How to receive full value for your investments?

Blog Title

561 |

You want to see to it that your investments fetch you maximum value, isn’t it? You want to ensure that your investments give you the maximum returns,isn’t it? You definitely want the maximum value on your investments. Read on to find out about two instruments where you can get full value for your investments.

Endowment plans

Endowment plans are life insurance plans that provide a mix of insurance and investments with secured and guaranteed returns. Edelweiss Tokio Life Wealth Builder is an example of an endowment plan which you can use for your investment planning. For instance, if you are 35 years of age and a non-smoker, by investing Rs. 50000/- per annum for a premium payment term of 12 years and policy term of 30 years, you can get a maturity benefit of Rs. 22,29,000/- which can take care of your retirement needs. If any time during the policy term , you meet with an untimely demise, your spouse will receive the Sum Assured of Rs. 6,50,000/- with which she can also live her life with dignity.

ULIPs

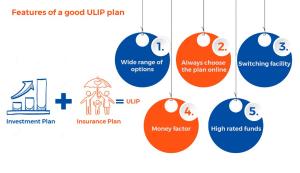

Unit Linked Insurance Plans like Edelweiss Tokio Life Wealth Accumulation (Accelerated Cover) are market linked insurance plans where the premium is divided into two parts. One part goes towards coverage of life and the other part goes towards investment in market-linked instruments to maximise the returns. For instance, for a Sum Assured of approximately 4 lacs, you will pay a premium of Rs. 27,000/- for 10 years with a policy term of 30 years. Your maturity benefit will depend upon the market conditions, but assuming an interest rate of 8%, the maturity benefit will be approximately 7 lacs. You also have the option of switching your investment between one fund and another. Funds are the category of stocks in which your money is invested. This option of selecting funds rests with you and you can switch between funds depending on your market outlook and risk appetite. If you are not averse to taking risks and are in search of higher returns, you can opt for this.

Chirag Iyer - BFSI Enthusiast

Chirag is a writer and an avid reader who loves to drink coffee! His other interests include boxing, karate, and singing.