Can I pay rent to my parents to save tax?

Blog Title

26570 |

How to Calculate House Rent Allowance (HRA) in India?

Every salaried person is provided with house rent allowance (HRA) as a part of remunerations specified in the company contract. If a person lives in a house which is not owned by him/her and he/she pays rent to the owners, the government allows a tax deduction on such rent under section 10(13A) of the Income Tax Act, 1961. Those who live in rented homes and pay monthly rent can save tax under HRA.

HRA is used as an effective tax saving tool by many people even when they don’t live in a rented house. For the same purpose of tax saving, often people wonder if they can save tax by paying rent to their parents. You can successfully get a tax deduction under HRA by paying rent to your parents, but for the rent to be eligible for the deduction, it must fulfil certain criteria.

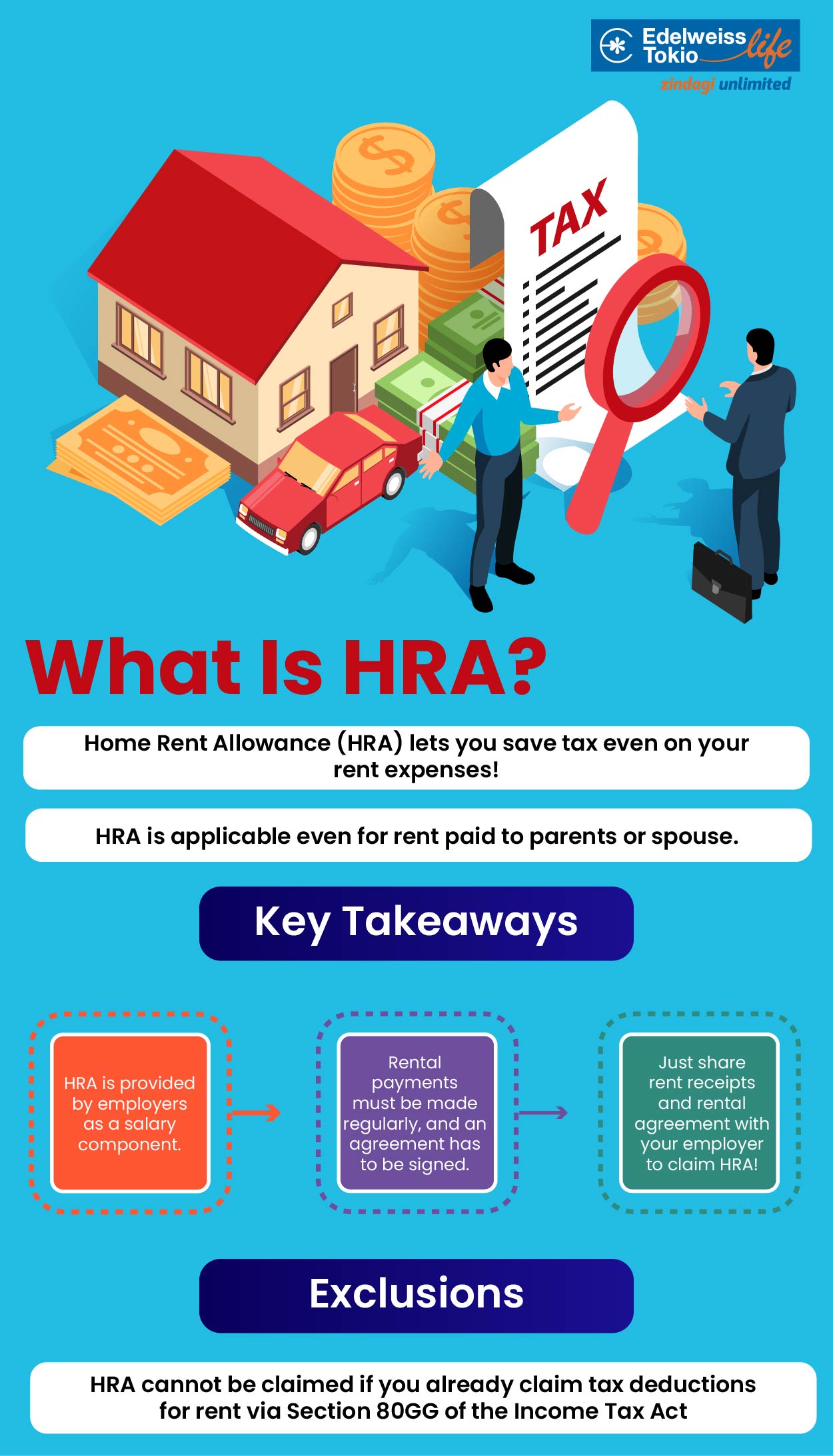

What is HRA?

