance company to help you estimate the premiums you are required to pay for the desired plan. The term insurance premium relies on certain elements such as the age, gender, health, profession etc, of the policyholder.

To make these calculations effortless, insurance providers developed the term insurance premium calculator. It helps you get quick access to your term plan cost by simply adding the required information. The term plan premium calculator is also customisable to accommodate the convenience of the insurance seeker and is a free tool available online.With several insurance companies providing diversified insurance offerings, the term insurance premium calculator also enables a comparison of different plans to help you find the best term insurance policy.

Benefits of Using a Term Insurance Calculator

Before you make any purchase, right from groceries to a car, the first thing that is checked is the price. Similarly, getting a term plan premium amount estimate helps you analyse your investments for the future. Following are the benefits of using a term insurance calculator to get term plan quotes:

- Assists in Decision Making: If you are someone who likes to know what you're buying in detail, you're in for a treat. The Edelweiss Tokio Life Term Insurance Calculator allows you to evaluate and understand the exact amount required, terms and conditions, and other factors that may affect your premium.

- Saves Time: We have often heard how time is wealth! With towering responsibilities, we all pray to somehow lengthen the day and accommodate all the pending tasks. Considering this, getting term plan quotes by visiting the insurance office seems too much of a hassle.

Contrarily, the online premium calculator gives term plan quotes in a matter of just a few minutes. There are no documents that need to be submitted. Simply input your age and cover needed, and the screen will display the monthly premium payable for your online term insurance. Don’t forget to include the cost of term insurance riders in this estimate. - Enables Comparison: Aside from giving term plan quotes quickly, some term insurance calculators also assist you in the comparison of different policies. This will help you as an insurance seeker to find the best term insurance policy that will suit your financial requirements on a single platform from the comfort of your home.

- Saves Money: Insurance companies are encouraging the online purchase of term insurance to reduce the distribution costs. This, in turn, benefits the consumer as the premium amount gets lowered with online purchases. This means that insurance seekers can avail themselves of the discounts for buying insurance online which is not available in an in-person scenario. Facilitating quick comparisons means that insurance seekers can save money and buy cost-effective term plans to secure their financial future.

- Plan Your Budget Accordingly: While selecting the right term insurance plan, you also get the option to choose additional riders for enhanced protection. With the help of a premium calculator, you can know the exact premium that you will be required to pay for the selected policy duration. This helps you plan your budget accordingly, so you never miss a premium payment and are always covered under the term insurance policy.

Check out Edelweiss Tokio Life Term Insurance Calculator here and calculate your premiums easily!

How to Use the Term Plan Calculator?

To give an uncomplicated analysis of your finances and investments, the calculation of your term plan premium is an easy three-step process:

- Step 1: To use the Insurance Premium Calculator, enter your personal details such as gender, name, date of birth, email address, contact details, annual income, and the life cover amount required. It is essential to be transparent in your answers for a hassle-free claim settlement process. Lying in the underwriting stage can lead to the rejection of your claim.

- Step 2: Add the desired sum assured, which is recommended to be at least 10 to 15 times your annual income. Following this, select the policy tenure. In this step, you will also have to mention how your nominees should receive the death benefit: as a one-time lump sum or as monthly income.

- Step 3: Once the above information is added, submit the form. The screen will then display the suitable term plan options along with the premium amount payable that you can compare based on personal financial needs.

One of the greatest benefits of term insurance is that it provides a high cover for an extremely reasonable premium. Generally, for an average 30-year-old to be secured until the age of 80 through a ₹1 crore term insurance policy, the premium for basic coverage would be within ₹1,200 to ₹1,500 monthly.

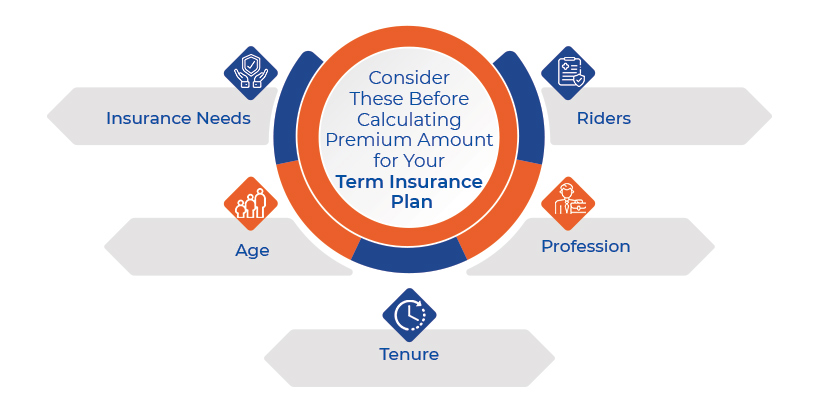

Factors to Consider Before Calculating Premium Amount for Term Insurance

As insurance is an important purchase, one must thoroughly analyse whether all the essential factors have been incorporated. These include:

- Insurance Needs: Observe your lifestyle to determine your insurance needs. Also, factor in future responsibilities such as caring for a child and aged parents. Finally, consider your existing liabilities such as a house or personal loan and the rate of inflation to calculate the coverage needed.

- Age: Term insurance premium is cheaper when you are younger. As you age, the premium amount keeps increasing. Therefore, you pay more for the same plan when you age. Consider buying a term plan early to save more.

- Tenure: The tenure of your policy is inversely proportional to the term insurance premium. This means, the longer the tenure of your policy, the lesser the premium amount.

- Profession: High-risk and unstable professions such as fishing, mining, etc., have to pay more for their term insurance policies as compared to low-risk occupations.

- Riders: Riders in insurance are optional advantages that you can add to your existing life insurance policy for a low cost. However, adding these riders comes with a cost and will increase your premium amount.

The Edelweiss Tokio Life Insurance term plan acts as your companion to cover you against uncertain possibilities of life. In keeping with the changing consumer needs, it is designed to provide unique offerings that can be customised based on diverse insurance requirements. Our term plan includes features such as additional better half benefit, discounts on high sum assured, and no medical coverage option.

Considering the fast-paced life and evolved consumer preferences, insurance providers have flexible premium payment options. A term plan is one of the most cost-effective investments for your financial future.

Swati Tumar - Travel & Finance Writer

Swati is a Writer in the day and an illustrator at night. Among her interests, she is quite fond of art and all things creative. She often indulges herself in creating doodles, illustrations, and other forms of content. She identifies herself as an avid traveller and shameless foodie.