3 Steps to Choose the Best ULIP

Blog Title

755 |

ULIP was the new in-thing in the investment market and so Richa was determined to research more about it.

Below is what she came across;

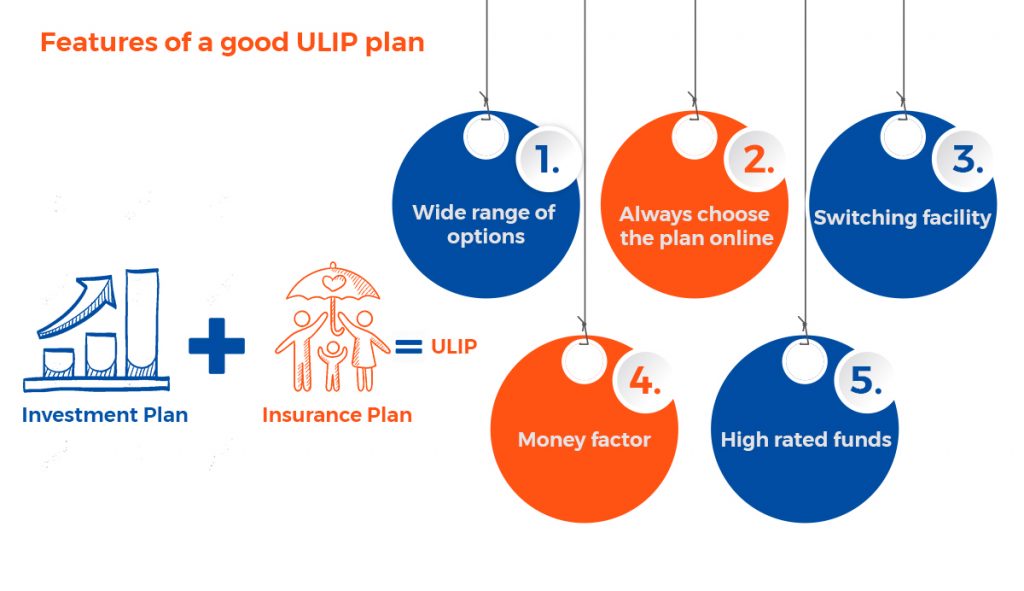

A unit linked investment plan (ULIP) is a product offered by the insurance company that, unlike a normal insurance policy gives the customer both the chance of investment and insurance under one integrated plan. A portion of the premium goes towards your life cover and the rest is invested in funds of the policyholder’s choice which gives you an opportunity to financially protect your family in the event of something unfortunate and to get favorable returns on your investment too.

Features of a good ULIP plan:

- Wide range of options Go for the ULIP plan which offers a wide range of options across asset allocation. A ULIP plan with maximum fund options with varying allocation in equities and better would be far better than investing all your money in just one or two funds. This will further lower you risk and will help you to find a suitable plan or option for your further investment.

- Always choose the plan online As there are so many options available in the market, you can go online and compare them with each other that will help you to find a plan according you to financial needs. So it will be a better idea to choose the ULIP plan online.

- Switching facility Always go for the ULIP plan that provides you with the facility of switching between funds. This means you can, anytime, choose to stop investing in a fund and switch to another fund if you think that will be a more suitable option for you.

- Money factor Always choose a ULIP plan after looking over your financial position so that the premium doesn’t create a financial burden on you. Keep in mind that if you are unable to pay the premium your policy can lapse, which is never good.

- Premium redirection facility Go for a ULIP plan that provides you with a facility of redirecting your premium. This means that you can choose what percentage of your premium is invested in which fund and can anytime, reduce or increase that percentage as you deem fit.

- High rated funds: Check the past performance of the individual funds and choose the plan which has high rated individual funds. This will ensure that your funds are comparatively safer in the volatile market.

Edelweiss Tokio Life Wealth Plus provides you with features that make up for an ideal ULIP plan as it contains facilities like:

- Facility to switch your accumulated investment from one fund to another at the opportune time free of cost

- Option of redirecting your premium in funds of your choice

- Access to you wealth anytime, through facilities of loans and partial withdrawal

- You can choose to pay premium for a limited time, yet the wealth accumulation and insurance protection for a longer period of time

- Tax benefits under Section 80C and Section 10 (10D) of Income Tax Act, 1961

- Additional allocation and premium boosters will help in accumulating your wealth to a great extent

- Rising Star Benefit, under which if an unfortunate event occurs to the policyholder then all the future premiums will be immediately credited in the fund value. This acts like a child plan where the nominee receives a lumpsum amount and the investment grows as planned by the parent.

Richa was now aware about the factors to consider while choosing the best ULIP.