What is an E-Insurance Policy, Electronic Insurance Account? A Complete Guide

Blog Title

2080 |

In today’s time, there is an insurance for everything – health, life, car, house, etc. E-insurance allows you to manage all your insurance policies, including health insurance, in one convenient location. This makes it easier to keep track of your policies and their renewal dates, which is important because having insurance is the best way to prepare yourself financially for unforeseen events. With e-insurance, you can easily manage all your insurance needs in one place.

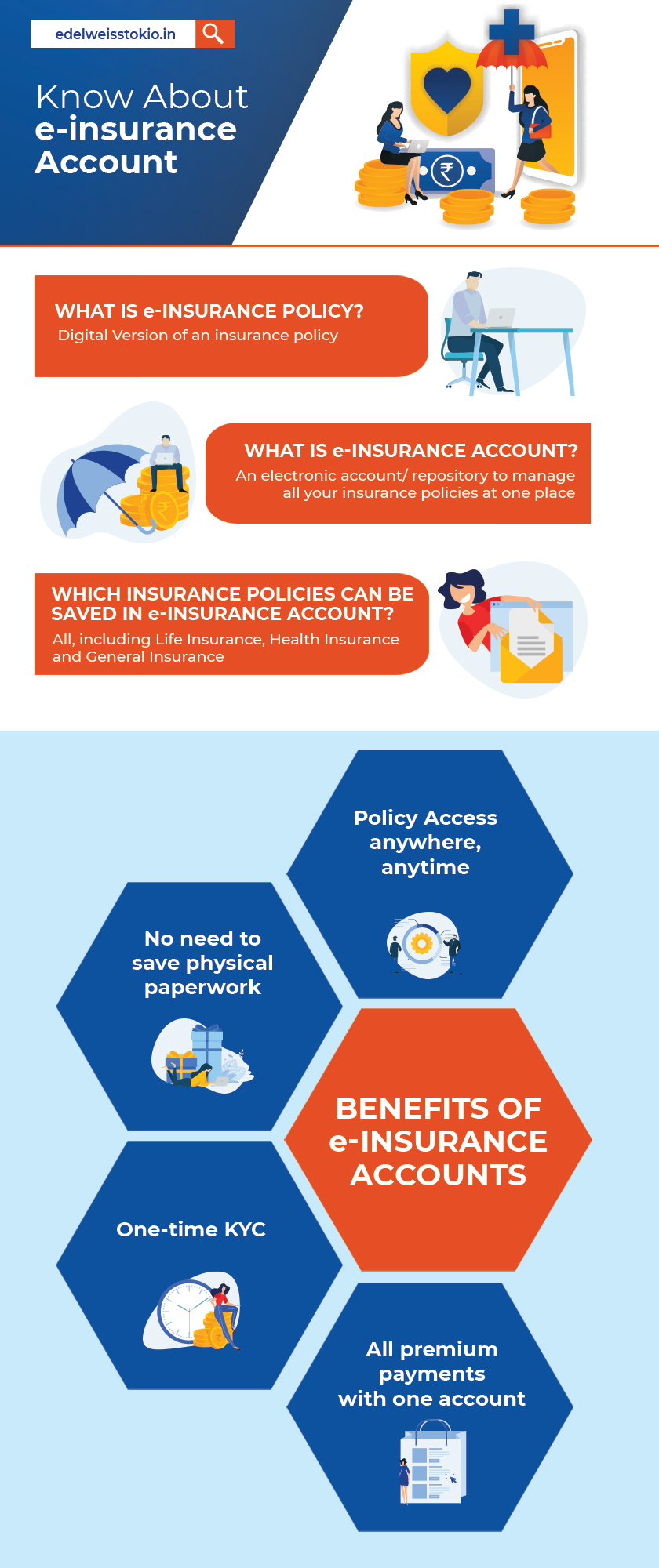

What is an e-Insurance Policy?

An E-Insurance Policy is a digital version of an insurance policy that is stored in an e-insurance account. This account is a convenient way to manage all your insurance policies, including life insurance and health insurance, in one place.

By storing your policies electronically, you can save yourself from the hassle of dealing with physical paperwork and protect your policies against loss or theft. E-insurance policies are easy to access and manage, making it simple to keep track of all your insurance needs.

What is an e-Insurance Account?

The Insurance Regulatory and Development Authority (IRDA) introduced the insurance repository system to improve services for insurance policyholders. This system allows individuals to store all their insurance information electronically. Policyholders can open e-insurance accounts with these repositories and access their information easily.

An e-Insurance Account (eIA) is a secure and convenient way to manage your insurance policies. It offers several benefits, including easy access to information and the ability to compare different policies. Some of the best insurance repositories in India include CAMS Insurance Repository Services Limited, NSDL Database Management Limited and Karvy Insurance Repository Limited. These companies offer a range of services and features to help policyholders manage their insurance needs.

More About CAMS Insurance Repository Services Limited

CAMS Insurance Repository Services Limited (CAMS IRSL) is a company that provides insurance repository services in India. It was established in 2013 and is a subsidiary of Computer Age Management Services (CAMS), a leading provider of mutual fund transfer agency and registrar services in India.

