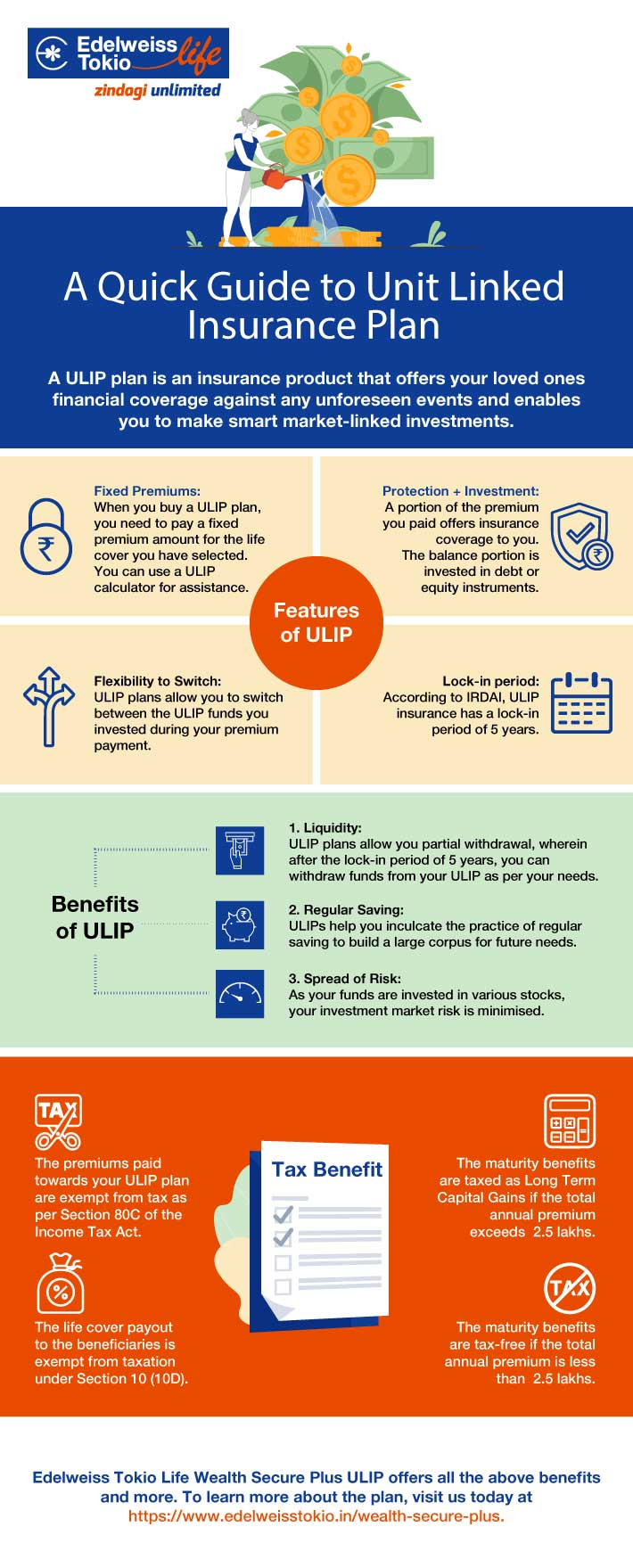

A Quick Guide to Unit Linked Insurance Plan

Blog Title

3429 |

A ULIP plan is an insurance product that offers your loved one’s financial coverage against any unforeseen events and enables you to make smart market-linked investments.

Features of ULIP

- Fixed Premiums: When you buy a ULIP plan, you need to pay a fixed premium amount for the life cover you have selected. You can use a ULIP calculator for assistance.

- Insurance + Investment: A portion of the premium you paid offers insurance coverage to you. The balance portion is invested in debt or equity instruments.

- Flexibility to Switch: ULIP plans allow you to switch between the ULIP funds you invested during your premium payment.

- Lock-in period: According to IRDAI, ULIP insurance has a lock-in period of 5 years.

Benefits of ULIP:

- Liquidity: ULIP plans allow you partial withdrawal, wherein after the lock-in period of 5 years, you can withdraw funds from your ULIP as per your needs.

- Regular Saving: ULIPs help you inculcate the practice of regular saving to build a large corpus for future needs.

- Spread of Risk: As your funds are invested in various stocks, your investment market risk is minimised.

Tax Benefits:

- The premiums paid towards your ULIP plan are exempt from tax as per Section 80C of the Income Tax Act.

- The life cover payout to the beneficiaries is exempt from taxation under Section 10 (10D).

- The maturity benefits are tax-free if the total annual premium is less than ₹2.5 lakhs.

- The maturity benefits are taxed as Long-Term Capital Gains if the total annual premium exceeds ₹2.5 lakhs.

To obtain the best ULIP plan returns, check the Edelweiss Tokio ULIP plan - Wealth Secure Plus today.

To learn more about our offers and ULIP plan charges, visit us today at https://www.edelweisstokio.in/wealth-secure-plus.