HRA stands for House Rent Allowance. The salaries of employees in both the public and private sectors are structured with various components allocated for different expenses. House Rent Allowance (HRA) is one of these components. The HRA can either be a predetermined amount or determined through a special agreement between you and your employer.

This allowance constitutes a segment of your earnings granted by your employer to cover the costs associated with leased housing. The option to avail an exemption on HRA is applicable exclusively if you are currently residing in a rented residence. The exemption for HRA falls within the provisions of Section 10(13A), accompanied by rule 2A of the Income Tax Act, 1961.

How is HRA Calculated?

The complete HRA received might not always be completely exempt from taxation. The exemption will be determined based on the least of the following three criteria:

- HRA received from your employer.

- Actual rent paid minus 10% of your salary.

- 50% of your basic salary for individuals living in metro cities, or 40% of your basic salary for individuals living in non-metro cities.

The remaining portion of your HRA will be included in your taxable salary.

For instance, let's consider this scenario:

Rekha resides in Mumbai.

She obtains an HRA of Rs.1 lakh from her employer. Her monthly basic salary is Rs.50,000. Furthermore, she has secured accommodation for which he pays a monthly rent of Rs.15,000.

What amount of HRA exemption can she claim?

No |

Criteria |

Calculation |

Amount |

1 |

Actual HRA received from employee |

- |

10,000 |

2 |

Actual Rent Paid – 10% of the salary |

(15,000 * 12) - 10% (50,000 * 12) |

120,000 |

3 |

50% of basic salary |

50% (50,000 * 12) |

300,000 |

Least of the Above |

|

100,000 |

|

Hence, Rekha is eligible for an HRA exemption of Rs 1 lakh.

Is HRA Claim Taxable for Parents?

Keep in mind that your parents will be required to pay taxes on the amount you pay them as rent. This income will come under ‘Income from House Property’ and will be included in the taxable income of your parents. But the good thing about this process is that your parents can claim these property taxes that they will pay along with the 30% standard deduction from this rental income.

What are the benefits of claiming HRA?

By paying rent to your parents, you can save a huge amount of taxes as a whole family. Let’s assume that you pay rent of Rs 1,20,000 to your parents annually and the property tax for the house is Rs. 20,000, then the net income becomes Rs. 1,00,000. With 30% standard deduction, the final taxable income will be around Rs. 70,000.

Moreover, if your parents’ total taxable income is less than yours, they will come in a lower tax bracket, and as a result, the overall tax you will pay as a family will be lower. If you pay tax, you only get exemption up to Rs 2.5 lakhs, but if your parents are of 60 years or more, they will get an exemption up to Rs 3 lakhs, or Rs 5 lakhs in case they are of 80 years or more.

You may want to see which tax regime you want to opt for. Under the old tax regime, taxpayers were allowed to claim various deductions such as House Rent Allowance (HRA) to reduce their taxable income. However, with the introduction of the new tax regime, HRA deductions are no longer considered, and taxpayers can only claim standard deductions. This means that taxpayers who opt for the old tax regime will have a higher tax liability compared to those who opt for the new tax regime.

Also, keep in mind that if you are married and house property is owned by your wife or husband, then also you can pay rent to her/him and claim HRA for tax exemption purpose.

By paying rent to your parents or spouse, you can successfully save tax by claiming HRA. If you are a salaried person and your parents are the sole owner of your house, you can use this method and can save tax by claiming a deduction under section 10(13A) of Income Tax Act, 1961.

Documents Required to Claim HRA

To claim HRA while living with parents, the following documents are required:

- Rent Receipts - Employers often request rent receipts as proof for HRA exemption.

- Rental Agreement - –Rental agreement is required if the rent paid is more than Rs.1,00,000/- annually. You can create a simple rental agreement with your parents and submit.

- Rent Receipt Generator - Utilize a rent receipt generator, to prepare receipts and submit them to HR/payroll department. You can print or save digital copies for your records. Make sure the receipt is duly signed by the owner of the house (in this case, your parent) or the person to which the payments are made.

It is crucial to keep accurate records as the assessing officer may ask for them.

What are some other Ways to Save Tax Apart from HRA?