As an insurance repository, CAMS IRSL offers a platform for policyholders to electronically store their insurance policies. It allows policyholders to view, download, and print their insurance policies online, as well as update their policy details and make premium payments. CAMS repository also provides a range of services to insurance companies, including policy issuance, policy servicing, and claims management.

Overall, the goal of CAMS insurance is to make the process of purchasing and managing insurance policies more convenient and efficient for both policyholders and insurance companies. Below are some of the benefits of owning an account with insurance repository companies like CAMS Insurance.

What Are the Benefits of Holding an E-Insurance Account (eIA)?

An e-Insurance Account (eIA) offers several benefits to policyholders. Some of the top benefits include:

- Convenience: Policyholders with an eIA can access their accounts from anywhere in the world and make changes to their insurance documents easily.

- Protection: With digital record-keeping, you don't have to worry about misplacing any important documents. Insurance repositories offer secure storage for your policies, so you can access them whenever you need to.

- Paperless Process: By opening an eIA, you can avoid dealing with physical paperwork and store your insurance policies electronically.

- One-time KYC: With an e-insurance account, you only have to submit your KYC documents once. This means that you don't have to go through the process of providing your personal information and proof of identity every time you purchase a new insurance policy. Instead, you can simply provide your e-insurance account number, and your KYC information will be automatically accessed by the insurance company. This saves time and makes it easier to manage your insurance policies.

- User-friendly: An eIA makes it easy to access your insurance information and avoid long lines when making changes to your policies. Opening an eIA with the best insurance repository in India is simple and quick.

Where will I find the e-Insurance Account opening form?

The eIA opening form and list of required KYC documents can be found at the following URL: https://www.edelweisstokio.in/content/dam/edelweisstokio/pdf/footer/CAMS.pdf

This form and information can help you open an e-Insurance Account (eIA) and manage your insurance policies in a convenient and secure way. By accessing the form at this URL, you can get started with opening your eIA and taking advantage of the benefits it offers.

What is the Process of Opening the Account with the Insurance Repository?

To open an e-Insurance Account (eIA), individuals should follow these steps:

- Fill out the eIA opening form CAMS Insurance Repository Services Limited here. You can also download the forms for any of the following Insurance Repositories - NSDL Insurance Repository, Karvy Insurance Repository, CIRL Insurance Repository.

- Submit the form to any branch along with the required KYC documents such as –

- PAN or UID card

- Address proof

- Date of Birth proof

- Cancelled cheque

- Bring the original documents with you when you submit your application for KYC verification and receive an acknowledgement.

- After you submit your eIA opening form and required documents, they will be reviewed and verified by an Approved Person or the insurance company.

- Once the verification is successful, the insurance repository will open your eIA and provide you with a login ID and password.

- You can then access your account by entering these credentials. This will allow you to manage your insurance policies and take advantage of the convenience and security offered by an eIA.

Frequently Asked Questions

Below are some of the Frequently Asked Questions that you may find helpful.

Q1: Can I store different insurance policies from different insurers in one insurance repositories?

Yes, insurance repositories allow you to store policies from different insurers in one account. This means that you can manage all of your insurance policies, regardless of which company they are from, in one convenient location. By using an insurance repository, you can easily keep track of all of your policies and access them whenever you need to. This makes it easy to compare different policies and make decisions about your insurance coverage.

Q2: Is there a fee to open an e-Insurance Account (eIA) or for using the services offered by an eIA?

No, you do not have to pay to open an e-Insurance Account (eIA). eIA accounts are offered free of charge to applicants. There are no fees associated with opening, maintaining, or changing the details of your eIA account. This means that you can access the convenience and benefits of an eIA without incurring any additional costs.

Q3: How can I make changes to my Policies?

To make changes to your insurance policy, you can contact the insurance repository where your policy is stored. The repository will then forward your request to the insurance company that issued your policy. This allows you to make changes to your policy details, such as the sum insured or the nominee, without having to deal directly with the insurance company. This can save time and make it easier to manage your insurance policies.

Q4: What KYC documents are required for opening an eIA?

To open an e-Insurance Account (eIA), you will need to provide proof of your identity and address. Acceptable documents for proof of identity include a PAN card or UID.

Acceptable documents for proof of address include a registered lease or license agreement, Aadhar letter, ration card, driving license, passport, voter ID card, or bank passbook that is less than six months old.

You will also need to provide proof of your date of birth, which can be shown with a PAN card, domicile certificate, ration card, driving license, passport, voter ID card, municipal birth certificate, notarized birth certificate, or other acceptable documents.

Q5: Which entities are authorized to open an e-insurance account, as per the guidelines of IRDA?

As per the guidelines of IRDA, the following entities are authorised to open an e-insurance account:

- Central Insurance Repository Limited

- Karvy Insurance Repository Limited

- CAMS Repository Services Limited

- NSDL Database Management Limited

Aastha Mestry - Portfolio Manager

An Author and a Full-Time Portfolio Manager, Aastha has 6 years of experience working in the Insurance Industry with businesses globally. With a profound interest in traveling, Aastha also loves to blog in her free time.