Life Insurance 101 A Comprehensive Guide

Blog Title

1677 |

Life Insurance is a contract between you (policyholder) and an insurance company where, the insurer pays benefits to your family in the event of your untimely demise. This benefit is also known as sum assured that is paid in exchange for a premium amount paid monthly or annually to the insurer.

This life cover secures the financial future of your loved ones by providing a lump sum payment in the event of a tragic occurrence, such as an unfortunate death, critical illness, or accident.

It ensures that your family remains well protected, away from financial burdens, and meets its basic requirements such as your child’s education, day-to-day expenses etc. Several life insurance plans also double up as savings plan, helping you plan and save for the big expenses in life like buying your dream house, an international vacation, child’s education etc.

Start this section with definition of Life Insurance. Please shorten this definition and squeeze it to two lines. Can be elaborated later in the text.

Types of Life Insurance Plans

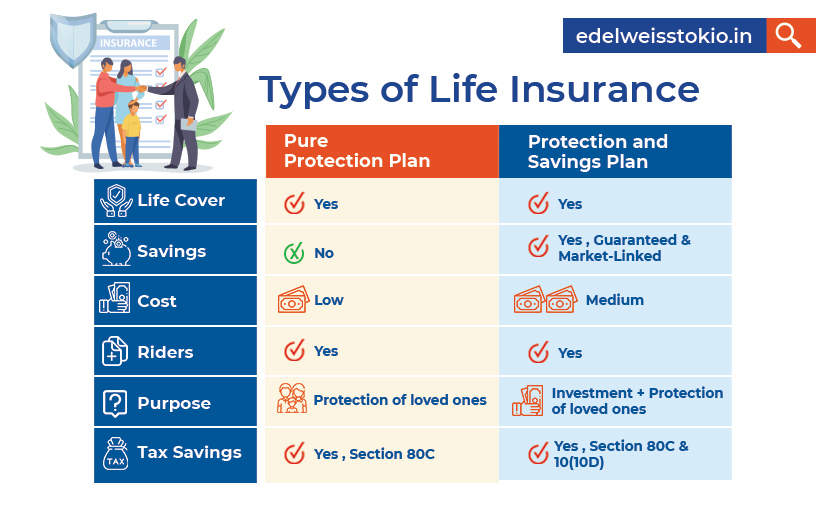

Life Insurance can be classified into two broad types:

- Pure Protection Plans :These are the purest and most affordable form of a life insurance plan as it offers a high sum assured for a low cost. It provides complete financial protection to your loved ones against any uncertainty of life.

If you are breadwinner of your family or have dependents, then these plans are a must for you. These types of plans are the most affordable form of life insurance plans. It provides complete financial protection to your loved ones against any uncertainty of life. - Protection and Savings Plans : As the name suggests, these plans offer a combined benefit of life insurance cover as well as the benefits of return over investment. These plans help you a peace of mind by offering your family or loved ones the protection via life cover along with a capability for fulfilling your short-term and long-term goals.

It helps you achieve your goals, such as buying your dream house, planning a peaceful retirement, or, your child’s marriage, etc. It aims to give wings to your dreams and provide stability for your finances while also not worrying about uncertainties. Different forms of Savings plans are ULIPs, Guaranteed Income Plans etc.Click here to learn more about the different types of investment plans.

Factors that Affect Life Insurance Premium

Let us look at some of your greatest financial aspirations: purchasing a home, sending your children for higher education, or setting aside money for retirement. We all want to fulfil these goals and more in our lives! We all want to safeguard those we care about, and we want to do so at a reasonable cost. And life insurance can offer protection against the unforeseen as you and your family save for these milestones. Below are some of the most important factors that may affect your life insurance premiums or payments:

- Age: This is the most important factor that affects your premium. As you age, the risk of developing medical conditions also goes up, thereby increasing the premium. Therefore, it is advisable to take life insurance plans at a younger age.

- Gender: Women have a longer life expectancy than men. So, women enjoy a lower premium rate than men. Hence, your gender is also a major factor in deciding the premium of your life insurance policy.

- Medical History: Your medical history, the chances of meeting a medical condition, pushes up the cost of protecting you, which, in turn, increases your life insurance premium.