In addition to HRA, various life insurance plans can also provide tax benefits for individuals in India. Here's how different life insurance plans offer tax advantages in accordance with various tax sections in the Income Tax Act:

Section 80D- The premiums paid towards ULIPs, term insurances, guaranteed income plans, endowment plans, and pension plans are all eligible for tax deductions under Section 80C. Pension plans are subject to an overall limit of ₹1.5 lakh, beyond which you will need to pay tax according to your bracket.

Section 80D- Section 80D provides tax deductions for Mediclaim insurance, critical illness insurance, and health checkups. Maximum deduction for health insurance policies is Rs 25,000, but for senior citizens the deduction is increased to Rs 65,000. Maximum tax deduction for health checkups is Rs 5,000 only.

Section 10D- Section 10D provides tax exemptions for various alternate sources of income for salaried individuals. Section 10(10D) specifically covers income earned through insurance plans. The maturity benefits received from ULIPs and endowment plans are tax exempt under Section 10(10D), provided that the plan meets the terms and conditions. Moreover, death benefits are always tax exempt under Section 10(10D).

Various Life Insurance Plans That Can Help You Sav e Tax

1. Unit Linked Insurance Plans (ULIPs): ULIPs combine life insurance with investment. The premiums paid towards ULIPs are eligible for tax deductions under Section 80C. Moreover, the maturity amount received from ULIPs is also tax-free under Section 10(10D) of the Income Tax Act. ULIPs provide a dual advantage of life cover and the potential for wealth creation.

2. Term Insurance: Premiums paid for term life insurance policies are eligible for tax benefits under Section 80C. Term insurance provides pure life cover, and if the insured passes away during the policy term, the death benefit received by the nominee is also tax-free under Section 10(10D).

3. Guaranteed Income Plans: These plans offer a combination of life insurance and guaranteed regular income. The premiums paid towards such plans are eligible for tax deductions under Section 80C. The income received from these plans is subject to tax rules, and tax implications depend on the specific terms of the policy.

4. Endowment Plans: Endowment plans are life insurance policies that provide both insurance coverage and savings. The premiums paid for endowment plans are eligible for tax benefits under Section 80C. The maturity amount received at the end of the policy term is also tax-free under Section 10(10D).

5. Annuity Plans: Annuity plans offer regular payouts to the policyholder after a certain period. A portion of the annuity received is considered a return of the principal amount and is not taxed. However, the interest component is subject to tax as per the individual's tax slab.

6. Pension Plans (Deferred and Immediate): Pension plans provide a steady income during retirement. Contributions made towards pension plans can be eligible for tax benefits under Section 80CCC, subject to an overall limit of ₹1.5 lakh along with Section 80C. The pension income received from such plans is taxed as per the individual's tax slab.

It's important to note that the tax benefits associated with life insurance plans can vary based on the specific terms of the policy and prevailing tax regulations. Before making any investment decisions, it's advisable to consult a tax advisor or our Agents to understand the most suitable options for your financial goals and tax planning needs.

FAQs

Who is eligible to claim HRA?

To claim HRA, you need to be a salaried person who receives HRA compensation as part of your salary component. Moreover, you actually need to pay rent and provide proof of rent payment to your employer.

How much HRA tax benefit can I claim?

Your HRA tax benefits will be the lowest of the three provisions listed below:

- The HRA amount paid by your employers

- The rent you pay for your house minus 10% of your basic pay

- 50% of your salary if you live in a metro city (Mumbai, Delhi etc.) or 40% of your salary if you live in a non-metro.

What happens if HRA is not claimed in a particular financial year?

Even if you cannot claim HRA, you can still receive tax deductions on your rent via provisions in Section 80GG in the Income Tax Act. Keep in mind that Section 80GG can only be claimed if you have not already claimed HRA.

How do I claim HRA on my tax return (ITR)?

First, you will need to calculate the amount of HRA deductions you can claim. Then just subtract the deductions from your salary while filing income with ITR. You will also need to share your rent agreement documents, Form-16, and ITR-1 to claim HRA benefits under income tax returns.

Can I claim both HRA and deduction under Section 80GG?

No, if you claim HRA then you cannot claim deductions under Section 80GG.

Siddhant Dubey - Writer & Photographer

Siddhant works as a freelance content writer who is interested in a wide range of spheres from photography and personal finance to cooking. He is also an aspiring photographer striving to showcase life around him through his vision.