- Sum Assured: The higher the sum assured in your life insurance policy, the higher the premium you pay for it and vice-versa.

- Tenure of the Policy: The longer the policy period, the higher the total premium outflow will be. However, many policies provide discounts on the yearly premiums if you buy a policy for a very long tenure.

- Mode of Premium Payment: The total premium paid for single pay and limited pay policies is lower than regular pay options.

- Premium Payment Frequency: If you choose annual payment options or even half-yearly options, you can save on the total premium paid for the life insurance policy of your choice.

- Choice of Riders: You can further enhance your life insurance plan with a range of riders, such as Critical Illness Rider, Income Benefit Rider, Waiver of Premium Rider, Payor Waiver Benefit, Accidental Death Benefit and Accidental Disability Riders, etc.

- Plan Type: If you are looking for a pure term insurance plan, your premiums will be lower as compared to the premiums for a savings or investment plan.

Rising Trend of Buying Life Insurance Online in India

Did You Know? India is the fifth largest life insurance market in the world's emerging insurance markets, growing at a rate of 32-34% each year. The life insurance industry is expected to increase at a CAGR of 5.3% between 2019 and 2023.

Adding to that, with the rising number of internet users in India, more and more people go online to purchase Life Insurance. Insurance services are reaching even the remotest parts of India. Today’s customers like to research products like life insurance online to make purchase decisions. This is leading to a rise in people who buy life insurance online.

You can effortlessly compare life insurance products online on the insurance provider's website or app to choose the one best suited to your needs. By reading all the terms and conditions yourself, you can make an informed decision regarding buying an insurance plan. You can easily check the claim settlement ratio on the insurance company’s website. The results you see are based on customer reviews and are, therefore, authentic. Finally, when you, as a customer, provide the necessary details yourself, it minimizes the chances of errors.

Once you apply for the life insurance plan online, you can upload all the documents digitally. These documents are also verified online. Thus, the application process becomes quick and hassle-free.

Life Insurance as a Crucial Part of Financial Planning

Life insurance plans are designed to provide several advantages to the policyholder. Some plans may provide a life cover for a set period, at most affordable rates (like Term Insurance Plans). In contrast, others can help you build a corpus (Endowment Plans) and even create wealth through investments in market-linked financial instruments (Unit Linked Insurance Plans). Let’s look at some of the benefits of Life Insurance Plan for a secured future.

- Death Benefits - This refers to the payout of a sum assured to your nominees in the event of your unfortunate demise. While nothing can replace the life lost, financial assistance in such a time can significantly alleviate your family’s burden.

- Maturity Benefits - These refer to the payout you receive if you survive the policy term. These benefits differ based on the type of life insurance plan you have.

- Loan Option - If you have life insurance, you can get a loan against your policy if you are in severe need of money. The loan amount might be taken as a portion of the policy's cash value (or sum assured), depending on the policy’ terms and conditions.

- Tax Benefits – You can avail tax benefits on premium paid and death benefit received under the policy as per Section 80C and Section 10(10D) of the Income Tax 1961, respectively.

- Planning for Life Goals – Depending on the type of life insurance plan you choose, a life insurance can let you fulfil your financial goals for each stage of your life. A savings and investment life insurance plan not only provides financial assistance in the event of an unexpected death, but it also serves as a long-term investment. Depending on your life stage and risk tolerance, you can achieve your goals, whether they are for your children's education, marriage, building your ideal home, or preparing for a quiet retired life.

- Riders – These are optional benefits that enable you to supplement your insurance coverage. Riders cover risks that are not included by the primary life insurance policy, resulting in complete protection against uncertainties.

Life Insurance is a must-have for everyone! Any sudden tragedy or calamity in life makes us aware that death could come at any time without any prior notice or signals. What if it occurred to you? The adage "Failing to plan is planning to fail" is a great fit for this situation.

Term Insurance Plans as a word has not been introduced in the article so far. This sentence is looking out of context.

Good thought of linking other articles, but please use references that go with the flow of article.

Here, you could have added, Click here to know more about investment Plans.

Siddhant Dubey - Writer & Photographer

Siddhant works as a freelance content writer who is interested in a wide range of spheres from photography and personal finance to cooking. He is also an aspiring photographer striving to showcase life around him through his vision.